- Category Finance

- Version2.2.5

- Downloads 1.00M

- Content Rating Everyone

Introducing Payactiv: Your Trusted Financial Wellness Companion

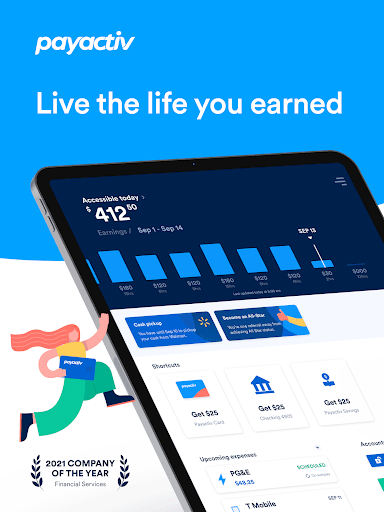

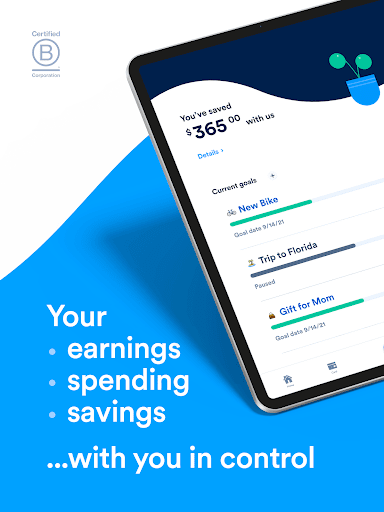

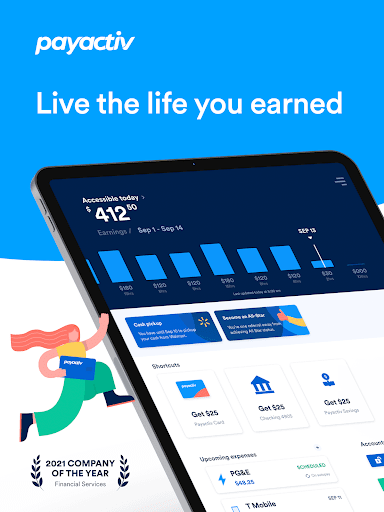

Payactiv is a comprehensive financial app designed to promote financial well-being by providing early access to earned wages, expense management, and financial education. Developed by Payactiv Inc., this platform aims to bridge the gap between employees' earnings and their immediate financial needs, transforming how users manage their day-to-day finances. Its standout features focus on empowering users with transparency, security, and seamless transaction experiences, making it an appealing choice for those seeking more control over their money. Whether you're an hourly worker, a salaried employee, or someone looking for better financial stability, Payactiv's intuitive design and targeted tools serve a diverse and growing audience eager for smarter money management solutions.

Engaging, User-Friendly Experience with a Focus on Security

Imagine a financial tool that feels less like a daunting ledger and more like a helpful, trusted companion—Payactiv delivers that experience with its clean interface and straightforward navigation. From the moment you open the app, it's clear that usability is a top priority. Simplified dashboards, easy-to-understand prompts, and quick access to key features make daily interactions smooth as silk. The app's operation flow is fluid, reducing learning curves and allowing users to quickly adapt to its functionalities. The design emphasizes clarity, with visually appealing layouts that guide users effortlessly through their financial options. Security is embedded into the core of the app, ensuring that sensitive data—like account details and transaction history—is protected through advanced encryption and multi-layered authentication, reinforcing trust and peace of mind.

Core Features That Put You in Control

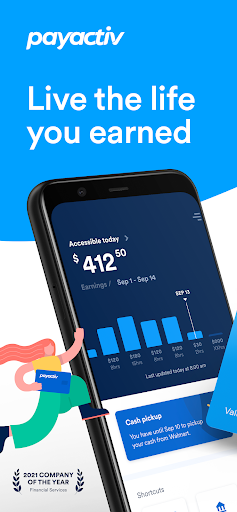

1. Early Wage Access Made Simple

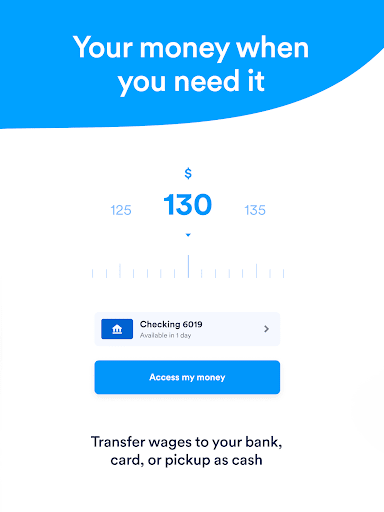

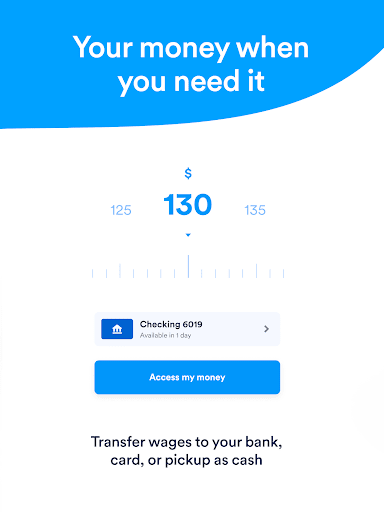

The highlight of Payactiv is its ability to give users early access to earned wages, a feature that's particularly vital for those living paycheck to paycheck. Instead of waiting for the traditional bi-weekly cycle, users can instantly access a portion of their wages directly within the app. This capability functions like having a financial safety net at your fingertips, reducing reliance on payday loans or high-interest alternative borrowing. The process is streamlined: simply link your employment account, verify earnings, and request early access with a tap. Funds are transferred securely and swiftly, allowing users to cover urgent expenses or avoid overdraft fees.

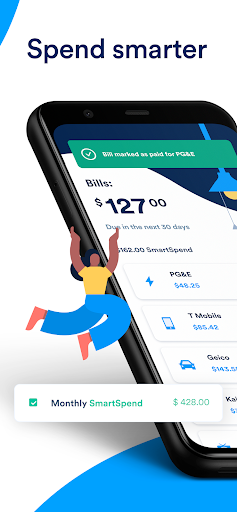

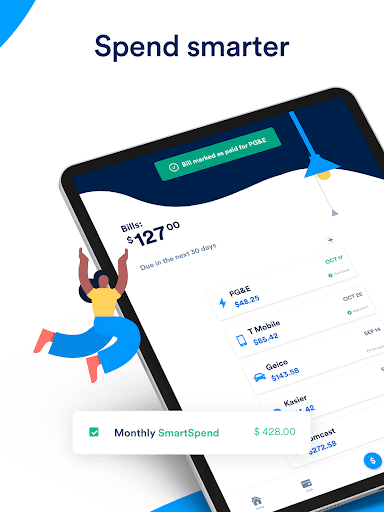

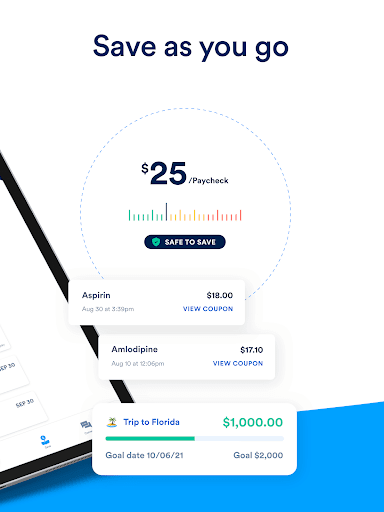

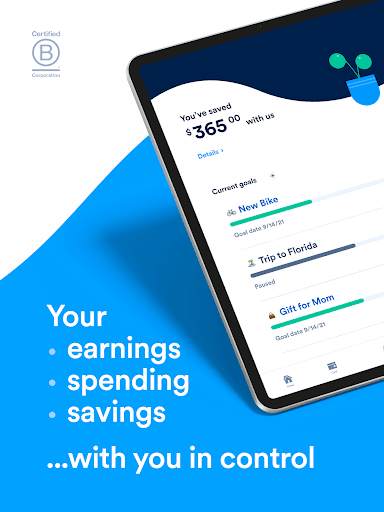

2. Expense & Budget Management

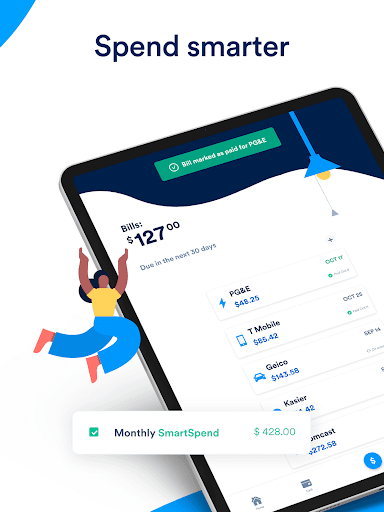

Another compelling component is the integrated expense management tool. Think of it as a digital financial coach that helps you anticipate, track, and plan your spending. The app categorizes transactions, displays spending patterns, and provides insights to help users make smarter financial decisions. This holistic view fosters better budgeting habits and discourages impulsive purchases. Additionally, personalized alerts notify users of upcoming bills or low balances, empowering proactive financial planning rather than reactive scrambling.

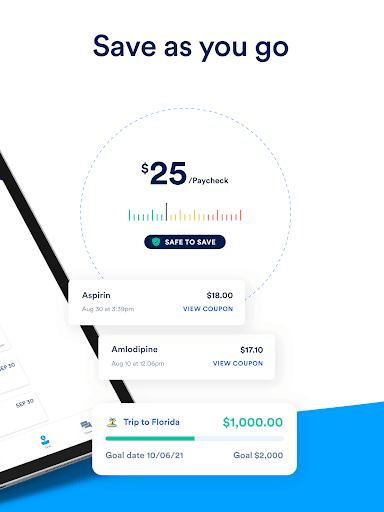

3. Financial Education & Rewards

Payactiv also invests in empowering users with financial literacy. Through educational content, tips, and rewards programs, it encourages healthy financial habits. The app gamifies responsible behaviors, such as saving or consistent bill payments, while providing incentives like cashback or discounts. This feature adds a motivational layer, transforming financial management from a chore into an engaging activity—a game that benefits your wallet in the long run.

Distinctive Strengths and Unique Selling Points

Compared to many similar financial apps, Payactiv shines in its emphasis on transactional and security excellence. Its proprietary account and fund security protocols uphold robust encryption standards and multi-factor authentication, making security a cornerstone rather than an afterthought. The transaction experience is also notably smooth—fund transfers are quick, intuitive, and transparent, avoiding the common pitfalls of delayed payments or confusing fee structures seen elsewhere.

Furthermore, Payactiv distinguishes itself through its focus on real-time wage access rather than mere savings or investment features. This targeted function addresses a specific pain point—timely access to earned money—rather than broad financial management, positioning it as an essential tool for users who need immediate liquidity without sacrificing security or ease of use.

Final Verdict: A Thoughtful, Practical Choice for Financial Convenience

Overall, Payactiv earns a solid recommendation as a practical, user-focused financial app. Its strongest attributes—the ability to access earnings early and its commitment to security—make it particularly suitable for cash-strapped workers or individuals seeking better cash flow control. For those comfortable with digital banking, the app's straightforward interface and seamless transaction flow simplify daily financial interactions. While it doesn't aim to replace comprehensive wealth management platforms, its niche features and accessible design make it a valuable addition to your financial toolkit.

If you prioritize quick, secure access to your earnings and want an app that combines practicality with educational support, Payactiv is definitely worth a try. For users looking for a reliable, user-friendly way to navigate financial emergencies and build healthier habits, Payactiv offers a thoughtfully crafted solution that feels more like a trusted companion than just another financial app.

Similar to This App

Pros

Immediate Access to Earned Wages

Users can quickly access a portion of their earned wages before payday, improving financial flexibility.

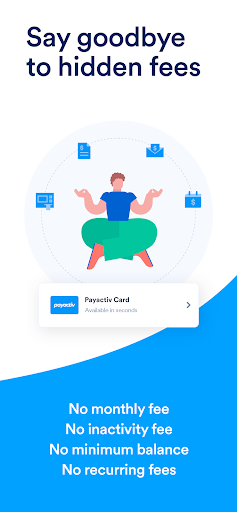

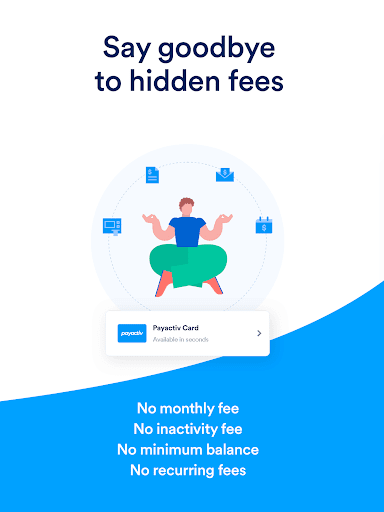

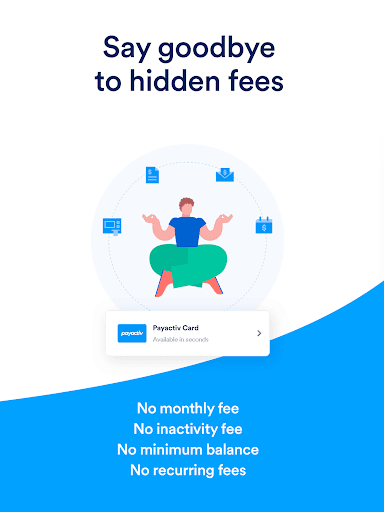

No Interest or Hidden Fees

Payactiv offers interest-free cash advances, making it a cost-effective option for users.

Integration with Payroll Systems

Seamless integration with employers' payroll systems facilitates quick and accurate fund transfers.

Budgeting and Financial Wellness Tools

The app provides financial education resources, helping users improve money management skills.

Wide Employer Adoption

Many companies partner with Payactiv, expanding access to a large user base.

Cons

Limited Access to Funds (impact: medium)

Users can typically access only a small portion of their earned wages, which may not meet all urgent needs.

Dependence on Employer Partnerships (impact: high)

Availability depends on employer adoption, which can limit access for some users; official expansions are expected to increase coverage.

Potential for Overuse (impact: low)

Frequent use of wage advance features might lead to financial over-reliance; promoting responsible usage is an ongoing focus.

Limited Cash Advance Limits (impact: medium)

The app caps advance amounts at a certain percentage of earned wages, which might be insufficient during emergencies.

App Reliability and Technical Glitches (impact: low)

Some users report occasional app crashes or delays in fund transfers; periodic updates aim to enhance stability.

Frequently Asked Questions

How do I get started with Payactiv and link it to my employer?

Download the app, create an account, then link your employer if they participate. Follow the onboarding steps to complete registration and verify your employment details.

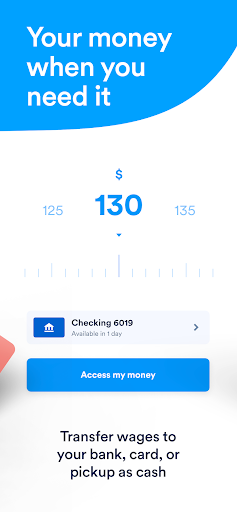

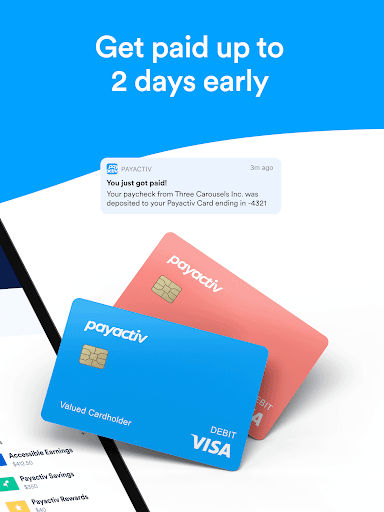

Can I access my wages early with Payactiv, and how does it work?

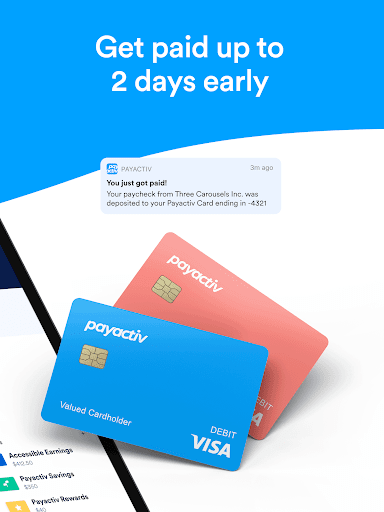

Yes, if your employer offers this feature, you can view and request early wages up to 2 days before payday via the app under the 'Wages' section.

What budgeting tools does Payactiv provide to help me manage my money?

Payactiv offers expense tracking, low balance alerts, and automatic savings transfers, accessible under the 'Budget' or 'Savings' tabs in the app.

How does the Payactiv Visa® Card work, and are there any hidden fees?

The prepaid Visa card has no hidden fees, no minimum balance, and offers surcharge-free ATM withdrawals at 37,000 MoneyPass® locations, accessible via the app.

How can I use the Payactiv app to make secure payments and transfers?

You can add your card to Google Pay or Apple Wallet for tap-to-pay. To transfer, use the 'Send Money' feature in the app, all protected with built-in security measures.

What should I do if I experience issues with early wage access or the app?

Contact Payactiv's 24/7 support through the app's help center or the support tab to resolve issues quickly and securely.

Is there a fee for using Payactiv or its features?

Basic features like early wage access are free if your employer offers it. The Visa® card is also free of monthly, hidden, or inactivity fees.

Are there any subscription plans or premium features I need to pay for?

Most core features are included at no extra cost, but check the app under Settings > Subscription for any optional premium plans or updates.

Can I link my Payactiv Visa® Card with mobile payment apps for contactless payments?

Yes, you can add your card to Google Pay or Apple Wallet for quick, contactless transactions at participating stores.