- Category Business

- Version2025.04.24

- Downloads 0.01B

- Content Rating Everyone

PayPal Business: Empowering Small and Medium Enterprises with Seamless Payment Solutions

PayPal Business is a comprehensive mobile application designed to streamline financial operations for small to medium-sized enterprises (SMEs), offering an integrated platform for payments, invoicing, and collaboration. Developed by PayPal Inc., the app combines robust features with user-friendly design, making financial management as effortless as a few taps on your smartphone. Whether you're managing online sales or brick-and-mortar transactions, PayPal Business aims to be your reliable partner on the path to business growth.

Core Features That Make a Difference

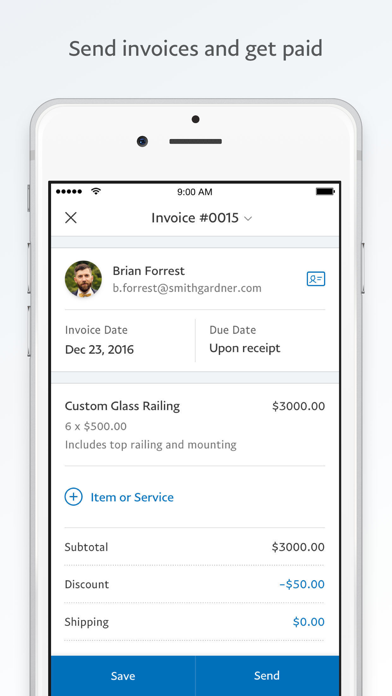

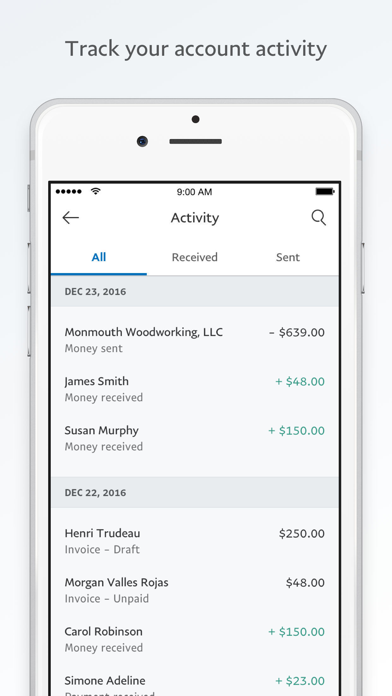

The app's standout features include instant payment processing, comprehensive invoicing tools, and collaborative work capabilities. The instant payment processing allows businesses to accept and send payments swiftly, reducing waiting times and cash flow disruptions. The invoicing feature enables customized billing directly from the app, simplifying accounts receivable management. Additionally, PayPal Business integrates tools that facilitate team collaboration, making it easier to coordinate tasks and communicate within a secure environment—all within a single app.

Intuitive Interface and Smooth User Experience

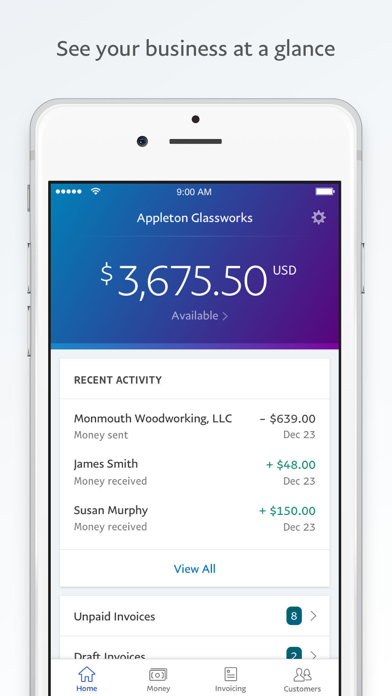

From the moment you open PayPal Business, you're greeted by a clean, intuitive interface that resembles a well-organized digital workspace. The dashboard presents your key financial metrics at a glance—like a cockpit designed for pilots—giving you total control with minimal effort. Navigating through functions such as payment acceptance, invoicing, and task management feels natural, thanks to straightforward icons and logical menus. The app operates smoothly, with responsive interactions that make managing daily operations a breeze. Its learning curve is gentle; even those new to digital financial tools find themselves up and running in minutes, thanks to helpful prompts and a concise onboarding process.

Differentiating from Competitors with Unique Collaborative Features

Unlike many traditional payment apps that focus solely on transactions, PayPal Business shines when it comes to fostering teamwork and streamlining project tasks. Its collaboration features are seamlessly integrated, allowing team members to share invoices, assign tasks, and comment within the same platform—much like having a virtual office that fits in your pocket. This sets it apart from competitors because it reduces the need for multiple tools, minimizing fragmentation and improving productivity. For example, a seller can create an invoice, assign follow-up tasks to team members, and communicate directly within the app—keeping everyone on the same page without switching apps or juggling emails.

Final Verdict: A Practical and Versatile Tool for Growing Businesses

Given its well-rounded feature set, clean interface, and unique collaboration capabilities, PayPal Business is highly recommended for small to medium enterprises seeking an integrated financial management tool. It's particularly suitable for businesses that value simplicity and mobility—think of it as your digital wallet that also handles team coordination. While it may not replace advanced enterprise resource planning systems, it strikes an excellent balance for everyday operational needs. I suggest giving it a try if you're looking for a reliable, easy-to-use app that combines payment processing with collaborative features to streamline your business workflow.

Similar to This App

Pros

Ease of Use

The app offers a user-friendly interface that makes it simple for small business owners to send and receive payments quickly.

Integrated Payment Solutions

Seamlessly integrates with PayPal's ecosystem, allowing smooth transactions across various platforms and websites.

Secure Transactions

Provides robust security features, including encryption and fraud detection, ensuring safe financial operations.

Multi-Device Compatibility

Works well across smartphones, tablets, and desktops, enabling flexibility for business management.

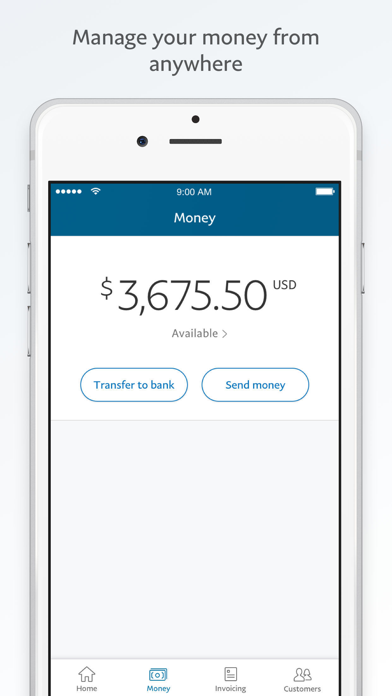

Quick Fund Transfers

Allows fast transfer of funds to linked bank accounts or other PayPal users, facilitating timely cash flow management.

Cons

Limited Offline Capabilities (impact: medium)

The app requires an internet connection for most functions, which can hinder usage in low-connectivity areas.

Occasional Transaction Delays (impact: medium)

Some users experience delays in fund transfers due to PayPal's verification process, which may affect cash flow.

Customer Service Responsiveness (impact: low)

Support can sometimes be slow to respond or lack immediate solutions for urgent issues.

Limited Advanced Accounting Tools (impact: low)

The app does not offer extensive accounting features, requiring integration with third-party software for detailed bookkeeping.

Fees for Certain Transactions (impact: medium)

Some transactions, such as currency conversions or receiving payments from international sources, incur fees which could be reduced in future updates.

Frequently Asked Questions

How do I set up my PayPal Business account on the app?

Download the app, open it, and follow the onboarding steps to link your bank account and verify your business info through Settings > Account Setup.

Can I use PayPal Business on both my phone and computer?

Yes, your account syncs across devices. Use the app for mobile management and log in via browser for desktop access.

How do I create and send an invoice with the app?

Go to the 'Invoices' tab, tap 'Create New', customize your details, then send it directly to your customer via the app.

What features help me track my sales effectively?

Use the 'Sales Analytics' section in the app to view daily, monthly, or yearly sales data and monitor performance trends.

How can I process contactless payments in person?

Select the 'QR Code' option in the app, generate a code, and customers can scan and pay via their PayPal app for contactless transactions.

How do I transfer funds from PayPal to my bank account?

Navigate to 'Transfers', choose your linked bank account, input the amount, and confirm to complete the transfer.

Are there any subscription fees for using PayPal Business features?

Basic transactions are free, but advanced features like recurring invoicing or payment processing may incur fees found in Settings > Payment Settings.

How do I manage billing or subscription payments from customers?

Create recurring invoices in the 'Invoices' tab, customize billing cycles, and automate reminders to streamline subscription management.

What should I do if a payment fails or I encounter an error?

Check your internet connection, verify linked bank info in Settings > Bank & Cards, and contact support if issues persist.