- Category Finance

- Version8.97.1

- Downloads 0.10B

- Content Rating Everyone

An Overview of PayPal - Pay, Send, Save

In an era where digital payments are seamlessly integrated into everyday life, PayPal's latest app, "Pay, Send, Save," emerges as a versatile tool designed to simplify financial transactions while prioritizing security and user convenience. Developed by PayPal Inc., a globally recognized leader in online payment solutions, this app aims to streamline money management for both novices and seasoned fintech users. Its core features include rapid peer-to-peer transfers, integrated savings options, and robust account security protocols—making it a compelling choice for anyone seeking a straightforward yet powerful digital wallet. The target audience primarily comprises young professionals, online shoppers, small business owners, and anyone looking to manage daily transactions conveniently from their smartphones.

A Fresh Spin on Digital Payments

Imagine effortlessly sending money to a friend across the globe or setting aside a little each day for that upcoming trip—without breaking a sweat. PayPal's "Pay, Send, Save" app packs this kind of convenience with an intuitive user experience that feels less like navigating a maze and more like chatting with an old friend. Its sleek interface, combined with smart features, transforms what used to be a chore into an enjoyable, almost instinctive activity. Whether you're splitting dinner bills, saving for a new gadget, or securely managing your funds, this app feels like a personal financial assistant always ready to lend a hand.

Core Functionality 1: Swift Peer-to-Peer Payments

One of the standout features of "Pay, Send, Save" is its ability to facilitate real-time, peer-to-peer transactions with minimal fuss. The process is akin to passing a note in class—quick, discreet, and effortless. Users can link their bank accounts or credit cards, then send money via email or phone number, even across borders—perfect for splitting rent, sharing weekend outings, or gifting loved ones. The app's transaction process is designed for speed; payments are processed almost instantaneously, and notifications confirm success in real time. This rapid transaction experience is particularly valuable in today's fast-paced world, where waiting or complicated steps can dampen the moment.

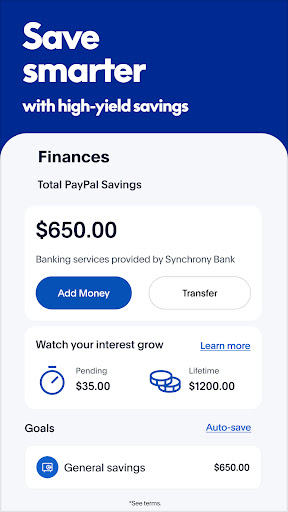

Core Functionality 2: Integrated Saving Features

Beyond simple transfers, "Pay, Send, Save" introduces a smart savings component that helps users set aside funds automatically. Imagine having a virtual piggy bank, but smarter—an app that can round up your purchases or allocate daily small amounts to a dedicated savings pool. This feature is especially appealing for users aiming to build financial discipline or save for specific goals. The interface makes it easy to create and track savings plans, with visual progress indicators motivating continued effort. It's like having a financial coach right in your pocket, guiding you toward your goals without the need for complex spreadsheets or third-party apps.

User Experience: Sleek, Seamless, and User-Friendly

From the moment you open "Pay, Send, Save," it's clear that user experience was a top priority during development. The app boasts a clean, modern interface with vibrant icons and straightforward navigation—think of it as stepping into a well-organized digital wallet where everything is just a tap away. Operation flows smoothly, with minimal lag or confusing menus. The learning curve is gentle; new users can learn essential functions within minutes, thanks to helpful prompts and an organized layout. For seasoned tech users, advanced features add depth without overwhelming, maintaining a balance between simplicity and function. This refined experience ensures users feel confident and in control, whether they're familiar with digital finance or just starting out.

Unique Selling Points: Security and Transaction Excellence

What truly sets "Pay, Send, Save" apart from other financial apps are its unwavering commitment to account and fund security, coupled with an optimized transaction experience. Unlike many competitors, the app employs multi-layered encryption, biometric authentication, and real-time fraud monitoring—trusting users can handle sensitive information without sleepless nights. Additionally, the transaction process is notably smooth; even cross-border payments benefit from competitive exchange rates and transparent fee structures. This focus on security and seamless execution ensures peace of mind and efficiency, addressing common pain points like delays, hidden charges, or security breaches—making it more than just an app, but a trusted financial partner.

Final Verdict and Recommendations

"Pay, Send, Save" is a thoughtfully designed digital payments app that combines core functionality with standout features like automatic savings and top-tier security. For users seeking a safe, fast, and visually appealing platform to handle everyday transactions, it offers significant advantages over many peers. I recommend it particularly for young professionals, small business owners, or anyone wanting a reliable, straightforward way to manage money without complicated procedures. While it may not replace comprehensive banking, its ease of use, security features, and innovative savings options make it an excellent addition to your financial toolkit.

Similar to This App

Pros

User-friendly interface

The app has an intuitive design that makes managing payments simple for users of all ages.

Fast transaction processing

Payments are completed instantly, which enhances user experience for sending and receiving funds.

Secure encryption technology

Strong security measures protect users' personal and financial information during transactions.

Seamless integration

Works smoothly with other PayPal services and popular e-commerce platforms, ensuring versatility.

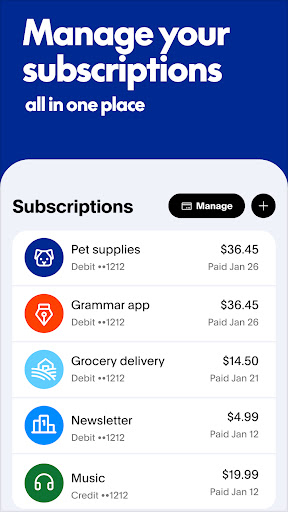

Multiple wallet management

Allows users to saving and budget tracking, facilitating better financial management.

Cons

Limited international support (impact: medium)

Some countries have restricted access or limited features, which may inconvenience global users.

Occasional app crashes (impact: low)

Users have reported crashes during high-traffic times; updates are expected to improve stability.

In-app customer service responsiveness (impact: medium)

Customer support can sometimes be slow; users might try contacting via email for quicker responses.

Limited budgeting tools (impact: low)

While basic savings features are available, advanced financial planning options are lacking; future updates may address this.

Occasional delay in transaction notifications (impact: low)

Some users experience a lag in receiving alerts, but official fixes are planned in upcoming releases.

Frequently Asked Questions

How do I set up my PayPal account for the first time?

Download the app, tap Sign Up, choose Personal, fill in your details, verify your email and phone, then link your bank or card to start using PayPal.

Can I use PayPal for free to send or request money?

Yes, sending and requesting money is free when using your bank account or PayPal balance within the US for personal transactions.

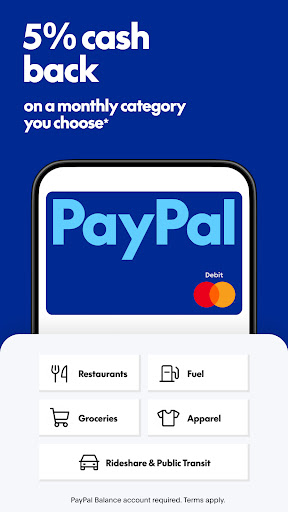

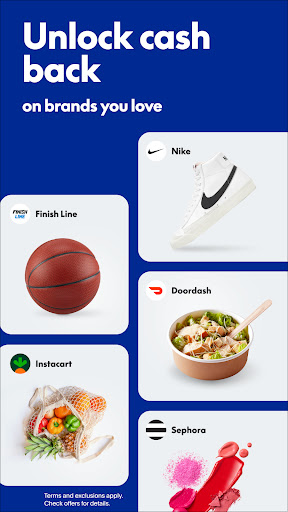

How do I find and redeem cashback offers in the app?

Open the app, go to 'Offers' tab, browse available deals, activate offers, and shop at participating brands to earn cashback automatically at checkout.

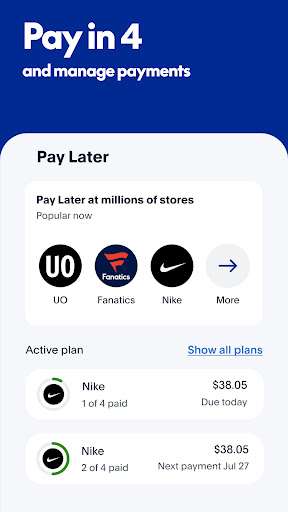

What is 'Pay in 4' and how do I use it?

Select 'Pay in 4' at checkout for eligible purchases between $30-$1500, split into 4 interest-free payments, managed through the app, with no late fees.

How do I request a PayPal Debit Mastercard?

In the app, go to 'Cards' or 'Banking,' choose 'Request Debit Card,' and follow prompts to receive your card, no credit check needed.

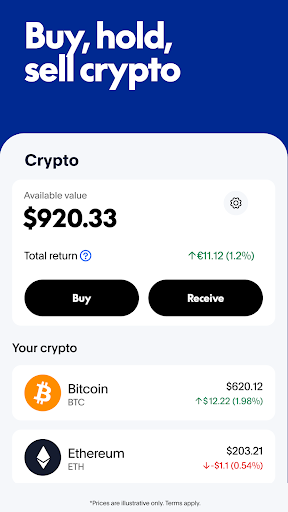

Can I buy and sell cryptocurrencies within the PayPal app?

Yes, go to 'Cryptocurrencies' in the app, choose your currency, and follow instructions to buy, sell, or hold supported crypto assets easily.

How does PayPal Savings work and how to set it up?

In the app, tap 'Savings,' set your savings goals, link your account, then enable automatic transfers to grow your money with competitive APY.

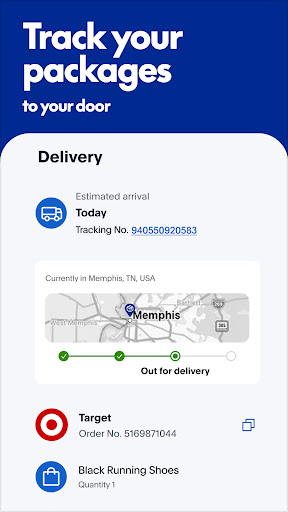

How do I track my packages through PayPal?

Link your Gmail or Outlook in settings, then check 'Package Tracking' to view real-time shipping updates and receive delivery notifications.

Are there any subscription fees for additional features like crypto or savings?

Most core features are free, but some services like crypto trading may involve transaction fees; check the app's 'Fees' section for details.

What should I do if I encounter an issue with the app?

Try updating the app, check your internet connection, or restart your device. If problems persist, contact PayPal support via 'Help' in the app.