- Category Business

- Version8.24.0

- Downloads 1.00M

- Content Rating Everyone

An In-Depth Look at PayPal POS (ex Zettle): Simplifying Small Business Payments

As a professional tech reviewer, I've examined PayPal POS (formerly Zettle), a point-of-sale application that aims to streamline payment processing and business management for small-to-medium enterprises. With its intuitive design and robust features, this app positions itself as a reliable partner for entrepreneurs seeking an integrated, easy-to-use solution.

Bright Features, Clear Value: The Core of PayPal POS

Developed by PayPal, a name synonymous with secure digital transactions, PayPal POS offers an all-in-one platform tailored to retail, hospitality, and service providers. Its primary strengths lie in seamless payment processing, inventory management, and integrated sales reporting—key tools that make daily business operations smoother and more efficient. Notably, its tight integration with PayPal's ecosystem ensures that transactions are not only quick but also securely stored and easily tracked.

Set the Scene: An App That Feels Like a Business Partner

Imagine walking into a bustling café or retail shop, where the staff effortlessly swipes a card, prints receipts, and views sales insights—all on a sleek, responsive device. PayPal POS aims to be that silent yet indispensable partner by simplifying payment workflows, reducing chaos at checkout, and providing real-time performance data. It's like having a friendly co-worker who handles the most tedious tasks so you can focus on giving your customers a personal touch.

User Interface and Design: Friendly Yet Professional

One of PayPal POS's standout qualities is its clean and straightforward user interface. The dashboard employs a minimalistic design with clear icons and logical navigation, helping users get acclimated quickly. The start-up process is intuitive—think of it as assembling a piece of furniture with straightforward steps rather than deciphering complex manuals. For new users, the learning curve is gentle; most features are accessible within minutes, which is crucial for small-business owners wearing multiple hats.

Operational Flow: Smooth, Efficient, and Reliable

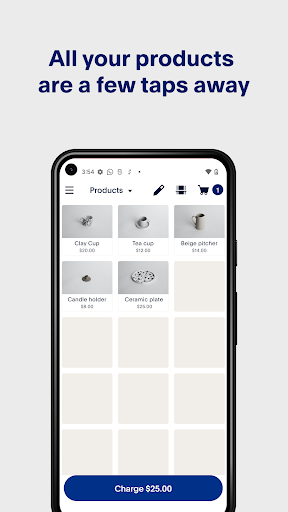

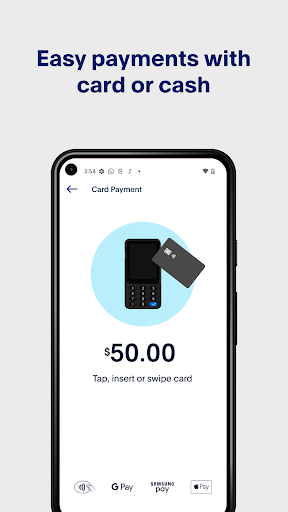

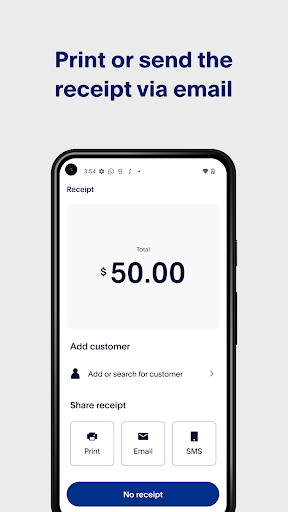

Running a sale feels seamless: select items, swipe or tap card, print or email receipt—all with minimal fuss. The app's responsiveness is generally impressive, thanks to optimized performance that handles transactions swiftly, even during busy hours. The hardware integration—such as with portable card readers—works reliably, reducing instances of lag or disconnection. In terms of user experience, this level of fluidity feels akin to a well-orchestrated dance, where each step is natural and unobstructed.

Differentiation: Standing Out Among Business Apps

While many point-of-sale apps focus solely on transaction processing, PayPal POS distinguishes itself with its integrated ecosystem features. Its collaboration tools, such as real-time sales sharing with team members and unified inventory management, foster teamwork akin to a well-coordinated orchestra—a feature somewhat rare in standalone POS solutions. Additionally, task management functionalities, like updating product info across devices and assigning roles, give it an edge over competitors that often lack such depth. This makes PayPal POS not just a payment tool, but a versatile business companion capable of supporting collaborative work environments, a true advantage for expanding teams or businesses with multiple locations.

Final Verdict: A Worthy Choice for Small Businesses

Overall, I would recommend PayPal POS to small and medium-sized enterprises looking for a reliable, easy-to-setup point-of-sale solution integrated with a trusted digital payment platform. Its user-friendly interface, quick setup, and unique collaborative features make it stand out from more basic competitors. For businesses that prioritize teamwork, seamless transaction flow, and integrated management tools, this app is a compelling option. However, those seeking highly customizable or industry-specific features may want to explore additional solutions—though for most, PayPal POS offers a well-balanced, efficient, and secure platform to handle daily transactions with confidence.

Similar to This App

Pros

User-friendly interface

The app has an intuitive design that simplifies onboarding and daily transactions for small businesses.

Fast payment processing

Transactions are completed quickly, reducing wait times for both merchants and customers.

Versatile hardware integration

Works seamlessly with a variety of POS hardware, including barcode scanners and cash drawers.

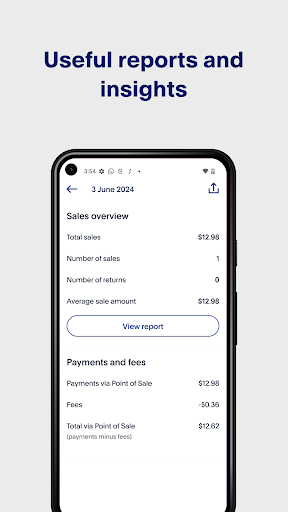

Robust reporting features

Provides comprehensive sales and inventory analytics to help businesses make informed decisions.

Strong security measures

Ensures secure transactions through encryption and compliance with industry standards.

Cons

Limited customization options (impact: low)

The app offers fewer customization settings for receipts and interface themes, which may restrict branding efforts.

Occasional synchronization delays (impact: medium)

Sales data sometimes takes a few minutes to sync across devices, but updates are generally accurate afterward.

Learning curve for advanced features (impact: low)

Some functionalities like inventory management require additional training for new users.

Limited offline capabilities (impact: medium)

Transactions are not fully processed offline; users can add sales but need internet for final approval, which may cause inconvenience during connectivity issues.

Minimal support for multi-language use (impact: low)

Primarily available in English, with limited options for localization, which can limit usability in non-English speaking regions. The company is planning multilingual updates soon.

Frequently Asked Questions

How do I set up PayPal POS for the first time?

Download the app, sign up with your PayPal account, and follow the on-screen instructions to connect your payment hardware and start accepting payments.

Can I accept contactless payments using PayPal POS?

Yes, you can accept contactless payments via Tap to Pay on mobile or using PayPal Reader and Dock for major contactless methods like Google Pay.

How do I add my products and manage inventory in the app?

Navigate to Inventory > Products within the app to add or update product details and monitor stock levels easily.

Can I track sales and generate reports with PayPal POS?

Yes, go to Reports > Sales to view detailed sales data, analyze trends, and export reports for insights.

How do I create staff accounts to monitor individual performance?

Go to Settings > Staff Management to add staff members and assign appropriate permissions to track their sales activities.

What are the hardware requirements to run PayPal POS?

The app runs on iPhone or Android devices; additional hardware like PayPal Reader or Dock can be connected for card payments.

Is there a fee for using PayPal POS, and what are the costs involved?

PayPal POS has no monthly or setup fees; transaction fees apply per payment processed, but hardware costs vary based on your choices.

Which payment methods does PayPal POS support?

It supports card payments, contactless options like Google Pay, Apple Pay, PayPal, and magstripe or chip card transactions.

Can I integrate PayPal POS with my existing accounting software?

Yes, the app supports integrations with popular accounting platforms; check Settings > Integrations for available options.

What should I do if the app crashes or encounters errors during use?

Try restarting your device, ensure the app is updated, and contact PayPal support if issues persist for assistance.