- Category Finance

- Version3.5.0

- Downloads 1.00M

- Content Rating Everyone

Perpay - Shop and Build Credit: A Fresh Approach to Financial Growth

Perpay is a user-friendly financial app designed to help consumers build credit through flexible shopping and payment plans, all while maintaining control over their finances. Developed by a dedicated team focused on accessible credit solutions, it combines shopping convenience with credit-building tools, making it ideal for those seeking to improve their credit scores without the complexity of traditional credit cards.

A Quick Snapshot: What Makes Perpay Stand Out

Unlike typical credit-building apps, Perpay offers an innovative approach that blends shopping with credit development, making the process feel more like a rewards program than a debt trap. The app's core features include flexible installment payments on everyday purchases, transparent credit reporting to major bureaus, and a unique savings incentive system. Its target audience comprises young adults, newcomers to credit, or anyone looking for a straightforward way to enhance their credit profile without the hassle of conventional credit cards or loans.

Engaging and Intuitive User Experience

From the moment you open Perpay, it feels like walking into a friendly neighborhood store that understands your financial needs. The interface boasts a clean, modern design with intuitive navigation that even tech novices can appreciate. The color palette is warm and inviting, complementing an uncomplicated layout that guides users effortlessly through their shopping and payment plans.

Operation-wise, the app runs smoothly on both iOS and Android, with rapid response times and minimal lag. The learning curve is gentle—new users quickly grasp how to select items, set up payment schedules, and monitor their credit progress, thanks to helpful prompts and a straightforward onboarding process. The experience is akin to having a helpful shopping guide by your side, making the credit-building journey less intimidating and more engaging.

Core Features: Building Credit While Shopping Smarter

Flexible Payment Plans That Feel Like Rewards

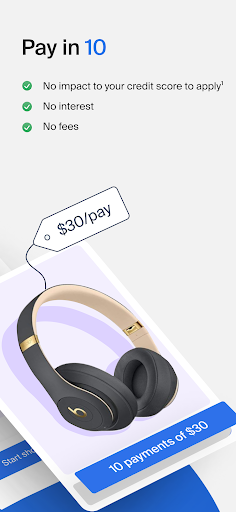

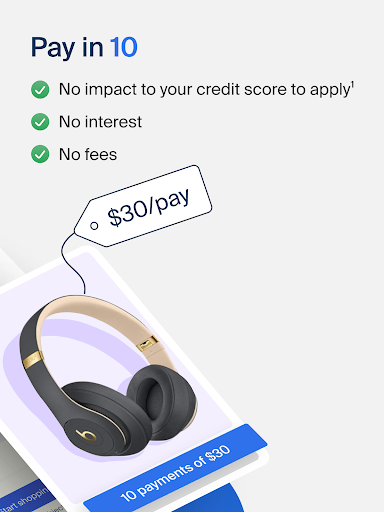

Perpay's hallmark feature is its ability to let users purchase items through installment payments without traditional credit checks or interest. Think of it as a layaway plan with a modern twist—buy what you need and spread the cost over time, all while avoiding the pitfalls of high-interest debt. This structure not only makes big-ticket items more accessible but also helps users demonstrate responsible payment behavior, which is reported directly to credit bureaus to boost credit scores over time.

Transparent Credit Reporting and Progress Tracking

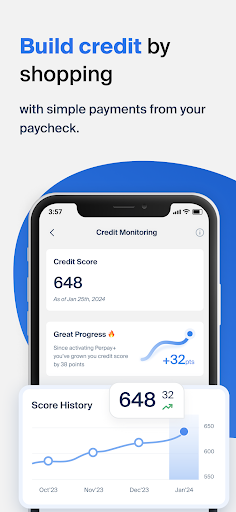

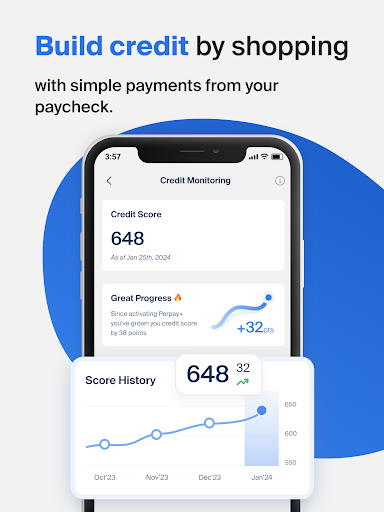

One of Perpay's standout qualities is its commitment to transparency. Users can see in real-time how their purchases and payments influence their credit profile, turning the app into a personal credit dashboard. This ongoing visibility helps users understand the direct link between consistent payments and credit improvement, fostering a sense of control and motivation.

Reward and Savings Incentives

Beyond just building credit, Perpay introduces an innovative savings aspect. For every on-time payment, users earn credits they can put toward future purchases or save, encouraging responsible financial habits. This feature transforms credit building from a mere necessity into an engaging, rewarding experience—much like earning points for good behavior in a loyalty program.

Comparative Edge: What Sets Perpay Apart?

When stacked against other financial apps like Credit Karma or Afterpay, Perpay's biggest differentiator lies in its integration of credit building with everyday shopping, all within a single seamless platform. Its approach to security is transparent—user data and transaction details are protected with robust encryption and secure login measures, comparable to established banking apps.

In terms of transaction experience, Perpay simplifies the purchase process, eliminating confusing interest calculations and hidden fees. Payments are predictable, and the app's notifications keep users updated at every step, reducing the chance of missed payments—a crucial factor for credit growth.

Perhaps most notably, its credit reporting feature—reporting purchase and payment history to bureaus—distinguishes it from apps that merely facilitate spending without impacting credit scores. This proactive stance on credit development makes it a trustworthy choice for users whose primary goal is to build or rebuild their credit profiles steadily.

Recommendation and Usage Tips

Overall, I'd recommend Perpay to anyone looking for a sensible, transparent, and user-friendly way to improve their credit while making practical purchases. It's especially suited for young adults, first-time credit builders, or those wary of traditional credit products. However, users should remember to treat it as a tool for responsible financial habits—consistent on-time payments are key.

If you're seeking an app that combines shopping, credit building, and financial education into a single straightforward platform, Perpay deserves a spot on your device. Just approach it as a helpful partner on your journey to better credit—no gimmicks, just clear pathways to financial health.

Similar to This App

Pros

Improves Creditworthiness

Allows users to build credit history through regular purchases and payments, which can enhance credit scores over time.

Flexible Purchase Options

Offers the ability to buy items now and pay later in manageable installments, making high-value items more accessible.

User-Friendly Interface

Features an intuitive design that simplifies navigation and smooths the purchasing and payment process.

Budget Management Tools

Includes tools that help users track their spending and plan payments, promoting financial responsibility.

Diverse Product Selection

Provides access to a wide range of stores and products, enhancing shopping options within the app.

Cons

Limited Credit Reporting Duration (impact: medium)

Credit-building benefits may be limited to a certain period, requiring users to make payments consistently to see lasting improvements.

Potential for Overspending (impact: low)

Easy access to buy now, pay later could encourage impulsive purchases, though budgets can be set to mitigate this.

Interest and Fees May Appear (impact: medium)

Some payment plans may have interest or fees, but users can choose options with zero interest for cost savings.

Limited Credit Bureau Reporting (impact: high)

Currently reports to only a few credit bureaus, which might limit credit score improvements for some users. The company is working on expanding reporting.

Customer Service Response Times (impact: low)

Some users have experienced slow responses from support; official updates indicate improvements are underway.

Frequently Asked Questions

How do I sign up and get started with Perpay?

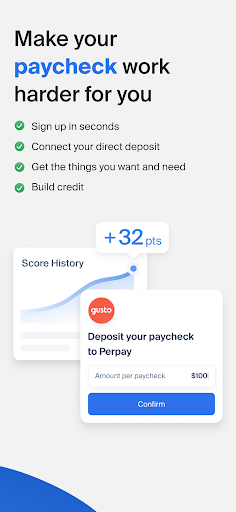

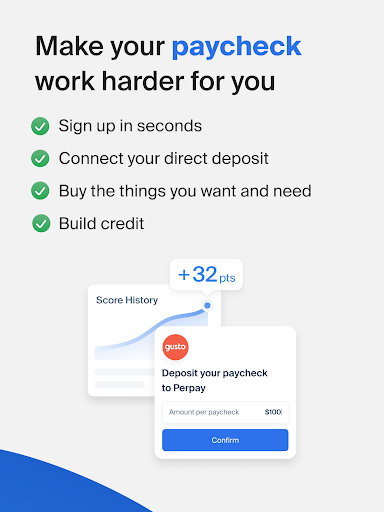

Download the app, create an account with basic info, and verify your identity. No hard credit check is required, then you can explore shopping and credit-building options within the app.

Can I use Perpay if I have poor or no credit?

Yes, Perpay does not perform a hard credit check during signup, making it accessible even if your credit history is limited or poor.

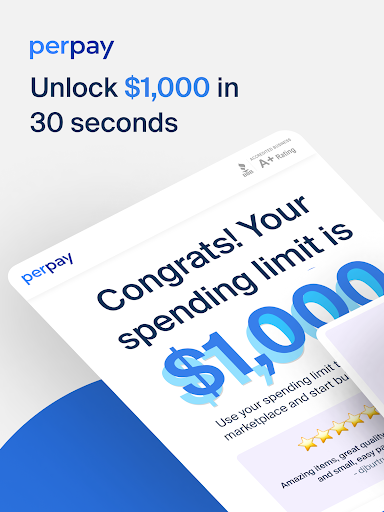

How do I shop on the Perpay Marketplace?

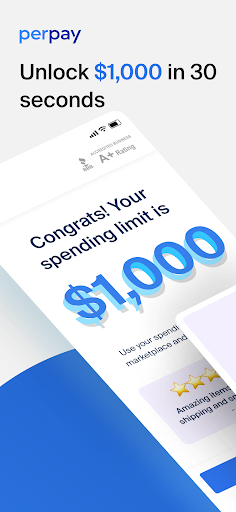

Open the app, navigate to the Marketplace, select your items, and choose the payment plan. You can unlock up to $1,000 for purchases with no interest or fees.

How does Perpay help me build credit?

Select ‘Build Credit with Perpay+' so your on-time payments are reported to all 3 credit bureaus, helping to improve your credit score over time.

What is Perpay+ and how do I activate it?

Perpay+ allows your payments to be reported to credit bureaus. Enable it in your account settings under ‘Credit Reporting' to start building your credit.

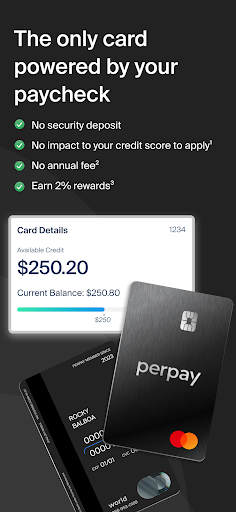

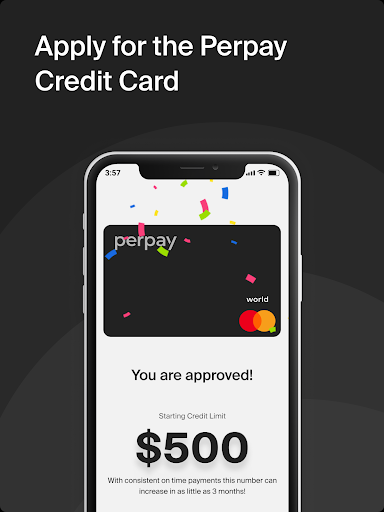

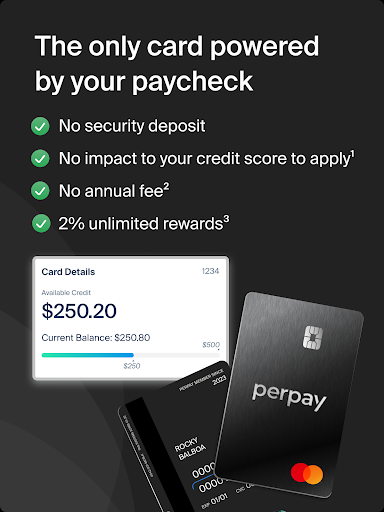

How can I apply for the Perpay Credit Card?

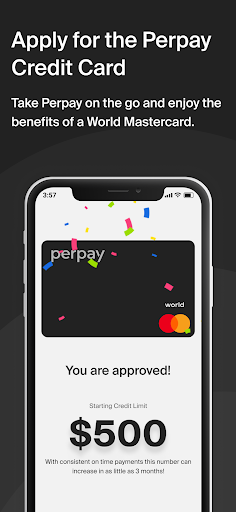

Go to the app's ‘Credit Card' section, tap ‘Apply,' fill in the required info, and submit. The process is simple and does not affect your credit score.

Are there any fees or interest on purchases or the credit card?

No interest or fees on marketplace purchases. The credit card has a $9 monthly servicing fee, but no annual fee or security deposit is needed.

What should I do if I experience issues with the app?

Try restarting the app, check your internet connection, or contact Perpay's customer support through the app's help section for assistance.

Can I change my payment plan or credit limit later?

Yes, you can adjust your payment plans or request a credit limit change in the account settings under ‘Payment Options' or ‘Credit Settings.'

Is there a monthly fee to keep using Perpay?

There's no monthly fee for using the app itself, but the Perpay Credit Card has a $9 monthly servicing fee. Marketplace purchases are interest-free.