- Category Finance

- Version2.4.0

- Downloads 1.00M

- Content Rating Everyone

Getting to Know Possible: Fast Cash & Credit

Imagine a financial app that acts as your friendly digital assistant, helping you access quick cash and manage credit efficiently—Possible: Fast Cash & Credit aims to do just that. Developed by a dedicated team focused on streamlining financial solutions, this application offers a sleek, user-friendly platform designed to serve busy individuals seeking immediate financial relief and credit management. Its core strengths lie in rapid cash disbursement, secure account handling, and an intuitive transaction experience. Whether you're a student, a young professional, or anyone in need of short-term credit, this app positions itself as a handy digital wallet on your phone.

Fun and Functionality Combined: The App's Core Features

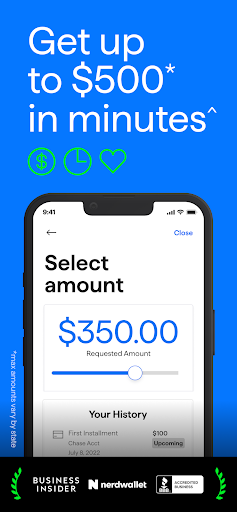

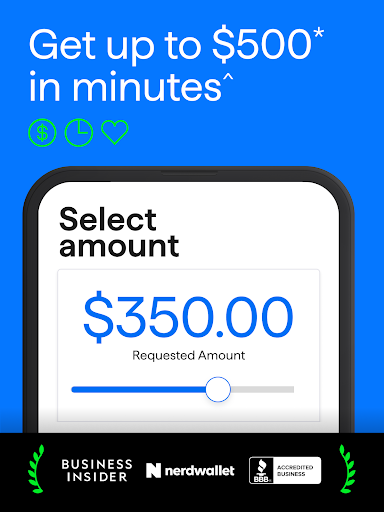

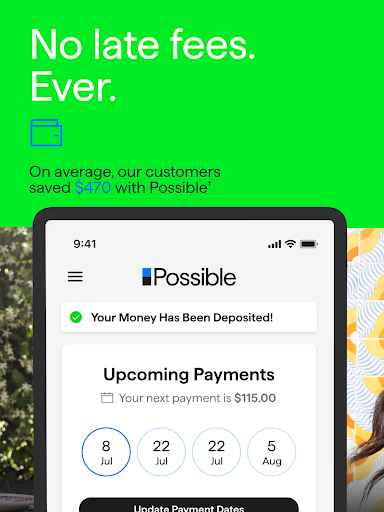

Swift Cash Access—Your Digital Emergency Fund

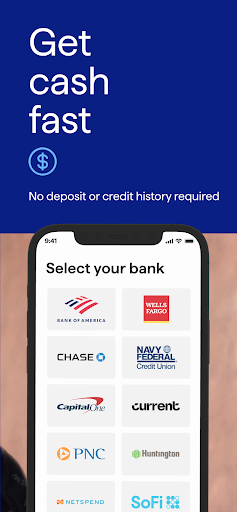

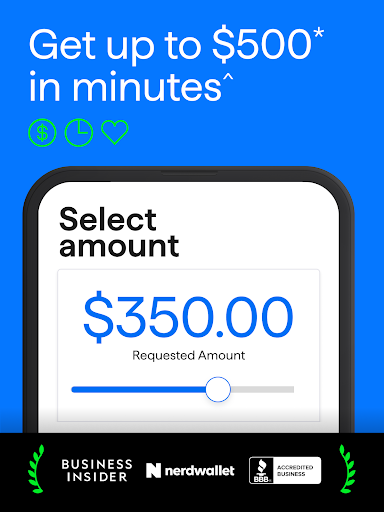

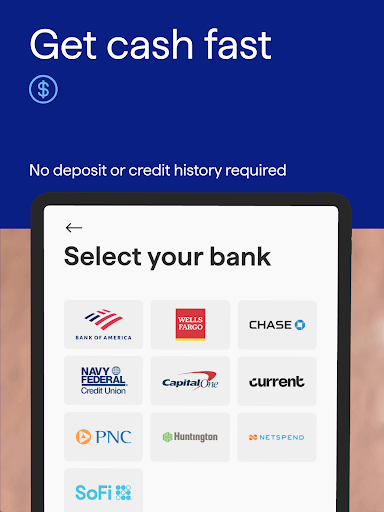

One of the standout features of Possible is its ability to provide instant cash advances. Imagine being caught in an unexpected expense—say, a sudden medical bill or an urgent travel need—and being able to tap a button for fast funds within minutes. The app uses intelligent algorithms to assess eligibility quickly, then facilitates a seamless transfer directly to your linked bank account or digital wallet. This eliminates the wait that traditional payday lenders or bank loans often impose, making it a reliable go-to for urgent cash needs.

Secure Credit Management—Control in Your Hands

The app's credit feature isn't just about borrowing; it's about empowering users to monitor and optimize their credit standing. Clear dashboards highlight your credit limits, current balances, and repayment statuses. Unique to Possible is its built-in educational component—offering tips on improving credit scores and alerting you to any suspicious activities. This fosters a sense of trust and encourages responsible financial behavior, setting it apart from many competitors that focus solely on the transactional aspect.

Smooth and Secure Transactions—A Truly Friendly Experience

The transaction process within Possible is straightforward and glides like a well-oiled machine. Designed with minimalistic aesthetics, the interface simplifies complex financial procedures into a few taps. Users report that the app's responsiveness is impressive, with quick load times and intuitive navigation. Additionally, robust security protocols—such as biometric authentication and end-to-end encryption—give peace of mind, making transactions feel safe and reliable. Compared to other finance apps that sometimes sacrifice usability for security or vice versa, Possible strikes a satisfying balance, ensuring users enjoy a hassle-free experience every time.

What Makes Possible Stand Out?

While many financial apps offer quick cash or credit features, Possible distinguishes itself through its dual focus on security and user education. Its advanced authentication methods and transparent account alerts defend against fraud, making it a trustworthy partner in your financial journey. Moreover, the app's commitment to educating users about credit health sets it apart—empowering you to build a stronger financial future instead of merely providing temporary solutions. These thoughtful touches create a more holistic experience that appeals to users who value both convenience and integrity.

Final Verdict and Recommendations

After exploring Possible: Fast Cash & Credit, I'd say it's a solid choice for individuals who need rapid financial assistance coupled with secure credit management. Its user interface is clean and responsive, suitable even for those less tech-savvy. The app's standout features—particularly its emphasis on account security and educational insights—make it a trustworthy companion in navigating personal finance challenges. I recommend this app for anyone seeking a straightforward, secure, and informative financial tool. For best results, pair it with responsible borrowing habits and keep security features activated to maximize your digital safety.

Similar to This App

Pros

Quick access to cash

Users can quickly get small loans or cash advances when needed, ideal for emergencies.

Simple application process

The app offers a straightforward, user-friendly interface that simplifies the approval process.

Instant approval notifications

Users receive real-time updates about their application status, saving waiting time.

Minimal documentation required

Most loans can be applied for with basic personal information, reducing barriers.

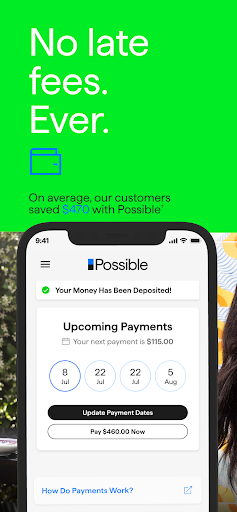

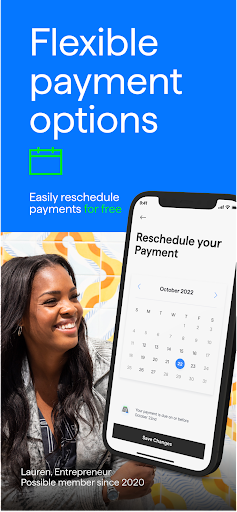

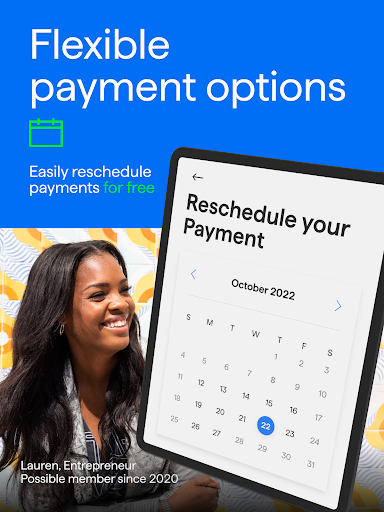

Flexible repayment options

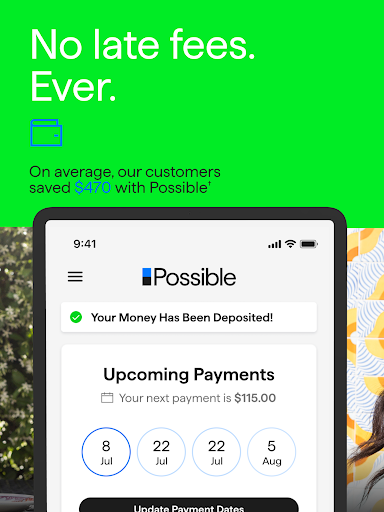

The app provides various repayment plans to suit different financial situations.

Cons

High interest rates (impact: medium)

Some loans come with elevated fees, which can increase repayment amounts; users should review rates carefully.

Limited loan amounts (impact: low)

The app generally offers small cash advances, which may not meet larger financial needs; users can consider multiple small loans over time.

Potential for repeat borrowing leading to debt cycle (impact: medium)

Frequent use might lead to dependency on short-term loans; users are advised to manage borrowing responsibly.

Verification processes may occasionally delay approval (impact: low)

Due to security checks, some users experience longer wait times; app developers are working on streamlining this process.

Privacy concerns with data sharing (impact: low)

Users should review permissions and data policies; official updates may enhance data security in future versions.

Frequently Asked Questions

How do I get started with Possible: Fast Cash & Credit?

Download the app, create an account, and complete the necessary verification steps to access cash advances and credit features.

What information do I need to provide to apply for a cash advance?

You need to provide personal ID, bank details, and income information during the sign-up process in the app.

How can I access my available credit and cash options?

Go to the main dashboard after login; your credit limits and cash advance options are displayed clearly on the home screen.

How does Possible help improve my credit score?

The app reports your on-time payments to credit bureaus, helping build your credit profile over time.

Can I customize my repayment schedule?

Yes, navigate to Settings > Payments to select your preferred autopay date or repayment plan.

Are there any hidden fees or charges with Possible?

No, the app offers transparent pricing with no hidden fees; all costs are disclosed upfront before you borrow.

What is the cost of using Possible's services?

Most users benefit from low or no interest, especially with the 0% APR offer; specific fees depend on your borrowing amount and repayment plan.

How do I cancel my subscription or stop using the app?

Go to Settings > Account > Subscriptions to manage or cancel your plan conveniently within the app.

What should I do if I experience issues accessing my account?

Contact the customer support through the Help section or Settings > Support for prompt assistance.