- Category Business

- Version1.80.1

- Downloads 0.50M

- Content Rating Everyone

Introducing Rain Instant Pay: Your Swift and Secure Financial Companion

Rain Instant Pay is a modern financial app designed to provide users with quick, seamless access to their earned wages and efficient financial management tools, all tailored for today's fast-paced digital lifestyle.

About the Developer and Key Features

The application is developed by RainTech Solutions, a forward-thinking fintech team committed to enhancing financial accessibility. With a focus on user-centric design and robust security, Rain Instant Pay aims to redefine how individuals handle their daily monetary needs.

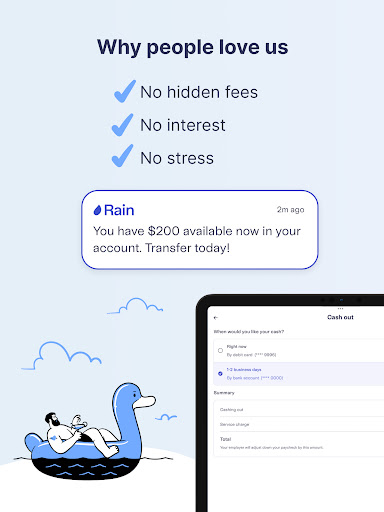

- Instant Wage Access: Enables users to withdraw their earned wages ahead of scheduled payday, reducing financial stress.

- Integrated Budgeting Tools: Provides real-time spending insights and savings goals to promote responsible money management.

- Secure Digital Transactions: Features multi-factor authentication and encrypted payments ensuring safety and privacy.

- Collaborative Work Features: Facilitates group expense tracking and shared financial goals, ideal for teams or family use.

The app primarily targets gig workers, early-career professionals, and anyone seeking flexible financial solutions with an easy-to-navigate platform.

A Fresh Take on Fintech: The Beginning of a Smooth Ride

Imagine this: you're rushing out the door, bills piling up, and the next paycheck still days away. Rain Instant Pay comes to your rescue like a trusted friend with a practical shoulder bag—ready to hold what you need right now. Its candid yet professional tone offers an inviting experience, making complex financial tasks feel like a chat with a knowledgeable companion. Let's put on our tech explorer hats and delve into the core features of this app that's making waves in digital finance.

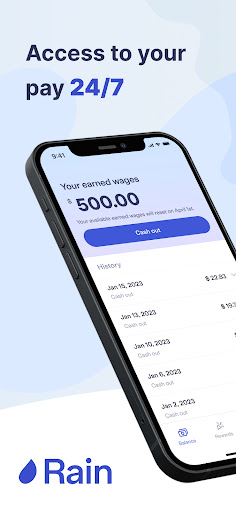

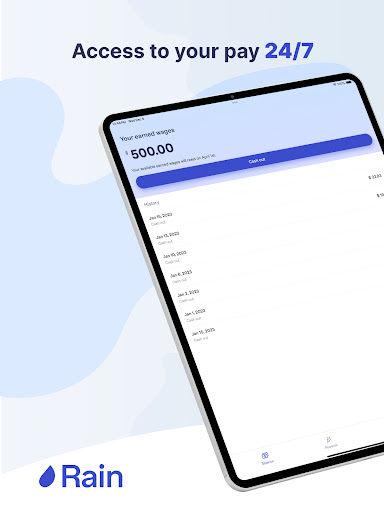

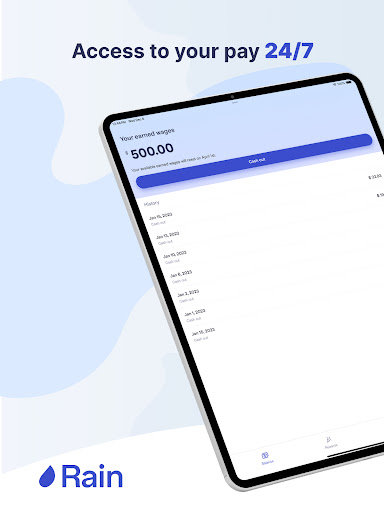

Core Functionality 1: Instant Wage Access — Your Financial Lifeline

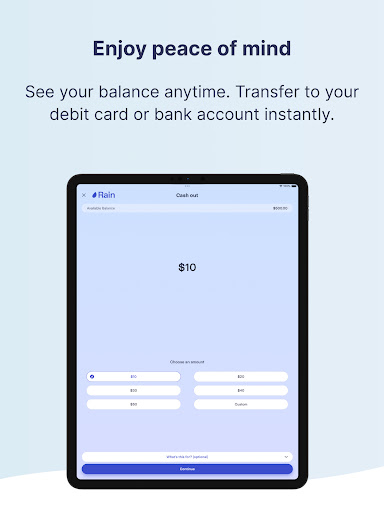

At the heart of Rain Instant Pay is its standout feature: the ability to access earned wages instantly. Unlike traditional banking apps that require waiting until payday, this function acts like your financial express lane. As soon as you complete your shift or task, the app updates your earnings in real time, giving you the option to withdraw part or all of these funds with just a few taps. It's like having a financial safety net accessible 24/7, ensuring you're not trapped by cash-flow crunches.

The interface for this feature is streamlined—simple icons and clear prompts guide you through withdrawal requests. The operation feels fluid; you tap, confirm, and your money arrives swiftly, almost as if your funds are teleporting right to your account. The app's backend prioritizes security without complicating the user journey, blending safety with convenience seamlessly.

Core Functionality 2: Collaborative Financial Management — Teams and Families Unite

This feature truly sets Rain Instant Pay apart. Imagine you're managing expenses for a family trip or team project—creating shared budgets and tracking collective spending becomes effortless. The app's collaborative tools allow multiple users to contribute, view, and manage shared funds in real time. Its design mimics a workspace, where transparency and communication are built into the platform.

This functionality is particularly useful for small businesses or families, replacing the hassle of multiple bank accounts and manual record-keeping. You can allocate funds, set spending limits, and review transactions collaboratively, all within a secure environment. The approach elevates traditional expense management by integrating social and financial elements, making group financial tasks less tedious and more engaging.

Design, Usability, and Differentiation

Rain Instant Pay boasts a clean, intuitive interface that resembles a friendly dashboard rather than a monotonous financial portal. Bright but professional color schemes, icon-driven navigation, and contextual tips reduce the learning curve—think of it as the GPS guiding you effortlessly through your financial journey. The app responds swiftly, with transitions that feel smooth like gliding on ice, providing a satisfying user experience even during intensive tasks.

Compared to similar apps, Rain's standout is its seamless integration of collaborative features alongside rapid wage access. While many fintech apps focus solely on individual use or basic transaction management, Rain positions itself as a collaborative financial platform. Its dual focus on quick cash access and team-oriented expense sharing creates a unique niche—striking a balance between personal finance freedom and social coordination.

Final Thoughts: Who Should Use Rain Instant Pay?

For those who value quick access to earnings, security, and the ability to manage finances jointly with others, Rain Instant Pay is a compelling choice. It's particularly suited for gig workers, freelancers, small teams, or families that need flexible, transparent financial tools. The app's user experience is polished enough for tech novices yet robust enough to satisfy seasoned users seeking efficiency.

While no app is perfect, and some might find the collaboration features less necessary for individual users, overall, Rain Instant Pay earns a strong recommendation. Its most distinctive strengths—real-time wage access combined with collaborative management—make it worth trying out, especially if you're looking to streamline your financial activities in one accessible platform.

In conclusion, Rain Instant Pay offers a practical, user-friendly approach to modern finance, turning what used to be tedious tasks into straightforward, collaborative experiences. It's not just another app—it's a digital partner ready to empower your financial journey."

Similar to This App

Pros

Instant access to earned wages

Users can withdraw their pay immediately after completing work, reducing financial stress.

No traditional bank account required

Supports users without bank accounts, broadening financial accessibility.

Easy-to-use interface

The app features a simple and intuitive design, making transactions straightforward.

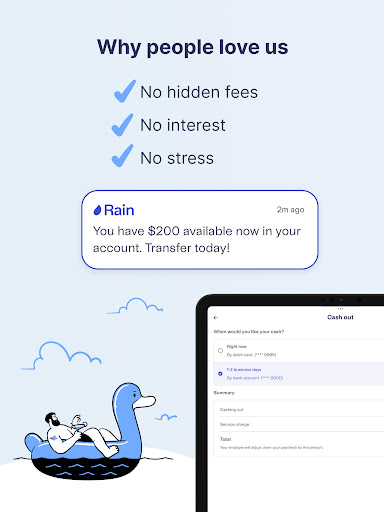

Low or no transaction fees

Most withdrawals are free or have minimal charges, saving users money.

Real-time transaction notifications

Keeps users updated immediately on account activities for better control.

Cons

Limited cash-out options (impact: medium)

Currently, funds can mainly be withdrawn to linked bank accounts or cards, which may inconvenience some users.

Potential delay in transaction processing (impact: low)

Some withdrawals may experience minor delays during high demand periods; users can try scheduling withdrawals outside peak hours.

Insufficient customer support channels (impact: medium)

Support is primarily via in-app chat, which may not resolve complex issues promptly; official plans include expanding support options.

Limited geographic availability (impact: high)

Currently only available in certain regions; users outside supported areas may need alternative solutions.

Security concerns over account linking (impact: medium)

Users are advised to enable two-factor authentication; future app updates are expected to enhance security protocols.

Frequently Asked Questions

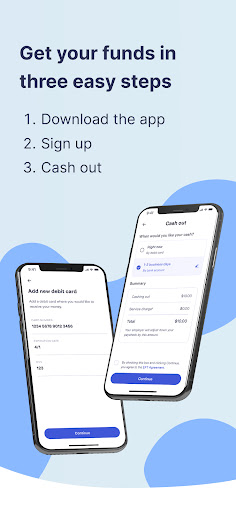

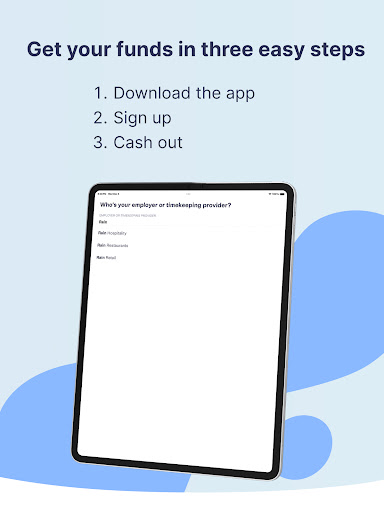

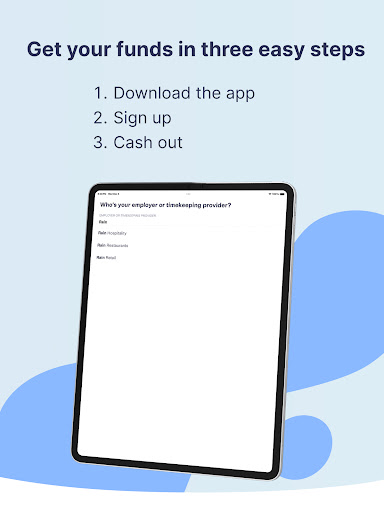

How do I get started with Rain Instant Pay?

Download the app, register, and link your employer if partnered. Your earnings will be tracked automatically, and you can request wages through the app's simple interface.

Is my employer required to partner with Rain before I can use the app?

Yes, your employer must partner with Rain. Confirm with your HR or payroll team to ensure integration and start accessing your wages anytime.

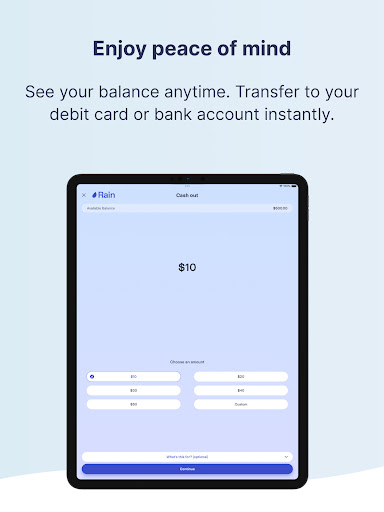

How can I request an early wage advance in the app?

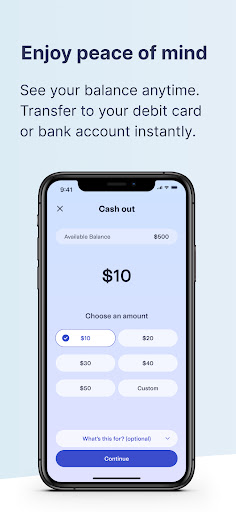

Open Rain, go to the Wage Access section, enter the amount you need, and submit your request. Funds are typically transferred within minutes.

Can I see my earnings and benefits in real-time?

Yes, the app provides real-time updates on your earnings and benefits. View this info on the dashboard after logging in.

What tools does Rain offer to help me manage my finances?

Rain includes spending analytics, automated transactions, balance alerts, rewards, and financial coaching to support your money management.

Are there any fees for accessing my wages early?

Yes, repeated early wage requests may incur fees. Check the app's fee policy in Settings > Fees or during the request process.

How do I check my current balance or transaction history?

Log into the app, then navigate to the 'Balance' or 'Transaction History' section to view your current funds and recent activity.

Is Rain Instant Pay a subscription service, and do I need to pay monthly?

Rain may offer optional benefits or features via subscription; check Settings > Subscription for details and manage your plans accordingly.

Are there any costs associated with using Rain frequently?

Frequent use might lead to service fees. Review the fee structure in Settings > Fees to avoid unexpected charges.

What should I do if I encounter a problem or the app isn't working?

Contact Rain's 24/7 customer support through the Help section or Settings > Support for troubleshooting and assistance.