- Category Finance

- Version1.0.105

- Downloads 1.00M

- Content Rating Everyone

Introducing Rapid! Pay: Your Smart Financial Companion

Rapid! Pay is a comprehensive mobile application designed to streamline personal finance management, offering seamless transaction experiences and robust security features. Developed by the innovative FinTech team at NextGen Solutions, this app aims to simplify digital money handling for everyday users. Its highlights include intuitive bill payments, real-time expense tracking, and advanced security protocols. Targeting tech-savvy professionals, students, and anyone looking to take control of their finances, Rapid! Pay positions itself as a user-friendly yet powerful tool in the crowded world of financial apps.

Engaging Yet Practical: Why Rapid! Pay Stands Out

Imagine managing your finances feels like conducting a symphony—each instrument perfectly in tune, every note deliberate and clear. That's the kind of experience Rapid! Pay seeks to deliver. The interface greets you with a clean, modern design—think of it as the dashboard of your personal financial spaceship, streamlined for ease and efficiency. Whether you're paying bills, transferring funds, or tracking expenses, each action feels smooth, almost as if the app anticipates your next move. With a learning curve that welcomes beginners without sacrificing advanced features for power users, Rapid! Pay balances sophistication with accessibility.

Key Features and Their Impact

Rapid! Pay's core offerings revolve around three main pillars: streamlined transactions, secure account management, and insightful financial monitoring. Each serves as a pillar supporting your financial well-being, all designed with user-centered thinking.

Seamless Transaction Experience: Moving Money Made Easy

Picture this: you're at a bustling café, and you'd like to settle the bill. With Rapid! Pay, a few taps grant you instant transfer capabilities. Its transaction process is notably effortless—drag and drop style, almost like on a well-designed e-wallet, but more flexible. The app's backend ensures that transfers are processed within seconds, backed by real-time confirmation notifications. Unlike many competing apps that require multiple steps or session timeouts, Rapid! Pay's transaction flow is optimized to feel as smooth as gliding on ice. Plus, the integration of QR code scanning for bill payments creates quick interactions without fumbling for cards or typing lengthy account numbers.

Enhanced Account and Fund Security: Fort Knox in Your Pocket

Security remains a top concern in digital finance, and Rapid! Pay takes this seriously. Its flagship feature is the multi-layered security architecture, combining biometric authentication, AI-powered fraud detection, and end-to-end encryption. Think of it as a digital vault that adapts and tightens its defenses based on your usage patterns. The app also offers real-time alerts for suspicious activities, giving you peace of mind knowing your funds are protected—not only by strong walls but also by intelligent guardians that learn your habits. This focus on security distinguishes Rapid! Pay from many peers that rely solely on basic password protection or outdated encryption methods.

Smart Expense Tracking and Budgeting: Your Financial Co-Pilot

Staying on top of personal finances can feel like trying to navigate a maze—complex and overwhelming. Rapid! Pay simplifies this with its intuitive expense categorization and visual dashboards. Imagine your financial life as a garden, where every expense is a plant; the app helps you see which ones are thriving and which need pruning. It automatically categorizes transactions, presents weekly and monthly summaries, and even suggests budget adjustments based on your spending patterns. This proactive approach transforms passive tracking into active financial planning, making budgeting less of a chore and more like tending your personal garden.

User Experience and Differentiators

From the moment you open Rapid! Pay, it's clear that usability was a priority in design. The interface's minimalist aesthetic extends beyond looks; it provides logical navigation pathways, reducing the usual cognitive load associated with financial apps. The navigation is fluid—swiping through screens feels natural, and the responsive design ensures smooth operation on various devices. New users can get acquainted in minutes, while power users find advanced features clearly accessible with minimal fuss.

Compared to other finance apps, Rapid! Pay shines with its dual focus on security and transaction speed. While many apps emphasize either security or ease of use, this app manages to bridge both—its security measures operate invisibly, not obstructing workflows, yet providing top-tier protection. Additionally, its intelligent expense analysis makes it stand out; rather than static charts, it offers actionable insights that help users adjust their financial habits over time.

Final Verdict: Is Rapid! Pay Worth Your Time?

Considering its strengths—particularly the unparalleled transaction speed and robust security—Rapid! Pay is highly recommended for users seeking a secure, intuitive, and feature-rich financial app. Beginners will appreciate its gentle learning curve, while experienced users benefit from its comprehensive monitoring tools and proactive security. For those tired of clunky interfaces or security doubts in other finance apps, Rapid! Pay offers a compelling alternative. It's more than just a payment app; it's a trusted companion for your financial journey.

Similar to This App

Pros

Streamlined Recharge Process

Rapid! Pay allows users to quickly top up carrier accounts with just a few taps, saving time.

Multiple Payment Options

Supports various payment methods like credit cards, e-wallets, and bank transfers, increasing flexibility.

User-Friendly Interface

The app features an intuitive design, making it easy for new users to navigate and complete transactions.

Secure Transactions

Utilizes encryption and security protocols to protect user data and payment details.

Instant Recharge Confirmation

Provides immediate notifications once a payment is successful, ensuring users are informed.

Cons

Limited Carrier Coverage (impact: medium)

Some lesser-known carriers are not supported yet, potentially requiring users to seek alternative methods.

Occasional Payment Delays (impact: low)

Certain transactions may experience slight delays due to network issues or system maintenance; official updates are expected to improve this.

App Stability Concerns (impact: medium)

Users have reported occasional crashes or glitches; developers are actively working on performance enhancements.

Lack of Refund Option within App (impact: low)

Currently, refunds are handled through customer service, which may take time; future updates may integrate automated refund features.

Limited Language Support (impact: low)

Primarily available in English, with plans to introduce additional languages to cater to more users.

Frequently Asked Questions

How do I set up and start using rapid! Pay for the first time?

Download the app from Play Store or App Store, open it, and follow the on-screen registration steps to link your accounts and activate your card.

Can I access my rapid! Pay account on multiple devices?

Yes, simply sign in with your credentials on any device. Enable biometric login for easier access and security.

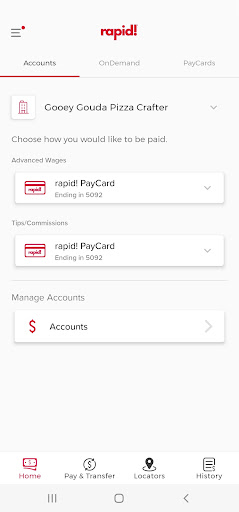

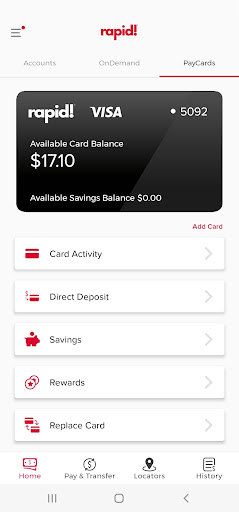

What are the main features of rapid! Pay's PayCard management?

You can activate, replace your PayCard, view balances, transaction history, transfer funds, and personalize your card with a custom image via Settings > Card Management.

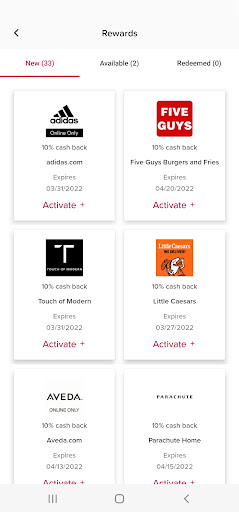

How do I view and earn Cash Back Rewards?

Go to the Rewards tab, view available offers, and make qualifying purchases to earn cash back. Track your rewards in the app.

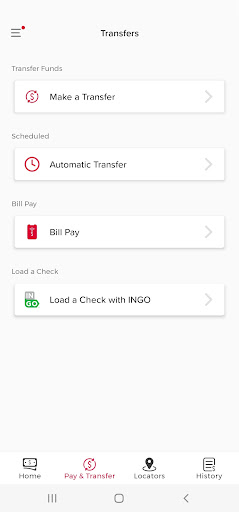

How can I send money or pay bills with rapid! Pay?

Navigate to the Pay Anyone or Bill Payment sections, select or add payees, enter amounts, and confirm transactions to pay bills or transfer funds.

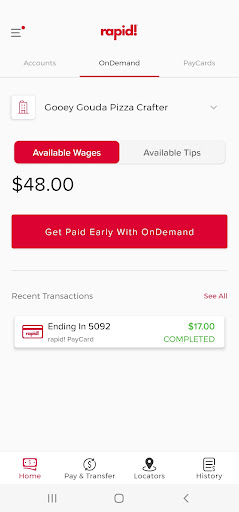

How do I access my earnings instantly through the app?

Go to the OnDemand/Disbursements feature, view your pay period, and select your preferred payout method to receive funds promptly.

Are there any subscription fees or charges for using rapid! Pay?

The app is generally free; however, certain services like expedited transfers or additional card features may incur fees. Check the Fees section in Settings.

How can I find out about additional costs or fees in the app?

Visit Settings > Fees & Charges to review available services and associated costs before completing transactions.

What should I do if the app crashes or I encounter technical issues?

Try restarting the app, checking your internet connection, or reinstalling. For further help, contact Customer Support via the app's Help section.

Can I customize my notification preferences for transactions?

Yes, go to Settings > Notifications to enable or disable alerts via email, SMS, or push notifications according to your preferences.