- Category Finance

- Version10.109

- Downloads 0.05B

- Content Rating Everyone

Revolut: Spend, Save, Trade – A Comprehensive Review of the Financial Powerhouse

Revolut's latest app aims to redefine personal finance management with its all-in-one approach, blending seamlessly digital banking, investment capabilities, and innovative security features, making it a compelling choice for modern users seeking convenience and control.

Introducing Revolut: A Digital Banking Companion for the Modern Era

Developed by Revolut Ltd., a fintech company renowned for its disruptive approach to traditional banking, this app positions itself as a versatile financial toolkit meticulously designed to cater to diverse user needs. From effortless currency exchange and budgeting to investing and security, Revolut consolidates multiple financial functions within a single, intuitive platform.

Key features include real-time money management, cross-border spending with minimal fees, integrated trading for cryptocurrencies and stocks, and advanced security measures to safeguard your assets. Its target audience spans frequent travelers, digital nomads, young professionals, and anyone interested in smarter financial control beyond traditional banking horizons.

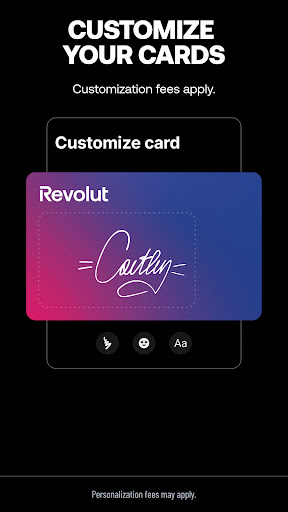

Engaging and User-Friendly Interface That Makes Fintech Feel Like a Breeze

One of the first things that strike you about Revolut is its sleek, modern interface that feels less like navigating a bank and more like scrolling through a favorite social app. The onboarding process is straightforward; even newcomers get up to speed quickly thanks to thoughtful tutorials and clear icons. The app's layout employs a clean, vibrant color scheme and minimalistic design, making complex tasks like currency conversions or stock purchases approachable for users at all levels.

Operational flow is seamless—transactions process instantaneously, and transitions between sections such as Spend, Save, and Trade are smooth and intuitive. Whether you want to check your spending insights or execute a trade, the design facilitates a minimal learning curve, empowering users to explore features without frustration or confusion.

Core Features That Stand Out in the Crowd

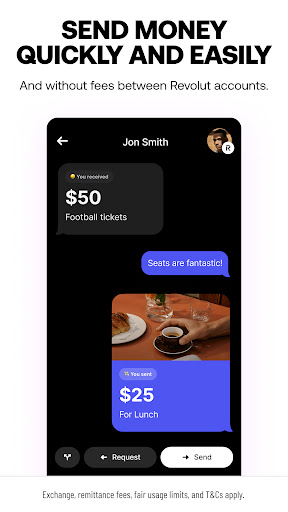

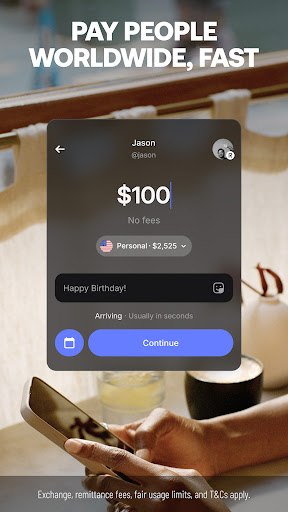

Spend & Currency Management: Making Global Payments Feel Local

Revolut's Spend feature is akin to having a multi-currency wallet in your pocket. Users can hold and exchange over 30 currencies at interbank rates, making international travel and online shopping effortless and cost-effective. The app's dynamic exchange rates and zero-fee international spending are particularly notable, transforming traditional banking limitations into seamless global financial mobility.

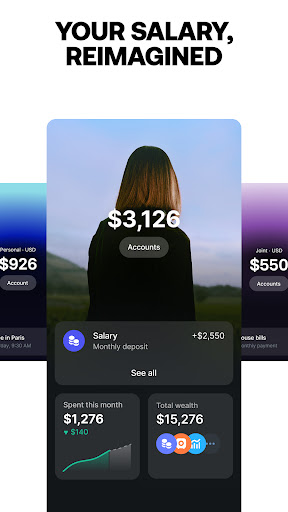

Save & Budget: Turning Spending Habits Into Savings

The innovative “Vaults” feature allows users to set aside money effortlessly, either round-up spare change or create dedicated savings pots. It's like having a piggy bank that grows passively through everyday transactions. Visual insights and customizable goals help users stay motivated and disciplined, fostering healthier financial habits with minimal effort.

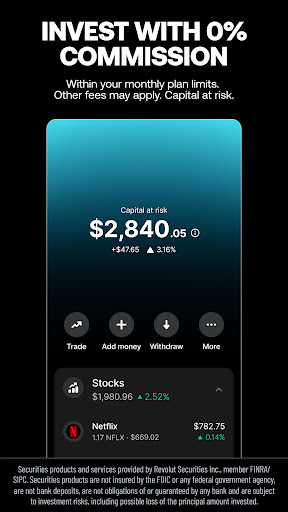

Trade & Invest: Exploring Markets With Ease

The integrated trading platform is a standout—users can buy and sell cryptocurrencies like Bitcoin and Ethereum, as well as stocks and commodities, all within a single app. The real-time updates, competitive fees, and intuitive charts democratize investing, making it accessible even for novices. Plus, the app provides educational snippets and risk assessments, guiding users to make informed decisions without feeling overwhelmed.

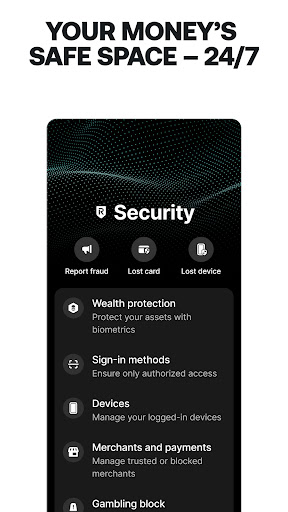

Security and Transaction Experience: Putting Your Money and Data First

Revolut employs cutting-edge security protocols, including biometric authentication, disposable virtual cards for online purchases, and instant freeze/unfreeze capabilities, akin to having a vigilant guard watching your digital valuables. This ensures that security is not an afterthought but a core component seamlessly integrated into the user experience.

Compared to traditional financial apps, Revolut's transaction experience feels fluid and reliable, minimizing delays and errors. The transparent fee structure and detailed transaction histories also contribute to peace of mind—think of it as having a personal accountant watching over your every move.

Final Verdict: Is Revolut the Right Financial Companion for You?

Considering its robust feature set, user-centric design, and focus on security, Revolut stands out as a versatile and reliable fintech app for a broad spectrum of users. The app's most compelling aspect is its all-in-one approach—blending spending, saving, and trading within a single interface—making financial management feel less like a chore and more like a journey of empowerment.

For those who travel frequently, want efficient currency handling, or explore investing young, Revolut offers a comprehensive toolbox that balances simplicity with depth. It's advisable to start with basic features like spending and saving, then gradually explore its trading options as confidence grows. Overall, I would recommend giving Revolut a solid try—especially if you value convenience, security, and innovation bundled into one sleek package.

In essence, Revolut is not just another banking app; it's a financial partner designed for the digital age, transforming how we control, grow, and protect our money.

Similar to This App

Pros

User-Friendly Interface

The app offers an intuitive and sleek design, making it easy for users to navigate and manage their finances.

Comprehensive Features

Revolut combines spending, saving, and trading functionalities in one platform, streamlining financial management.

Competitive Exchange Rates

The app provides favorable currency exchange rates, beneficial for international travelers and traders.

Real-Time Spending Alerts

Immediate notifications help users monitor their transactions and prevent fraud.

Innovative Trading Tools

Built-in trading features allow users to trade stocks, cryptocurrencies, and commodities directly within the app.

Cons

Limited Free ATM Withdrawals (impact: Medium)

Free ATM withdrawal limits are modest, potentially incurring fees for frequent cash users.

Inconsistent Customer Support Response (impact: Medium)

Support response times can be slow during peak hours, which may frustrate users needing immediate assistance. Using the chat feature during off-peak times can alleviate this.

Limited Cryptocurrency Offerings (impact: Low)

Revolut's crypto trading options are somewhat restricted compared to dedicated crypto platforms, but expansion is expected in future updates.

Additional Premium Fees (impact: Low)

Some advanced features require a subscription, which might be costly for casual users; reviewing free tier options can be a temporary workaround.

Geographic Restrictions (impact: High)

Certain features are unavailable in some countries, though official updates often expand accessibility over time.

Frequently Asked Questions

How do I sign up and start using Revolut?

Download the app, open it, follow the registration steps, verify your identity, and link your bank account via Settings > Accounts.

Can I use Revolut outside my country?

Yes, Revolut offers international spending with great exchange rates. Just set up your card and select the desired currency through the app.

How do I generate virtual or single-use cards?

Go to Cards > Create Virtual Card or Single-Use Virtual Card, then follow prompts to instantly generate them for secure online payments.

How can I set up savings and manage my Vaults?

Navigate to Wealth > Savings Vaults, then set recurring transfers or enable round-up to start saving effortlessly.

How do I start trading stocks on Revolut?

Open the Stocks section, complete account verification, and then you can buy stocks from over 2,000 companies starting at $1.

What are the benefits of upgrading to Premium or Metal plans?

Go to Settings > Subscription and choose Premium or Metal for exclusive cards, travel perks, and enhanced security features.

How does Revolut ensure my security?

Revolut offers features like card freeze, spending limits, fraud alerts, biometric login, and dynamic single-use cards to protect your account.

What should I do if I encounter transaction issues or app errors?

Contact Revolut 24/7 in-app support via Settings > Support for assistance and troubleshooting guidance.

Are there any fees for ATM withdrawals using Revolut?

Access over 55,000 ATMs worldwide without fees; extra charges may apply depending on your plan or withdrawal amount.

Can I manage multiple bank accounts through Revolut?

Yes, link external bank accounts in Settings > Accounts to view and manage all your transactions effortlessly.