- Category Finance

- Version342.1.0

- Downloads 1.00M

- Content Rating Everyone

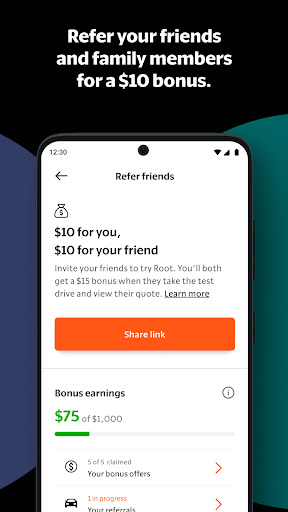

Introducing Root: Better Car Insurance — Your New Digital Insurance Companion

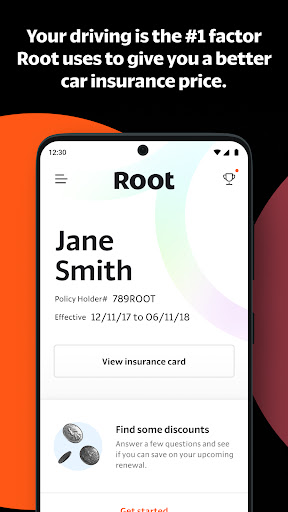

Root: Better Car Insurance is a modern app designed to revolutionize the way drivers find and manage their car insurance policies. With a focus on personalized, data-driven coverage, it aims to give users a smarter, more transparent insurance experience through innovative technology.

Developed by a Forward-Thinking Tech Team

Founded by a team passionate about reimagining insurance through technology, the developers behind Root combine expertise in automotive data analysis, app development, and customer-centered design. The result is an intuitive platform that not only simplifies insurance management but also tailors policies based on actual driving behavior.

Core Features That Make a Difference

Root's standout functionalities include:

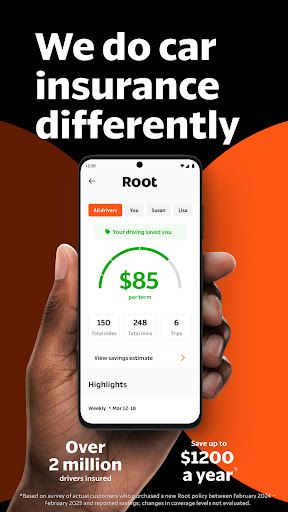

- Driving-Based Premium Pricing: The app uses real-time driving data to assess safe driving behavior, offering personalized premium quotes that can lower costs for well-behaved drivers.

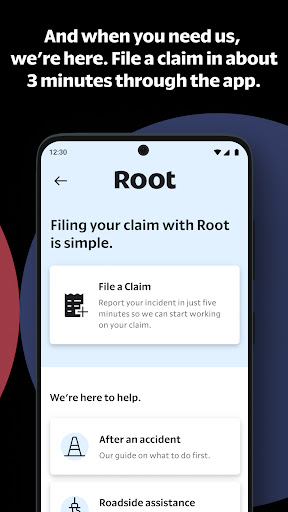

- Seamless Claims Process: Users can file, track, and settle claims directly within the app, minimizing paperwork and waiting times.

- Real-Time Driving Insights: The app provides feedback and tips on driving habits, encouraging safer driving and potentially reducing insurance premiums over time.

- Integrated Vehicle Tracking & Security: For added peace of mind, Root offers optional features like vehicle tracking and theft protection, all accessible via the app.

Engaging and Intuitive User Experience

From the moment you open Root, you're greeted with a sleek, modern interface that feels like a friendly dashboard for your car's insurance journey. The main menu's clean layout ensures that vital functions such as quotes, claims, and driving insights are just a tap away. Navigating through the app is smooth, akin to gliding through well-oiled machinery — with swift transitions and responsive controls that make the experience pleasant rather than a chore.

Easy on the Learning Curve, Powerful in Practice

Even for those less tech-savvy, Root's design prioritizes clarity. The onboarding process guides users through activating driving tracking and understanding policy options without overwhelming them. Real-time feedback — like friendly tips on eco-driving or braking habits — helps users adapt their behavior intuitively. Overall, the app's learning curve is gentle, but behind the scenes, it harnesses sophisticated algorithms that deliver meaningful, personalized insurance solutions.

How Root Stands Out from Traditional and Peer Apps

Compared to conventional insurance apps, Root's key differentiator lies in its emphasis on usage-based pricing driven directly from driving data, akin to a driving coach who grades your skills and rewards cautious drivers. This data-centric approach creates a direct link between your safe driving habits and potential savings, making it more transparent than typical fixed-rate policies.

Furthermore, Root integrates a robust security layer with features like vehicle theft alerts and GPS tracking, giving users confidence that their vehicle is protected beyond just insurance coverage. This combination of behavioral insights and vehicle security provides a holistic safeguard, unlike many competitors that focus solely on policy management or claims.

Final Take: Who Should Give Root a Try?

If you're someone who appreciates transparency, personalized pricing, and a tech-savvy approach to insurance, Root deserves serious consideration. Its driving-based premium model not only promotes safer driving but also means you pay for what you truly usage, rather than blanket rates. However, if your driving patterns are unpredictable or you prefer traditional fixed premiums, it might be less advantageous.

Overall, I recommend Root for cautious drivers seeking an app that actively rewards good habits and provides a seamless, engaging experience. With its innovative use of real-time driving data and integrated security features, it stands out as a forward-looking solution worth exploring for modern drivers looking to manage their car insurance smarter—and perhaps even save a few bucks along the way.

Similar to This App

Pros

User-friendly interface

The app's layout is intuitive, making it easy for users to navigate and find insurance options.

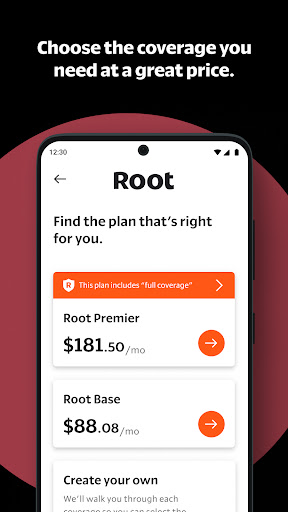

Comprehensive coverage options

Root offers a variety of tailored insurance plans suitable for different driver needs.

Real-time quotes and instant policy issuance

Users can receive quotes and purchase coverage quickly without lengthy processes.

Clear pricing with no hidden fees

Pricing details are transparent, helping users make informed decisions.

Excellent customer support

The app provides accessible and responsive support channels for user inquiries.

Cons

Limited availability in some regions (impact: medium)

Currently, Root mainly serves specific states in the U.S., limiting options for users elsewhere.

Occasional app crashes during high traffic (impact: low)

Some users have experienced app freezes during peak hours, but updates are expected to fix this.

Lack of detailed policy explanations in some areas (impact: low)

Some policy documents could be more comprehensive for better understanding, with future updates likely improving this.

Premium rates may vary significantly based on driving data (impact: medium)

Users with less driving data may see higher premiums; contacting support can help explore discounts.

Limited integration with third-party services (impact: low)

Currently, the app doesn't support many third-party add-ons, but this may be expanded in future releases.

Frequently Asked Questions

How do I get started with Root: Better Car Insurance?

Download the app from the App Store or Google Play, open it, and complete the quick test drive to receive your personalized quote.

Do I need to complete a driving test before getting insured?

Yes, the app uses your phone's sensors to monitor your driving during a test drive, which helps determine your rates.

How does Root determine my insurance premium?

Root analyzes your driving habits via the app's sensors, and safer driving scores can lead to lower premiums based on your behavior.

Can I manage my policy easily within the app?

Yes, you can view policy details, file claims, make payments, and adjust coverage all within the app's user-friendly interface.

What features does the Root app offer for managing claims?

Claims can be filed in minutes by tapping a button, and your documents are stored digitally for easy access and tracking.

How can I pause my coverage when I am not driving?

Open the app, go to the policy section, and select 'Pause Coverage' during your non-driving periods to save costs.

What are the subscription options for auto insurance on Root?

Coverage levels and costs can be customized within the app during setup; payments are managed through the app's billing section.

Are there any additional fees or charges I should know about?

Root provides transparent pricing, but check the app's billing section for any surcharges or additional features you may select.

How does billing and payment work within Tree?

Payments are managed directly through the app's billing section, where you can set up, view, and modify your payment methods.

What should I do if the app is not functioning properly?

Try reinstalling the app, clearing cache, or contacting customer support via the help section in the app for assistance.