- Category Finance

- Version7.1.0

- Downloads 1.00M

- Content Rating Everyone

Self - Credit Builder: Empowering Your Financial Future with Simplicity and Security

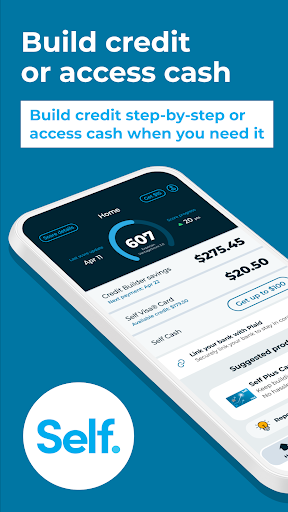

Designed to help users build credit effortlessly while maintaining control and transparency, Self - Credit Builder is a thoughtfully crafted financial app that combines innovative features with user-friendly design. Developed by a dedicated team of financial technology enthusiasts, this app aims to provide a seamless pathway for individuals to establish or improve their credit health.

Core Features That Make a Difference

1. Credit Building Through Responsible Saving

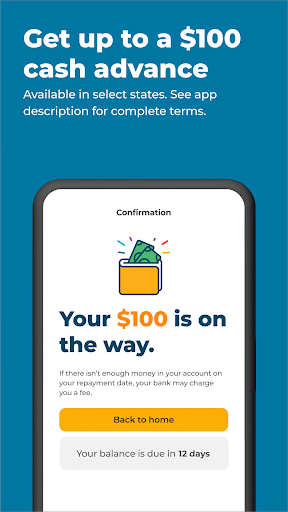

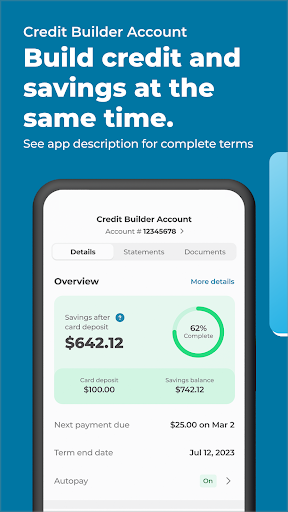

Unlike traditional credit-building tools, Self integrates a unique model that combines savings with credit reporting. Users make manageable monthly payments into a secured account, which in turn reports to credit bureaus, helping them establish a positive credit history. This dual-purpose approach not only helps users save money but also continuously enhances their credit profile, acting like a steady drumbeat that signals financial progress to lenders.

2. Transparent Credit Reporting & Progress Tracking

Transparency is at the heart of Self. The app offers real-time insights into how payments affect your credit score, illustrated through intuitive charts and easy-to-understand metrics. This feature demystifies the often opaque credit scoring process, allowing users to see exactly how their actions influence their score, akin to having a personal financial coach guiding each step.

3. Secure and User-Friendly Interface

Designed with simplicity and security in mind, Self boasts an interface that feels like a clean, well-organized workspace. Navigation is smooth, with logical flow between setup, payments, and progress overview. The app employs robust encryption measures, making transaction and account security a top priority, comparable to locking your financial vault behind state-of-the-art digital safeguards.

Evaluating the User Experience

From the moment you open Self, the interface greets you with a calm and welcoming layout. The onboarding process is straightforward, with step-by-step guidance that reduces the learning curve—imagine a friendly tour guide leading you through a new city. Operations such as setting up payments and checking your credit progress are responsive and intuitive, ensuring that users don't feel lost or overwhelmed. The app's design strikes a fine balance between simplicity and depth, making it suitable for both newcomers to credit building and more experienced users seeking clarity.

How Self Stands Out in a Crowded Marketplace

While many financial apps focus solely on transactions or budgeting, Self's core emphasis on credit building, combined with its transparent reporting, sets it apart. Its unique model of linking responsible savings directly to credit score improvement acts like a two-way street—progress in one fuels the other. Compared to other credit-focused apps, Self's emphasis on security is notable; it uses bank-level encryption and regular security audits, ensuring personal and financial data remains protected. Additionally, its emphasis on user education—through insights and progress tracking—serves as an empowering feature that demystifies credit mechanics, unlike some competitors that merely report scores without explanation.

Final Thoughts and Recommendations

If you're someone seeking a straightforward, secure way to establish or improve your credit without the hassle of complex financial jargon, Self is worth considering. Its most distinctive feature—building credit through responsible savings with real-time feedback—acts like a compass guiding you confidently toward your financial goals. I'd recommend this app for those who want transparency, security, and an educational edge in their credit journey. Whether you're just starting out or looking to recover from past credit challenges, Self provides a trustworthy, user-centric platform tailored to help you succeed.

Similar to This App

Pros

Credit score improvement

Self - Credit Builder helps users establish and enhance their credit scores by reporting positive financial behavior.

User-friendly interface

The app features an intuitive design that makes it easy for users to manage their credit building activities.

Affordable setup fees

Low initial costs make it accessible for users with limited budgets.

Clear progress tracking

Offers detailed dashboards to monitor credit growth and account activity over time.

Educational resources

Includes helpful tips and information to improve financial literacy and credit habits.

Cons

Limited credit reporting agencies (impact: medium)

Currently reports only to a specific credit bureau, which might limit credit score impact for some users.

Slow credit score changes (impact: medium)

Credit score improvements may take several months to become noticeable due to reporting lag.

App stability issues (impact: low)

Some users have experienced occasional bugs or crashes, which could disrupt their tracking.

Lack of customization options (impact: low)

Limited ability to tailor the program to individual financial situations or goals.

Customer support response time (impact: low)

Support services can sometimes be slow, but official updates indicate plans for improvements.

Frequently Asked Questions

How do I start using Self to build my credit?

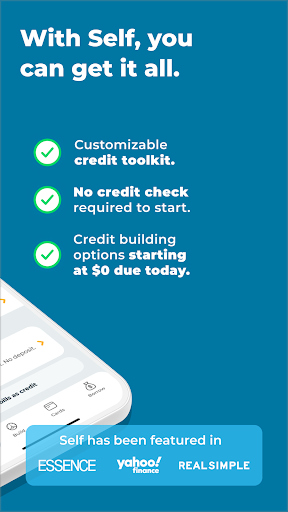

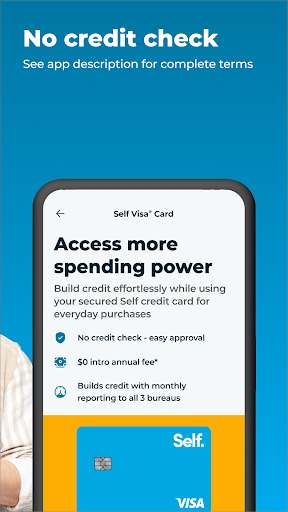

Download the app, create an account, and select a plan to begin building credit and saving money; no credit check is required for initial setup.

Is there a minimum or maximum credit score required to use Self?

No, Self is designed for all credit scores, including no credit or poor credit; it helps you improve regardless of your starting point.

How does the Self Visa® Credit Card help me build credit?

The secured card reports your payments to credit bureaus, helping establish a positive credit history without the need for a credit check; apply via the app under Card settings.

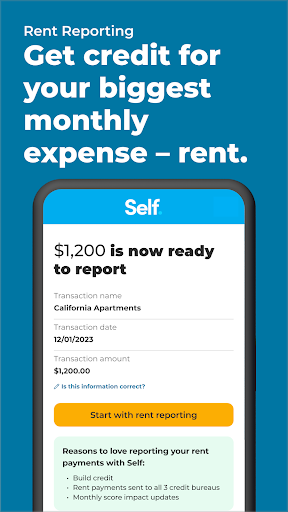

Can I report my rent and utility payments for free?

Yes, you can report rent, water, electricity, gas, and cell phone payments at no extra cost through the app's reporting feature in the Payments section.

How do I report my bill payments to credit bureaus?

For $6.95/month, go to the Payments tab, select your bills, and choose to report; payments are reported to all three bureaus within 72 hours.

What savings benefits does Self offer along with credit building?

Self allows you to save money while making monthly payments; your savings accumulate and can be unlocked at the end of your plan via the app's Savings section.

What are the subscription options and their costs?

Self offers various plans starting at $25/month for credit-building and an additional $6.95/month for bill reporting; you can select your plan during sign-up or in account settings.

How do I update or cancel my subscription?

Navigate to Settings > Account > Subscriptions in the app to manage, update, or cancel your subscription easily at any time.

Will I get charged if I miss a payment or cancel early?

You are charged based on your selected plan; missing payments may affect your credit building, and cancellation stops future charges—review plan details in Settings.

What should I do if the app is not updating my payments or credit score?

Try restarting the app, ensure internet connection, and check the Payments section for updates; if issues persist, contact support via the Help or Support section.