- Category Shopping

- Version5.0.2

- Downloads 1.00M

- Content Rating Everyone

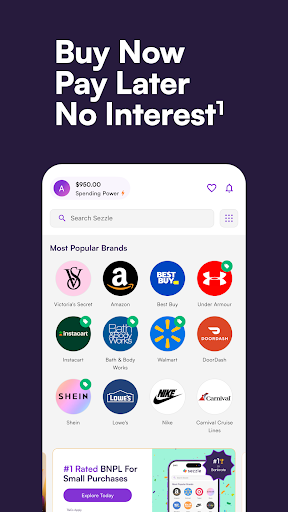

Sezzle - Buy Now, Pay Later: A Modern Twist on Flexible Shopping

Sezzle stands out as a user-friendly financial tool that empowers consumers to split purchases into manageable payments without interest, making shopping more accessible and budget-friendly.

Developed by a Forward-Thinking Fintech Team

Created by Sezzle Inc., a fintech pioneer dedicated to revolutionizing the way consumers access credit, the app combines innovative payment solutions with a commitment to transparency and responsible lending.

Core Features That Make a Difference

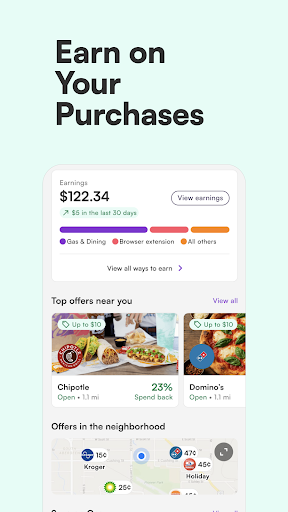

Sezzle offers an intuitive split-payment system that allows users to divide their purchases into four interest-free installments. Its instant approval process and transparent fee structure stand out, providing a hassle-free experience. Additionally, the app integrates seamlessly with various online retailers, often promoting ethical credit practices to encourage responsible spending.

Who Is It For?

Sezzle is ideal for budget-conscious shoppers, students, young professionals, and anyone looking to avoid high-interest credit cards while enjoying the flexibility to spread payments over time. Its target demographic values transparency, simplicity, and the ability to control their spending without surprises.

A Closer Look at Sezzle's Winning Features

Imagine browsing your favorite online store—Sezzle becomes your on-demand financial partner, making the checkout process feel like a friendly chat rather than a daunting finance decision. The app's core functionalities are designed to simplify this journey.

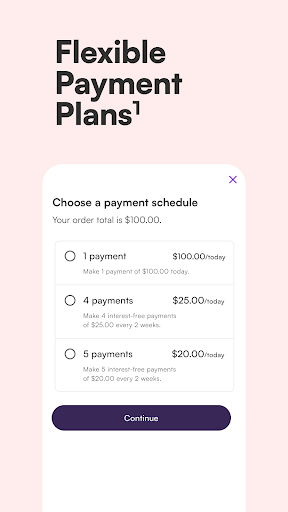

Sezzle's Flexible Payment Plans: Your Personal Budget Buddy

At the heart of Sezzle lies its core feature: the interest-free installment plan. When you make a purchase, Sezzle instantly evaluates your eligibility based on a soft credit check, then offers you to split the total into four equal payments paid every two weeks. This holds true whether you're buying trendy clothing, electronics, or everyday essentials. The clarity around fees—only applicable if payments are late—makes it easier to budget and plan your expenses prudently. This transparency boosts confidence, especially for first-time users wary of hidden costs that often plague other buy-now-pay-later apps.

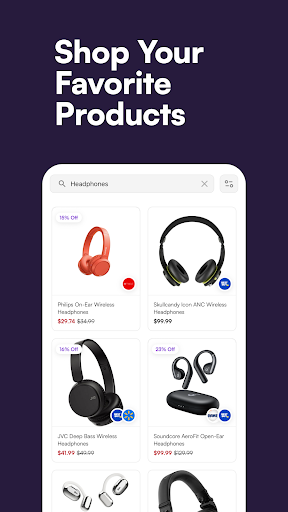

Sezzle's Seamless Shopping Integration: Shopping Made Effortless

Sezzle has partnered with a host of online retailers, ranging from fashion outlets to electronics sites. Its browser extension and mobile app integrate smoothly during checkout, prompting you with a clear, straightforward payment option. Imagine it as having a knowledgeable shopping buddy whispering, “Hey, split this into manageable bites”—encouraging smarter spending without gatekeeping. The user interface resonates with simplicity: clean design, bold icons, and easy navigation make selecting Sezzle as natural as adding items to a cart.

User Experience: Friendly, Intuitive, and Non-Intimidating

The app's layout emphasizes ease of use, with a reassuring color palette and straightforward onboarding process. The registration flow feels more like a casual chat than a rigid form—perfect for those new to buy-now-pay-later services. While some features, like managing payments or viewing transaction histories, become more intuitive with minor usage, the overall learning curve remains gentle. The app's speed and responsiveness keep interactions smooth, ensuring users don't get frustrated navigating through options.

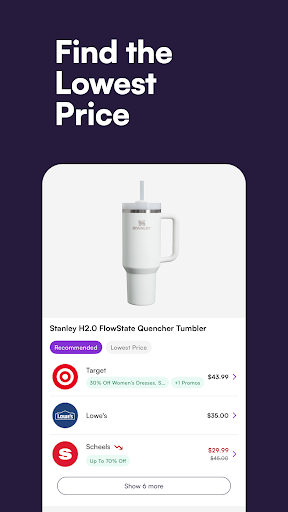

What Sets Sezzle Apart in the Shopping App Crowd?

Compared to other shopping applications that merely facilitate transactions, Sezzle's key differentiators lie in its focus on transparency and ethical credit practices. Unlike some apps that juggle numerous payment options, Sezzle maintains a specific niche—interest-free, installment-based financing—making it a specialized tool rather than a jack-of-all-trades. Its categorization approach—grouping stores by categories like fashion, electronics, or beauty—makes browsing more organized and user-friendly.

Furthermore, Sezzle's pricing structure is transparent: no hidden fees or surprise charges, which builds trust. Its competitive advantage lies in avoiding overly aggressive credit limits or complex reward systems—its simple, honest approach appeals to users wary of predatory lending. Another unique aspect is its emphasis on responsible spending: the app discourages excessive use by providing clear insights into your installment schedule and remaining balances, fostering healthier shopping habits.

Is Sezzle Worth Your Time? Recommendations and Final Thoughts

If you're someone who enjoys online shopping but wants better control over your cash flow, Sezzle is definitely worth trying. Its particular strength in offering interest-free, transparent installment plans makes it stand out, especially for consumers cautious about hidden fees or predatory lending schemes. However, users should be mindful of timely payments to avoid late fees, which, while minimal, can counteract the app's primary appeal.

For casual shoppers, students, or budget-conscious consumers, Sezzle can function as a friendly guide—not a financial burden. It's best suited for planned purchases where spreading costs over a few weeks can make a noticeable difference. Overall, if you appreciate a straightforward, trustworthy alternative to traditional credit, Sezzle deserves a spot in your smartphone arsenal—serving as both a shopper's helper and a responsible financial tool.

Similar to This App

Pros

Flexible installment options

Allows users to split payments into multiple manageable installments, making large purchases more accessible.

Easy-to-use interface

User-friendly app design facilitates quick setup and seamless shopping experience.

Instant approval process

Provides quick credit decisions, reducing wait times for users.

Wide acceptance

Partnered with many popular online and in-store retailers, increasing usability.

Zero interest plans available

Offers interest-free installment options, promoting cost-effective shopping.

Cons

Limited payment schedule options (impact: low)

Currently, Sezzle primarily offers a two or four-installment plan, which may not suit all users' needs.

Maximum purchase limits (impact: low)

Some users may encounter spending caps that restrict larger purchases; this could be addressed with clearer communication.

Late payment fees (impact: medium)

Fees may be charged if payments are missed; setting reminders within the app can help mitigate this.

Account freezes for repeated late payments (impact: medium)

Accounts may be temporarily frozen if payments are repeatedly missed, which could inconvenience users.

Limited geographic availability (impact: high)

Currently available in select regions, limiting access for some international users; official expansion plans may improve this in future updates.

Frequently Asked Questions

How do I get started with Sezzle for the first time?

Download the Sezzle app from App Store or Google Play, sign up with your details, and link your payment methods to begin shopping with buy now, pay later options.

Is there any credit check required to use Sezzle?

Sezzle offers instant approval without a hard credit check, making it quick to start shopping and manage payments easily within the app.

How do I split my payments into installments?

During checkout, select Sezzle as your payment method. You'll then pay in 4 interest-free installments over six weeks automatically scheduled within the app.

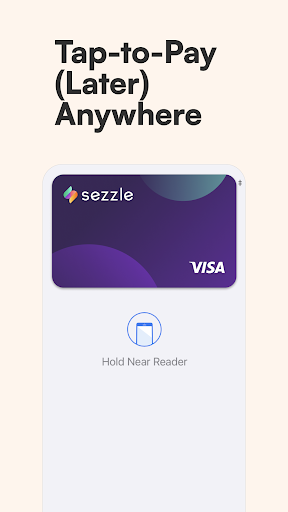

Can I shop in physical stores using Sezzle?

Yes, you can shop in-store by adding Sezzle to Apple Wallet or Google Pay, then selecting it at checkout when Visa is accepted.

How does Sezzle help me manage my finances?

Sezzle's app tracks your payments and provides a budgeting overview, helping you stay on top of installments and prevent overspending.

What should I do if I can't find my favorite retailer on Sezzle?

Check the 'Retailers' section in the app or contact Sezzle support for assistance. Sezzle partners with many popular stores for easy shopping.

Are there any hidden fees or interest when using Sezzle?

No, Sezzle offers interest-free installments. Fees may apply only for late payments or rescheduling, clearly shown during checkout.

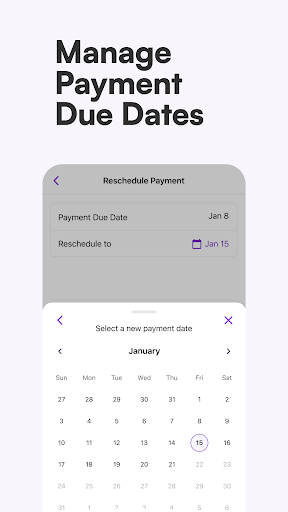

How do I reschedule my payments if I need extra time?

Open the Sezzle app, go to 'Payments,' select the installment, and choose 'Reschedule' if eligible. Rescheduling options vary depending on your account status.

Can I cancel or return a purchase made with Sezzle?

Yes, follow the retailer's return policy. Your refunds will be processed through the retailer, and your remaining payments will adjust accordingly.

What should I do if the app crashes or I experience technical issues?

Please restart your device, update the app, or contact Sezzle support via the app's help section for assistance with troubleshooting.