- Category Business

- Version6.4.2

- Downloads 0.50M

- Content Rating Everyone

Clear and Focused Retirement Investment Management

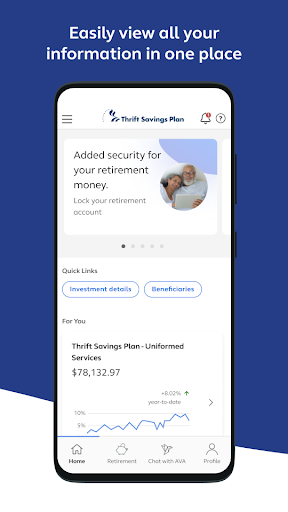

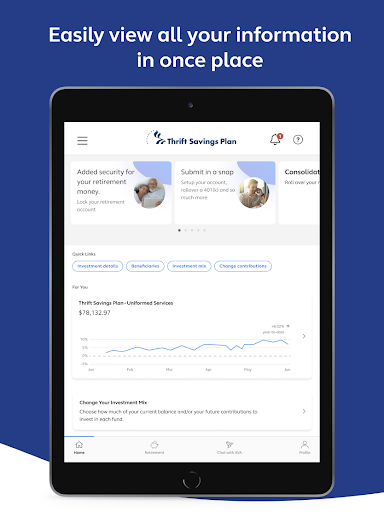

The Thrift Savings Plan (TSP) app is a streamlined platform designed to help federal employees and uniformed services members efficiently manage their retirement savings with ease and confidence.

Developed by the Federal Retirement Service Team

This app is crafted by the dedicated team behind the TSP, a government-operated initiative committed to providing secure and accessible retirement investment options tailored specifically for federal personnel. Their focus on security, simplicity, and transparency is reflected in every aspect of the app's design.

Key Features That Stand Out

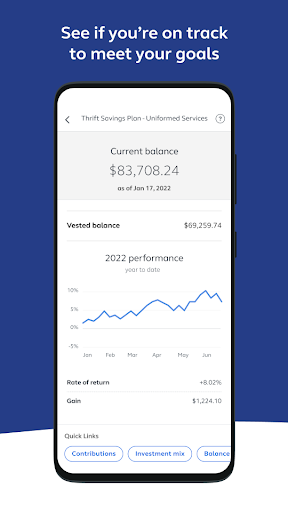

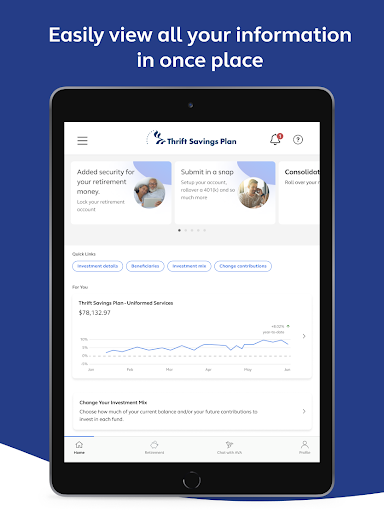

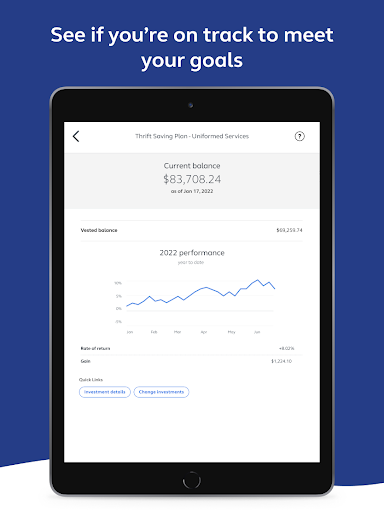

- Real-time Account Monitoring: Users receive up-to-the-minute updates on their balances, contributions, and investment portfolio performance, helping them stay informed without hassle.

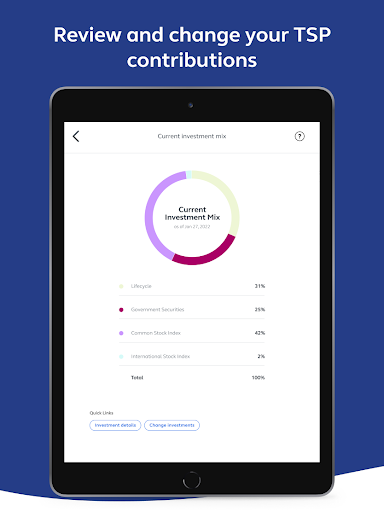

- Personalized Investment Dashboard: An intuitive interface presents tailored recommendations and easy navigation through different fund options, making diversification straightforward.

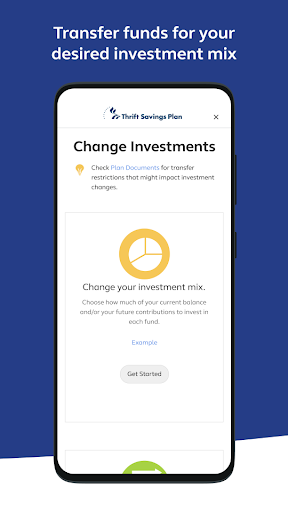

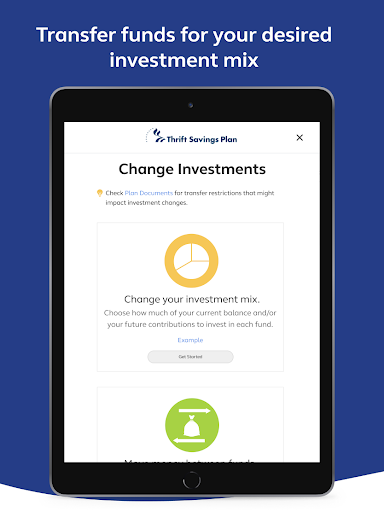

- Seamless Contribution Management: The app simplifies adjusting contribution amounts or switching investment funds, empowering users to fine-tune their retirement strategy effortlessly.

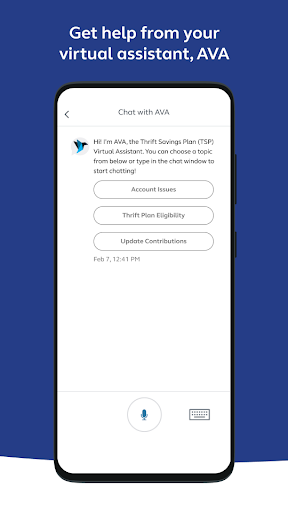

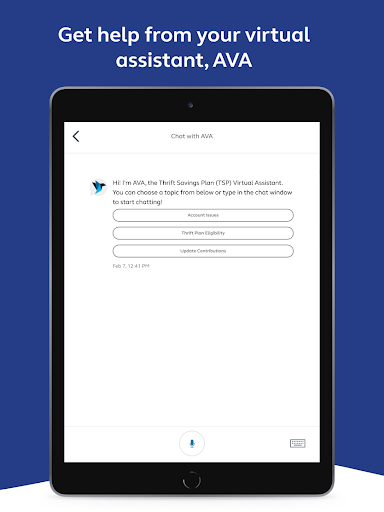

- Educational Resources & Alerts: Built-in guidance tools and notifications help users better understand their options and stay on track with their savings goals.

Engaging the User: A Fresh Take on Retirement Planning

Picture a busy federal employee ending their workday, anxiously checking their phone, but instead of sifting through complicated menus or loading sluggish webpages, they open the TSP app. Instantly, their financial landscape unfolds before them in a clean, lively interface—balances, recent contributions, and suggested actions—like a well-organized dashboard designed by someone who truly understands their journey. The app transforms what might be a daunting financial task into a manageable, even engaging, daily habit.

Streamlined Interface and User Experience

The design employs a minimalistic yet colorful approach, combining clarity with a welcoming feel. Navigating between sections - account details, contribution adjustments, or educational content - feels fluid and intuitive. Smooth animations and quick load times contribute to a sense of responsiveness that keeps users engaged without frustration. For first-time users, a gentle onboarding process guides them through core functions, lowering the learning curve and making the app accessible to all comfort levels. Experienced users will appreciate the quick access to detailed metrics and the ability to customize views according to their preferences.

Core Functional Modules – Deep Dive

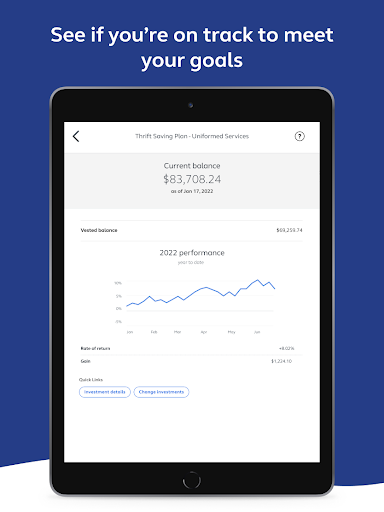

Account Overview and Performance Tracking

This section acts like a GPS for one's retirement journey. Instead of static numbers, users see interactive charts and categorized summaries that depict how contributions and investment funds are performing over time. The visualizations are designed to make complex financial data comprehensible at a glance, helping users understand the impact of their actions and market fluctuations without feeling overwhelmed. Unlike typical financial apps, TSP's focus on simplicity paired with real-time updates ensures users are always in the know.

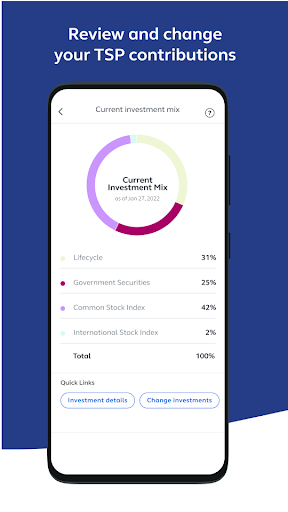

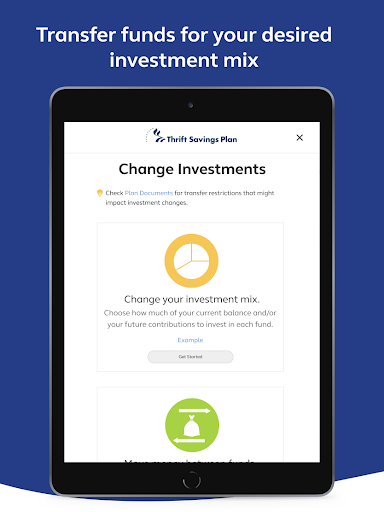

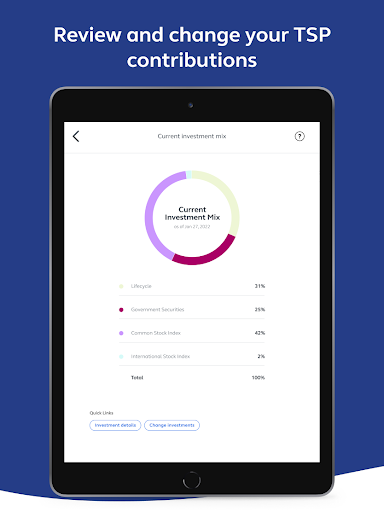

Contribution Management and Fund Switching

This core feature is where the app shines brightest—literally. The process of adjusting contributions or switching funds is nothing short of effortless. Using straightforward sliders or dropdowns, users can modify their savings rate or explore suggested allocations based on their retirement horizon. This flexibility encourages proactive management, and notification prompts remind users about upcoming contribution deadlines or opportunities to optimize investments. The emphasis on ease and clarity fosters greater engagement and confidence in managing one's future.

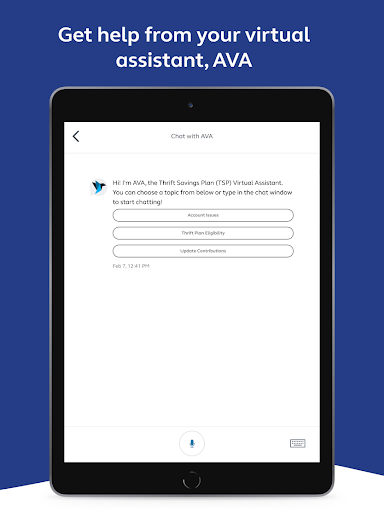

Educational Resources and Actionable Alerts

Understanding retirement plans can feel like trying to decode a foreign language—unless you have a helpful guide. The TSP app integrates bite-sized educational content, FAQs, and expert tips directly within the interface. Paired with personalized alerts—such as reminders to review investment choices or notifications about market changes—this feature transforms passive monitoring into active learning. It empowers users to make informed decisions, helping demystify complex concepts without drowning them in jargon.

What Sets TSP Apart from Its Peers?

While many financial apps offer broad investment tools, TSP's unique advantage lies in its specialized focus on federal employees' retirement plans. Its collaborative features extend beyond simple account management—integrating personalized investment recommendations that adapt over time and enabling better coordination with federal benefits. Compared to generic business apps, TSP's task-oriented design, emphasizing contribution adjustments and educational engagement, ensures users are not just passive investors but active participants. This layered approach creates a sense of partnership, making retirement planning feel less like a chore and more like a strategic game.

Recommendation and Usage Suggestions

Considering its clarity, tailored features, and user-friendly design, I would confidently recommend the TSP app to federal employees and service members seeking an effective, no-fuss way to oversee their retirement savings. It's particularly beneficial for those new to financial planning or anyone who appreciates a straightforward interface that doesn't sacrifice depth. For users comfortable with digital tools but craving a focused, purpose-built platform, TSP offers a compelling blend of accessibility and robust functionality.

To maximize benefits, new users should take advantage of the educational resources and notifications to build good habits early. Experienced users, on the other hand, can leverage the detailed performance tracking and customization options to optimize their investment strategies over time. In essence, this app is best suited for those who want a trustworthy partner guiding them step by step toward a secure retirement, without the distraction of extraneous features.

Similar to This App

Pros

User-Friendly Interface

The app features an intuitive layout that makes navigation simple for all users.

Real-Time Portfolio Updates

Users can view their investment performance instantly, aiding better financial decisions.

Secure Login Options

Multiple authentication methods ensure account safety and protect user data.

Comprehensive Account Management

Users can easily manage contributions, transfers, and account details within the app.

Educational Resources Access

The app provides valuable tools and articles to help users understand investment options.

Cons

Limited Investment Tools (impact: Low)

Advanced features like detailed analysis are minimal, but users can access these via the web platform for now.

Occasional App Crashes (impact: Medium)

Some users experience crashes during peak times; updating the app or reinstalling might temporarily fix this.

Slow Data Refresh Rates (impact: Low)

Investment data may update with slight delays, but future updates are planned for faster syncs.

Inconsistent Notification Alerts (impact: Low)

Some users report missed alerts; enabling push notifications or reinstalling could improve this.

Limited Customer Support Access (impact: Medium)

Support options are primarily through FAQs and email; future updates might include live chat features.

Frequently Asked Questions

How do I get started with the Thrift Savings Plan app?

Download the app from your device's app store, open it, and log in with your tsp.gov credentials to access your account and features.

Is the TSP mobile app free to use?

Yes, the app is completely free. Just download from your app store and log in to manage your retirement savings.

How do I review my TSP account balance and contributions?

Open the app, go to 'Account Overview,' where you can view your balances, contributions, and investment details instantly.

Can I change my investment allocations within the app?

Yes, navigate to 'Investment Management,' select 'Adjust Allocations,' and follow prompts to update your investment mix easily.

How do I deposit a check or rollover funds using the app?

Go to 'Mobile Check Deposit' feature, follow the instructions to take photos of your check, and submit securely for processing.

How can I enroll in or manage the Mutual Fund Window on the TSP app?

Access the 'Mutual Fund Window' section from the main menu to enroll or adjust your mutual fund investments directly.

What security measures does the app include to protect my data?

The app uses biometric login, two-factor authentication, and secure encryption to safeguard your personal and financial information.

Can I access the app's features without a tsp.gov login?

Some features, such as viewing account summaries, require login. However, limited info may be accessible without logging in.

How do I set up or change my contribution amounts within the app?

Navigate to 'Contributions,' select 'Change Contribution,' input your desired amount, and confirm the update via the secure interface.

What should I do if I experience login problems or the app crashes?

Try reinstalling the app, check your internet connection, or contact TSP support via 'Help & Support' for assistance.