- Category Finance

- Version5.5.0

- Downloads 1.00M

- Content Rating Everyone

Introducing TransUnion: Credit Monitoring – Your Personal Credit Guardian

In a digital age where your financial health is just as important as your social reputation, TransUnion: Credit Monitoring stands out as a reliable companion, offering comprehensive insights into your credit profile and helping you stay ahead of potential issues.

A Closer Look at the Developer and Core Features

Developed by TransUnion, one of the major credit bureaus with decades of experience, this app aims to provide users with real-time credit updates and secure monitoring capabilities. Its main highlights include:

- Real-time Credit Alerts: Immediate notifications on any significant changes to your credit report, helping you detect fraud or identity theft early on.

- Comprehensive Credit Report Access: Easy retrieval of your up-to-date credit scores and detailed report summaries to help you understand your financial standing.

- Enhanced Security Features: Features like credit freeze options and password protection to safeguard your sensitive information.

- Educational Resources: Tips and insights to improve your credit health, empowering users with knowledge for smarter financial decisions.

Geared towards consumers seeking proactive credit management, this app caters to anyone from young adults just starting their credit journey to seasoned borrowers wanting to keep their financial health in check.

Vivid App Experience: Navigating Your Credit Journey with Ease

From the moment you open TransUnion: Credit Monitoring, it feels like stepping into a well-organized digital control room. The intuitive interface is akin to a friendly dashboard guiding you through your credit life, making complex data feel like an understandable story rather than a cryptic puzzle. With a sleek, minimalistic design, users can navigate effortlessly—no steep learning curve here.

Core Functionality Deep Dive

First, the real-time alert system is the heart of this app, much like having a vigilant watchman who whispers warnings whenever suspicious activity is detected—be it a new credit inquiry or a sudden spike in your score. These alerts are customizable, allowing users to set thresholds based on their comfort levels, thus ensuring you're never in the dark about your credit profile.

Secondly, accessing your credit report is straightforward and speedy. Instead of drowning in a sea of financial jargon, TransUnion offers clear, digestible summaries. You can see your credit score trends over time, identify factors affecting your score, and even drill down into individual accounts or inquiries. This transparency is especially helpful for those working to improve their credit or preparing for major financial commitments.

The security features are perhaps the most underrated yet critical parts. In an era of increasing digital threats, TransUnion's credit freeze and password protections act like an impenetrable fortress around your credit data. These options allow you to lock down your profile when needed, giving peace of mind that your financial identity remains intact.

How It Sets Itself Apart from Other Financial Apps

While many credit monitoring apps offer similar functionalities, TransUnion's app shines particularly in its focus on **Account and Fund Security** and an intelligently designed **Transaction Experience**. Unlike some competitors that bombard users with excessive notifications or confusing interfaces, TransUnion strikes a balance—it's like having a trusted friend who gently tips you off on the important stuff without overwhelming you.

One standout feature is its proactive fraud detection mechanism. When suspicious activity is detected, the app doesn't just notify you—it guides you through steps to lock your credit or dispute invalid accounts. This approach turns simple monitoring into tangible protection, giving users a sense of control and security.

Moreover, the app's transaction experience is seamless. Actions like freezing your credit or reviewing detailed reports are straightforward—almost as if the app anticipates your needs. This smooth flow enhances user confidence, particularly because managing credit can often feel daunting or intimidating in other contexts.

Final Verdict: Is It Worth a Spot on Your Phone?

Overall, TransUnion: Credit Monitoring offers a balanced combination of reliable features, user-friendly design, and vigilant security measures. It's an essential tool for anyone wishing to maintain a clear view of their credit health while feeling secure in the digital space. For those who prioritize proactive protection over passive observation, this app is highly recommended.

If you're looking for an app that not only informs but actively empowers you to safeguard your financial future—consider giving TransUnion: Credit Monitoring a try. It's like having a dependable co-pilot steering you clear of credit storms, making the journey smoother and safer.

Similar to This App

Pros

Real-Time Credit Alerts

Provides instant notifications for any changes to your credit report, helping users respond quickly to potential fraud.

Comprehensive Credit Monitoring

Tracks multiple credit bureaus and offers detailed insights, giving users a complete picture of their credit health.

User-Friendly Interface

Intuitive and easy-to-navigate app design makes managing credit straightforward for all users.

Identity Theft Protection Tips

Includes educational resources and tips to help users safeguard their personal information.

Affordable Subscription Plans

Offers competitive pricing with tiered options, making credit monitoring accessible to a wide audience.

Cons

Limited Free Features (impact: Medium)

The free version provides only basic monitoring; advanced alerts require a subscription.

Notification Overload (impact: Low)

Users may receive frequent alerts, some of which might be unnecessary, leading to alert fatigue.

App Stability Issues (impact: Medium)

Occasional crashes or slow response times have been reported, but updates are expected to improve stability.

Limited Credit Score Insights (impact: Low)

Provides basic scores but lacks detailed explanations or scoring factors, which could be improved in future updates.

No Dark Mode (impact: Low)

The current app design lacks a dark mode option, which might affect user comfort during extended use.

Frequently Asked Questions

How do I get started with the TransUnion Credit Monitoring app?

Download the app from your store, sign up for free using your personal details, and verify your identity to access your credit scores and reports easily.

Is there a cost to use the basic features of this app?

No, the basic credit score tracking and reports are free; additional features like premium reports may require subscription upgrades.

How can I check my credit score and report on the app?

Open the app, navigate to the dashboard, and your updated credit score and report are displayed on the home screen for easy access.

What features help me stay informed about changes in my credit report?

Activate real-time credit alerts in Settings > Notifications; you'll receive instant updates on significant report changes.

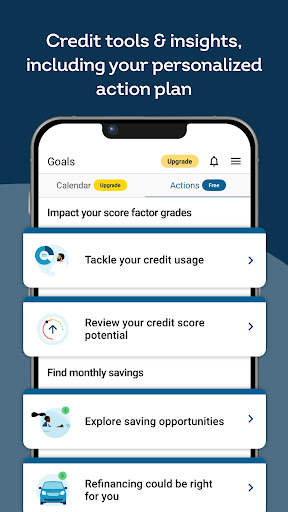

How can I improve my credit score using this app?

Use personalized insights to identify areas for improvement, such as reducing debt or limiting inquiries, and follow the suggested strategies.

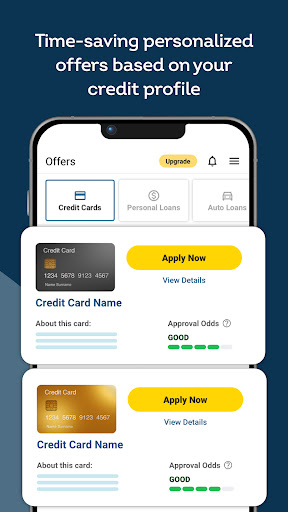

How does the app suggest personalized credit offers?

Based on your credit profile, go to the Offers section in the app to see tailored credit card and loan suggestions.

What are the benefits of upgrading to the premium version?

Premium offers quarterly 3-bureau reports, identity monitoring, and deeper insights into your credit health, accessible via Subscription > Upgrade.

Can I access my credit report from all three bureaus with this app?

Basic app provides reports from TransUnion only; to access 3-bureau reports, upgrade to a premium plan in Settings > Subscription.

Is the app secure, and how is my personal data protected?

Yes, the app uses industry-standard encryption and transparent privacy policies; review Terms of Service in Settings > Legal for details.

What should I do if the app is not updating my credit report or giving errors?

Try refreshing the app, check your internet connection, or reinstall. If issues persist, contact Customer Support in the app's Help section.