- Category Finance

- Version5.73.0 (1852)

- Downloads 0.05B

- Content Rating Everyone

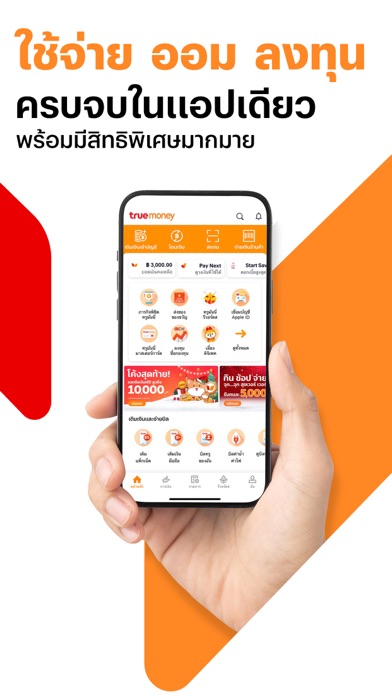

TrueMoney: Empowering Your Digital Wallet Experience

In the ever-evolving landscape of digital finance, TrueMoney stands out as a versatile and user-centric mobile application designed to simplify financial transactions and management for a diverse user base. Developed by the reputable TrueMoney Group, this app brings a suite of features that make everyday financial activities seamless and secure. Whether you're a small business owner, a student, or someone looking for a trustworthy digital wallet, TrueMoney aims to be your reliable financial companion.

Core Functions That Make a Difference

One-Stop Digital Wallet for Payments and Transfers

TrueMoney excels at consolidating various financial transactions within a single platform. Users can effortlessly pay utility bills, top-up mobile credits, buy goods online, and send money to friends and family with just a few taps. The intuitive interface ensures that complex processes are simplified, turning what once took multiple apps and steps into a smooth, unified experience. This feature is especially advantageous in regions with limited banking infrastructure, enabling wider financial inclusion.

Robust Security and Account Management

Security is a top priority for TrueMoney. The app incorporates advanced encryption protocols, biometric authentication, and real-time transaction alerts to safeguard users' funds and personal information. Unlike some peers, TrueMoney emphasizes transparency, allowing users to track all their transactions meticulously. This focus on security and accountability reassures users that their digital assets are protected, boosting confidence in daily digital financial activities.

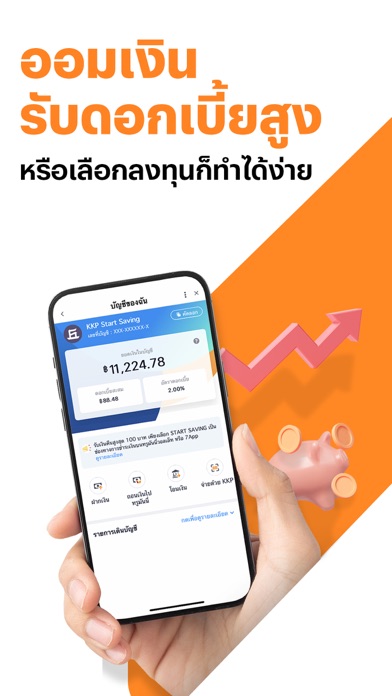

Financial Tools and Insights

Beyond basic transactions, TrueMoney provides users with tools to manage budgets, monitor expenses, and analyze spending patterns. These insights are presented through clear, visually appealing charts that help users make informed financial decisions. This educational component positions TrueMoney not merely as a payment app but as a comprehensive financial management platform—especially useful for new digital users or those striving for better money habits.

Design and User Experience: Smooth Sailing for Beginners

TrueMoney's interface is clean, modern, and user-friendly, akin to a well-organized pocket where everything is within easy reach. The app's navigation is thoughtfully designed, reducing clutter and enhancing discoverability of features. Transitions between screens are fluid, reflecting a high level of operational smoothness that reduces frustration and makes adopting the app feel natural, even for tech novitiates. The learning curve is gentle; most features can be mastered within minutes, making it accessible for a broad demographic.

What Sets TrueMoney Apart from Its Peers

Unmatched Security with a Trustworthy Reputation

While many finance apps promise security, TrueMoney distinguishes itself through its transparent security protocols and strong emphasis on user trust. The platform's multi-layered security system, combined with real-time fraud detection, minimizes risks. Its active approach to safeguarding user funds and data creates a sense of reliability that is sometimes lacking in other digital wallets.

Enhancing Transaction Experience with Speed and Transparency

TrueMoney offers lightning-fast processing for transactions, which is crucial when time is of the essence—be it paying for a last-minute bill or sending emergency funds. Additionally, detailed transaction histories with clear descriptions help users understand exactly where their money is going, reducing confusion and errors. This level of clarity and responsiveness enhances overall user satisfaction.

Final Verdict: Is TrueMoney Worth Trying?

Considering its comprehensive feature set, secure infrastructure, and smooth user experience, TrueMoney is a compelling choice for anyone seeking a reliable digital financial companion. Its unique focus on security and transaction transparency makes it particularly appealing for users who prioritize safety and clarity in their digital dealings.

We recommend TrueMoney for users who want an easy-to-use, secure, and versatile app that keeps pace with the demands of modern financial life. Whether managing daily expenses, sending money abroad, or exploring financial insights, this app is worth a try—especially if you value trustworthiness and simplicity in your digital wallet.

Similar to This App

Pros

User-friendly interface

The app offers a clean and intuitive design, making it easy for users to navigate even for beginners.

Fast and secure transactions

TrueMoney provides quick processing times with strong security measures like encryption and two-factor authentication.

Wide range of financial services

It supports various functions such as mobile top-up, bill payments, and fund transfers, consolidating multiple needs in one app.

Extensive agent network

Numerous physical outlets facilitate cash-in and cash-out services for users without bank accounts.

Promotional offers and rewards

Regular discounts and cashback promotions incentivize more frequent app usage and customer loyalty.

Cons

Occasional app crashes or slow response (impact: medium)

Users have reported experiencing crashes during high traffic periods, which may temporarily hinder transactions.

Limited language options (impact: low)

Currently, the app primarily supports only one language, potentially impacting non-native speakers, though language support updates are expected soon.

Need for internet connection (impact: medium)

An active internet connection is required for most functions, which might be a challenge in areas with poor connectivity.

Customer service responsiveness (impact: low)

Some users find customer support response times to be slow, but the company is working on expanding their support team.

Features occasionally delayed in updates (impact: low)

New features or improvements may take time to roll out, but frequent updates are promised to enhance user experience.

Frequently Asked Questions

How do I get started with TrueMoney for the first time?

Download the app from your store, create an account by providing basic info, verify your identity, and then add a payment method to start using TrueMoney.

Is it safe to link my bank account with TrueMoney?

Yes, TrueMoney uses multi-layered security, data encryption, and face verification to protect your bank links and transactions.

How can I top-up my mobile phone balance using TrueMoney?

Open TrueMoney > Mobile Top-Up, select your provider, enter the amount, and confirm to instantly recharge your TrueMove H or Dtac prepaid number.

What are the main features of TrueMoney's digital wallet?

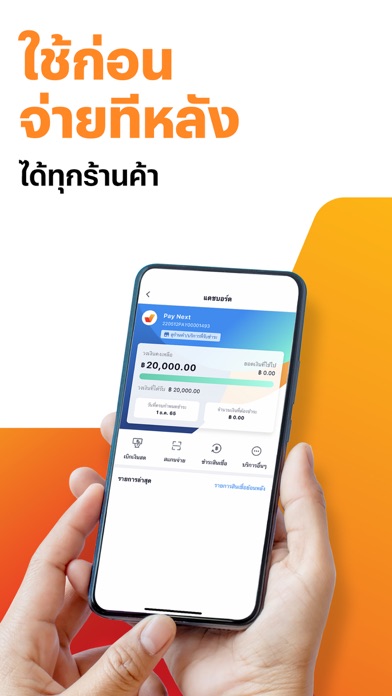

It allows cashless payments, mobile top-ups, money transfers, online shopping, bill payments, and access to digital loans — all through a user-friendly interface.

How do I transfer money to another TrueMoney user?

Navigate to 'Send & Receive' > 'Send Money,' enter recipient details, amount, then confirm. Transfers are instant and fee-free.

Can I make international payments with TrueMoney?

Yes, you can pay abroad at over 40 destinations by linking your wallet, making international transactions quick and easy.

How do I apply for a digital loan through TrueMoney?

Open the app > Services > Digital Lending, choose your loan product, fill out the application, and get approval within minutes.

What are the fees for withdrawing cash from a loan or making transactions?

Disbursement fees vary by amount, typically 30-300 THB. Cash withdrawals from loans may incur additional charges; check specific terms in the app.

How do I link my TrueMoney Wallet to Google Play for digital purchases?

Go to Settings > Payment Methods > Add TrueMoney, then select it as your default payment method for app, music, or sticker purchases.

What should I do if I encounter transaction issues or app errors?

Try restarting the app, check your internet connection, or contact TrueMoney customer support via the app's help section for assistance.