- Category Finance

- Version1.30.0

- Downloads 1.00M

- Content Rating Everyone

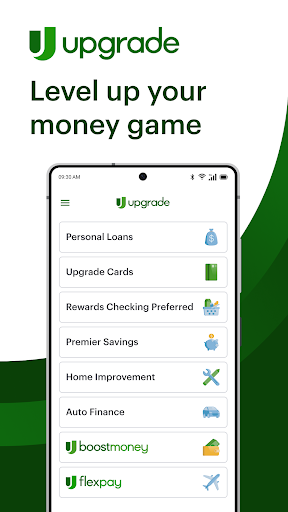

A Fresh Take on Personal Finance: UpClose with Upgrade

Imagine managing your finances with the ease and precision of a seasoned pilot navigating through clear skies—Upgrade aims to be that trusted co-pilot, blending advanced security with seamless transaction experiences. Developed by the innovative team at Upgrade Inc., this app positions itself as an all-in-one financial companion designed for everyday users who seek both simplicity and safety in their money management.

Fundamental Facts: What Makes Upgrade Stand Out

Upgrade is a modern finance app crafted to streamline personal lending and banking activities. Spearheaded by Upgrade Inc., a company renowned for its fintech solutions, the app offers several key features:

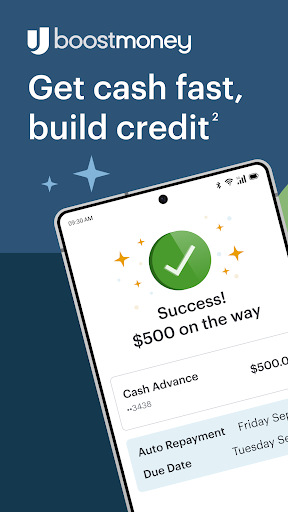

- Unified Platform for Lending and Banking: Combines personal loans, credit creation, and checking account features within one sleek interface.

- Enhanced Security Protocols: Implements cutting-edge account and fund security measures, including real-time fraud detection and biometric authentication.

- Smart Transaction Experience: Provides real-time notifications, customizable spending categories, and intuitive fund transfers—making your financial flow smooth and transparent.

- Goal-Oriented Financial Planning: Helps users set savings targets and track progress visually—motivating smarter money habits.

Targeted at everyday consumers—whether you're a young professional, a small business owner, or a diligent saver—Upgrade seeks to make financial management accessible, secure, and straightforward.

Feeling the Pulse: Let's Dive Into Upgrade's Core Features

Safety First: Advanced Security Measures

One of Upgrade's most compelling aspects is its robust security framework. Think of it as a vault reinforced with multiple layers of defense—biometric logins, real-time fraud monitoring, and end-to-end encryption. Unlike many competitors that merely offer basic PIN codes, Upgrade's security acts proactively. Transactions are scanned constantly for anomalies, and in case of suspicious activity, instant alerts and funds freeze happen automatically. This proactive stance gives users peace of mind, knowing their hard-earned money is under vigilant watch, preserving trust in a cluttered digital world.

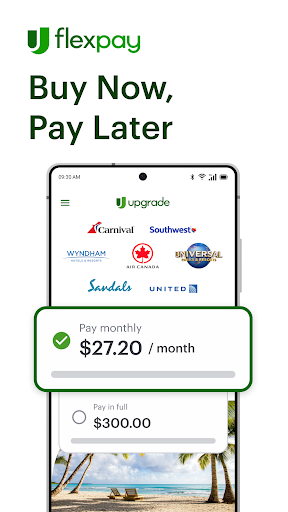

Streamlined Transactions: Making Money Movement Effortless

Imagine your transactions as a well-choreographed dance—fluid, precise, and without awkward pauses. Upgrade excels in this realm, offering instant fund transfers, scheduled payments, and customizable categories. The app's interface simplifies complex processes into just a few taps. For example, sending money to a friend or paying bills is as straightforward as sending a message. Plus, the real-time notifications keep you updated about every movement of your funds, ensuring transparency and immediate control. Compared to traditional banking apps that often bombard you with multi-layered menus, Upgrade's transaction experience feels like chatting with a knowledgeable friend—familiar, intuitive, and efficient.

User Experience: Sleek, Intuitive, and User-Friendly

Stepping into Upgrade feels like entering a well-designed, cozy workspace. Its interface boasts a minimalist yet colorful aesthetic that's easy on the eyes. Navigation flows naturally—little to no learning curve for newcomers—making it suitable for all age groups. The responsiveness is smooth; transitions are seamless, and pages load quickly, creating a satisfying user journey. This level of refinement means users can focus on their financial goals rather than wrestling with complex menus or confusing processes. Whether you're a tech-savvy millennial or someone new to digital finance, Upgrade adapts flexibly to meet your comfort level.

Special Features That Make a Difference

The standout aspect of Upgrade lies in its focus on security and transaction clarity. Its innovative approach to account and fund security isn't just about encrypting data but actively detecting threats in real time, akin to having a security guard who is always alert. Alongside this, its transaction experience features smart notifications and easy-to-set budget categories that give users a clear picture of their spending habits. Compared to similar apps on the market, this combination of proactive security and user-centric transaction design makes Upgrade particularly trustworthy and pleasant to use. These features set it apart, especially for users for whom financial safety is paramount and who desire a transparent, hassle-free experience.

Final Verdict: Should You Give Upgrade a Spin?

Overall, Upgrade proves to be a competent, reliable financial app that balances security, usability, and innovative features. I would recommend it to users who prioritize safe transactions and streamlined digital banking—whether for daily expenses, managing loans, or saving towards goals. Its intuitive design and proactive security systems make it a standout choice among the vast sea of finance apps. If you're seeking an app that acts not just as a wallet but as a trusted financial partner, Upgrade warrants serious consideration. For those willing to explore a slightly more involved financial toolkit for increased peace of mind, it's definitely worth trying out.

Similar to This App

Pros

Intuitive User Interface

The app offers a clean and user-friendly design that makes navigation easy for all users.

Efficient Performance

Upgrade loads quickly and operates smoothly, providing a seamless experience even on older devices.

Extensive Device Compatibility

Supports a wide range of smartphones and tablets, ensuring accessibility for most users.

Regular Updates and Improvements

The developers frequently release updates that fix bugs and introduce new features.

Strong Security Features

Includes robust privacy settings and data encryption, safeguarding user information.

Cons

Limited Customization Options (impact: medium)

Currently, customization features are basic; more themes or personalized settings would enhance user experience.

Occasional App Crashes (impact: medium)

Some users report occasional crashes, especially when accessing certain features; a temporary workaround is to restart the app.

Limited Free Features (impact: low)

Many advanced features are behind a paywall, which might inconvenience free users.

Incomplete Localization (impact: low)

Some language options are not fully translated, leading to inconsistent user interface understanding.

Battery Consumption (impact: high)

The app can consume noticeable battery power during intensive use; reducing background activity can help mitigate this temporarily.

Frequently Asked Questions

How do I get started with using the Upgrade app for finance management?

Download the app, create an account via sign-up, verify your identity, and then connect your financial accounts to begin managing your finances easily.

Is the Upgrade app free to download and use?

Yes, the app is free to download. Some premium features or loans may require fees or loan approval, but basic financial tracking is free.

How can I view my account balances and transaction history?

Navigate to the 'Accounts' tab on the home screen after logging in to see balances, recent transactions, and handle payments quickly.

What features does Upgrade offer for managing my credit score?

Go to 'Credit Monitoring' in menu to check your score, receive notifications for changes, and use simulation tools to explore credit impact.

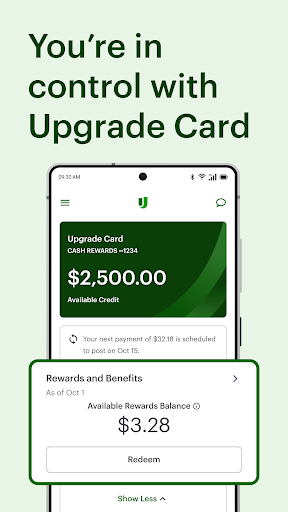

How do I earn and track cashback rewards with Upgrade?

Activate cashback tracking in 'Rewards' settings, link qualifying accounts, and view your earned cashback under the 'Rewards' section.

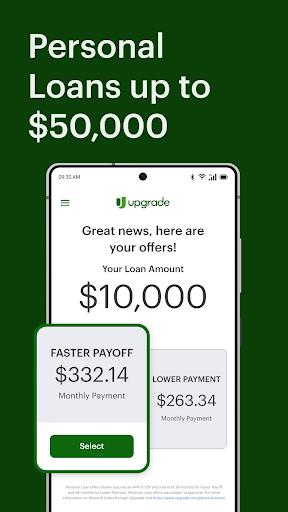

Can I manage personal loans and credit payments through the app?

Yes, go to 'Loans' to view balances, upcoming payments, and make payments directly from the app.

How do I apply for a personal loan in Upgrade?

Open 'Loans', choose 'Apply for Loan', fill in your details, select preferred terms, and submit your application for approval.

Are there any costs for using advanced features or premium services in Upgrade?

Certain features like personal loans or premium credit tools may have fees or interest; check specific details within the app's fee section.

What should I do if the app crashes or has trouble syncing my accounts?

Try restarting the app, check your internet connection, or reinstall the app. If issues persist, contact support via Settings > Help or Support.

How do I link or disconnect my bank accounts in Upgrade?

Go to 'Settings' > 'Bank Accounts', then choose 'Add Account' or 'Disconnect' to manage your linked accounts easily.