- Category Finance

- Version11.20.0

- Downloads 1.00M

- Content Rating Everyone

Discovering Financial Serenity with Vanguard: Save, Invest, Retire

Imagine having a trusted financial companion that guides you seamlessly from daydreams of a comfortable retirement to the practical steps needed to realize those dreams. Vanguard's newest app, "Save, Invest, Retire," emerges as just that—a well-crafted tool designed to make financial planning accessible, safe, and straightforward for everyday users.

About the App: The Basics

Vanguard: Save, Invest, Retire is a comprehensive financial management platform developed by the renowned investment management firm Vanguard Group. Known for its emphasis on low-cost index funds and investor-centric philosophy, Vanguard extends its expertise into this intuitive mobile app.

- Main Features Highlights:

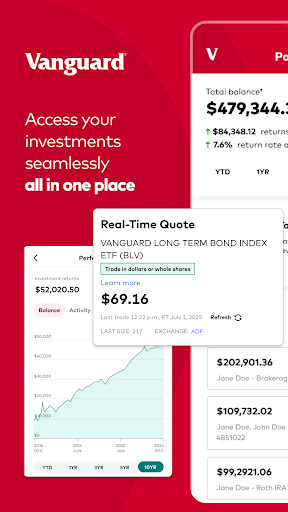

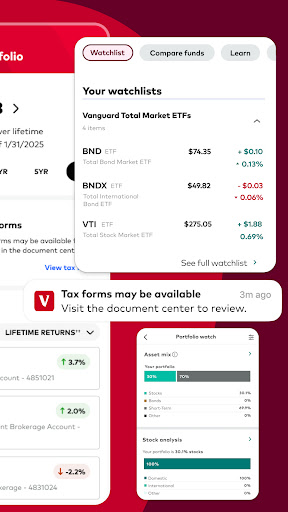

- All-in-One Financial Dashboard: Consolidates accounts, investments, and retirement plans for a holistic view.

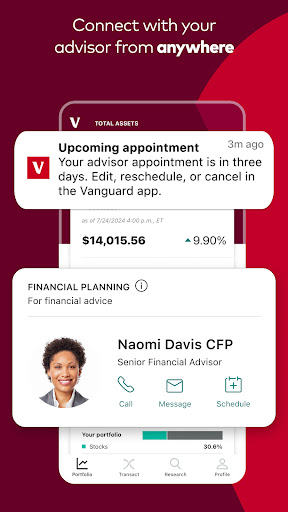

- Smart Investment Guidance: Offers tailored recommendations based on user goals, risk profile, and timeline.

- Goal Tracking & Planning Tools: Helps users set, visualize, and adjust their saving and investment objectives dynamically.

- Secure and Transparent: Prioritizes account security and transparency, building user trust.

- Target Audience: Individuals starting to plan their financial futures, young professionals, or those seeking a simplified platform for managing retirement savings without the complexity often associated with investment apps.

Making Finance Fun and Friendly

Imagine opening an app and feeling instantly at ease—colors, icons, and layouts that invite exploration rather than overwhelm. "Save, Invest, Retire" accomplishes this with an elegant and user-friendly interface that feels like a digital financial coach gently guiding you through your journey. It's not just about numbers; it's about empowering you to shape your future confidently, all while humming along with a pleasantly seamless experience.

User Interface and Experience: Smooth Sailing or Rough Waters?

The app excels in crafting a clean, intuitive interface that balances simplicity with depth. The home screen displays your overall financial health in a digestible manner, with bright graphs illustrating progress toward your goals. Navigating between features like investment portfolios, savings plans, and retirement calculators feels natural—swipes and taps are fluid, akin to turning the pages of a well-loved book.

Learning curve-wise, Vanguard: Save, Invest, Retire is friendly enough for beginners yet robust for more seasoned planners. The onboarding process is straightforward, with clear explanations and helpful prompts that demystify each feature without overwhelming the user. This blend of accessibility and sophistication is a key strength, ensuring users stay engaged and informed without frustration.

Distinctive Strengths: Safety and Transaction Experience

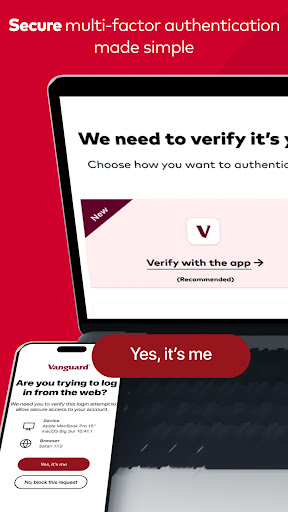

Compared to other financial apps, Vanguard's core differentiation lies in its unwavering commitment to security and trust. First, regarding account and fund security, the app employs bank-grade encryption and multi-factor authentication, ensuring your sensitive data remains locked tight—think of it as having an impenetrable vault for your financial secrets.

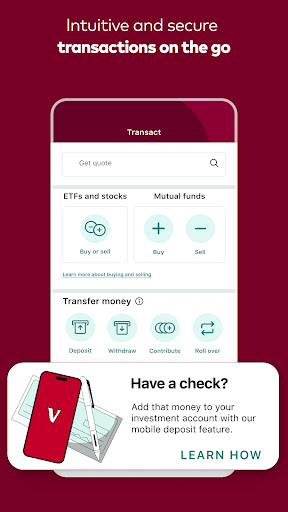

Secondly, the transaction experience is notably smooth. Funds transfer and investment adjustments are executed swiftly with real-time updates, mirroring the efficiency you'd expect from a seasoned bank branch but at your fingertips. This immediacy reduces the usual anxiety associated with online transactions, fostering confidence in daily financial management.

Moreover, Vanguard's emphasis on transparency—clear fee breakdowns, investment insights, and risk assessments—sets it apart from many competitors that sometimes obscure costs behind fine print. This honesty not only builds trust but also educates users, turning passive savers into informed investors.

Final Thoughts and Recommendations

All things considered, Vanguard: Save, Invest, Retire earns a solid recommendation especially for users who value security, clarity, and a collaborative feel in managing their finances. Its balanced approach makes it suitable for those new to investing as well as seasoned planners looking for a streamlined tool to complement their existing strategies.

If you're seeking an app that feels less like a cold, transactional platform and more like a trusted advisor quietly guiding your steps toward retirement goals, this is a noteworthy choice. While it might not replace more complex enterprise solutions for professional investors, for everyday users aiming to build a safer financial future, Vanguard's offering stands out as a reliable, user-friendly partner.

Similar to This App

Pros

User-friendly interface

The app offers an intuitive design that makes navigation easy for users of all experience levels.

Comprehensive investment options

Vanguard provides a wide range of investment products, including mutual funds, ETFs, and retirement accounts.

Strong emphasis on security

Advanced security measures protect user data and financial information effectively.

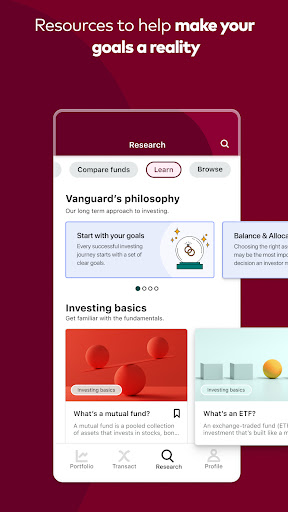

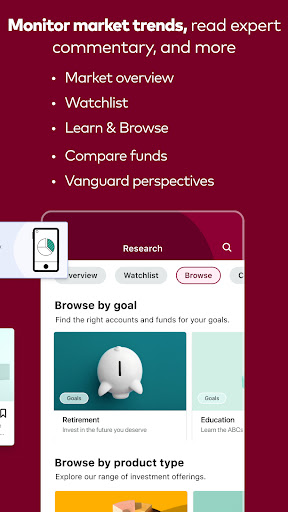

Educational resources included

The app offers various tools and articles to help users understand saving, investing, and retirement planning.

Automated features for easy management

Features like automatic contributions and rebalancing help users maintain their investment goals effortlessly.

Cons

Limited customization options for advanced investors (impact: medium)

Users seeking in-depth analytical tools may find the current features somewhat basic.

Mobile app occasionally experiences slow loading times (impact: low)

Some users report delays when accessing account information, which may affect user experience.

Lack of real-time market alerts (impact: medium)

The app does not yet offer instant notifications for market movements, but this may be added in future updates.

Customer support response times can vary (impact: low)

Some users have experienced delays when seeking assistance, though official improvements are planned.

Limited international account options (impact: high)

Currently primarily designed for users in the US, which may restrict global users; future expansion is anticipated.

Frequently Asked Questions

How do I get started with the Vanguard app for first-time users?

Download the app, create an account following the onboarding prompts, link your bank account, and set up your preferences to start managing your investments.

Can I access my Vanguard account on both mobile and desktop?

Yes, your Vanguard account is accessible via the mobile app and through the official website for a seamless experience across devices.

What security features does the app offer to protect my data?

The Vanguard app uses strong encryption and two-factor authentication, including Fingerprint ID login, to ensure your account is secure.

How can I view my investment performance and account details?

Open the app, navigate to the 'Accounts' tab, and select your account to see performance summaries, holdings, and detailed transaction history.

How do I buy or sell stocks and ETFs using the app?

Go to the 'Trade' section, select your investment, choose buy or sell, enter amount, and confirm your transaction to execute trades.

Can I deposit checks into my Vanguard account through the app?

Yes, use the 'Deposit Checks' feature available in the app's menu, follow the instructions to take a photo, and submit your deposit.

Are there any subscription costs or fees for using the Vanguard app?

The app itself is free to download and use. However, investments may incur management fees; there are no subscription charges for app access.

How can I manage or update my subscription or account settings?

Navigate to 'Settings' > 'Account Preferences' within the app to update login options, notifications, or subscription details.

What should I do if I forget my login password or face login issues?

Use the 'Forgot Password' option on the login screen, or contact Vanguard support through the app's Support tab for assistance.

Does the app offer retirement planning tools and personalized advice?

Yes, the app provides retirement planning features and tailored recommendations accessible under the 'Retirement' section for goal setting and advice.