- Category Finance

- Version4.21.2

- Downloads 5.00M

- Content Rating Everyone

Introducing Varo Bank: A Fresh Take on Digital Banking

Varo Bank's online banking app positions itself as a user-centric, innovative financial tool designed to simplify everyday banking while prioritizing security and convenience. Developed by the well-regarded Varo Money, Inc., the app aims to provide a seamless, all-in-one banking experience for modern consumers eager to manage their finances effortlessly from their smartphones. Its standout features include no-fee banking, early direct deposit access, intelligent savings tools, and easy money management—all tailored to the tech-savvy user. The primary audience encompasses young professionals, digital natives, and anyone seeking an approachable yet robust mobile banking platform.

Engaging User Experience with a Friendly Touch

From the moment you open the Varo app, you're greeted with a clean, intuitive interface that makes navigating your finances feel more like exploring a helpful digital companion than managing a complex bank account. The onboarding process is smooth, almost like chatting with a knowledgeable friend who knows exactly what you need. The app's design feels lively yet uncluttered, ensuring that even tech newbies can pick up the functions quickly without a steep learning curve. Transactions are snappy, with fluid animations and logical flow, making routine operations like transfers or bill payments feel natural and satisfying.

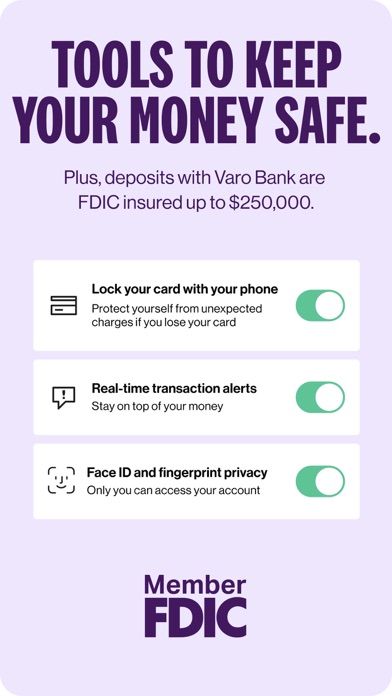

Advanced Security that Welcomes Trust

Security is the backbone of any banking app, and Varo excels here by offering robust measures like multi-factor authentication, biometric login options, and real-time fraud alerts. What sets it apart, however, is its proactive approach to account and fund security. The app employs intelligent monitoring that can flag suspicious activity instantly, giving users peace of mind. Compared to traditional banks or competing mobile apps, Varo's layered security approach emphasizes transparency and user control, making it feel like your money is being guarded by a digital fortress.

Effortless Transactions and Innovative Savings Tools

One of Varo's most compelling features is its intelligent savings buckets, which help users allocate funds towards specific goals—whether it's saving for a vacation, emergency fund, or monthly bills. This feature feels like having a personal financial coach sitting right in your pocket, gently nudging you towards smarter habits. The transaction experience itself is smooth, with instant transfers and real-time balance updates that make managing money feel immediate and reliable, like having a conversation with your bank that never leaves you guessing.

What Makes Varo Stand Out?

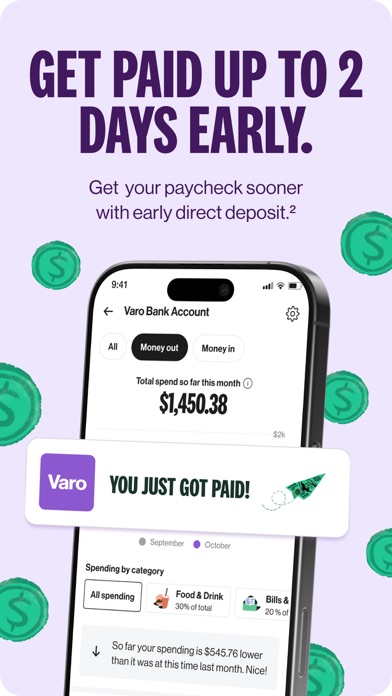

While many digital banks focus mainly on basic functionalities, Varo's standout feature is its combination of security and personalized savings. Its intelligent monitoring actively protects your funds without compromising ease of access, creating a sense of trust rarely seen in comparable apps. Furthermore, its focus on providing early access to direct deposits—sometimes up to two days before traditional banks—caters perfectly to those who need quick access to their earnings, making it feel like your paycheck arrives with a friendly heads-up.

Final Verdict and Recommendations

Overall, Varo Bank offers a thoughtfully crafted digital banking experience that is both secure and user-friendly. Its innovative savings tools and proactive security features make it particularly appealing to users who want more control and confidence in their financial app. It's well-suited for anyone who values simplicity without sacrificing security or functionality, especially young professionals or digital natives eager for quick, smart money management. I recommend giving it a try if you're looking for a reliable, modern alternative to traditional banks, and especially if you want an app that feels like it's working with you—rather than just for you.

Similar to This App

Pros

User-friendly interface

The app has an intuitive design that makes navigation simple for all users.

Seamless account management

Users can easily view balances, transaction history, and manage accounts in real-time.

Strong security features

The app employs multi-factor authentication and encryption to protect user data.

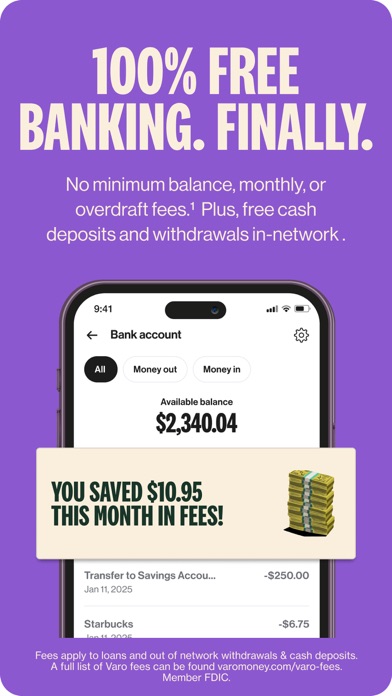

No monthly maintenance fee

Varo Bank offers free online banking with no hidden charges, providing cost savings.

Quick account opening process

User can sign up and get started within minutes, often with instant approval for accounts.

Cons

Limited branch access (impact: medium)

As a fully digital bank, there are no physical branches, which may inconvenience some users.

Occasional app crashes during high traffic (impact: medium)

Users have reported app stability issues during peak hours, but a future update is expected to improve this.

Limited international features (impact: low)

The app primarily serves U.S. residents, with limited support for international transactions; future updates may expand this.

Customer service response times can be slow (impact: medium)

Support via chat or phone may experience delays, but the company is working on enhancing response efficiency.

Less extensive budgeting tools (impact: low)

The app offers basic financial tracking but lacks advanced budgeting or investment features, which might be added later.

Frequently Asked Questions

How do I open a Varo Bank account for the first time?

Download the app, tap 'Sign Up,' and follow the prompts to verify your identity and set up your account in Settings > Profile > Open Account.

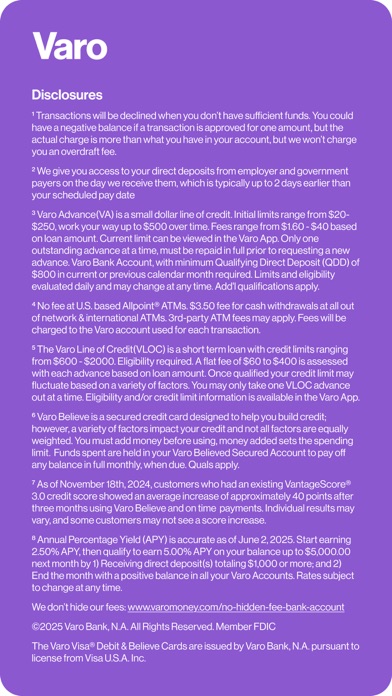

Is there any fee to use Varo Bank services?

No, Varo offers fee-free banking including no monthly maintenance fees, overdraft charges, or foreign transaction fees. Just download and start using the app.

How can I monitor my credit score with Varo?

Navigate to the 'Credit' section in the app menu to view your free credit score and credit report in Settings > Credit Monitoring.

How do I deposit checks through the Varo app?

Go to the 'Deposit' tab, select 'Check Deposit,' then follow prompts to take photos of your check and submit for deposit.

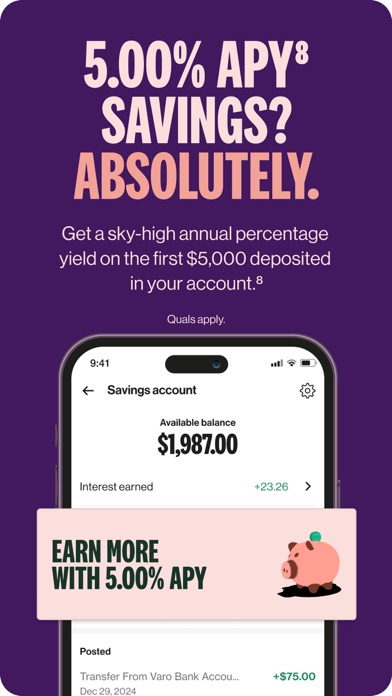

What are the main features of Varo's high-yield savings account?

Open a savings account, then set up automated transfers or enable rounded-up purchases in Settings > Savings to earn up to 5.00% APY on balances up to $5,000.

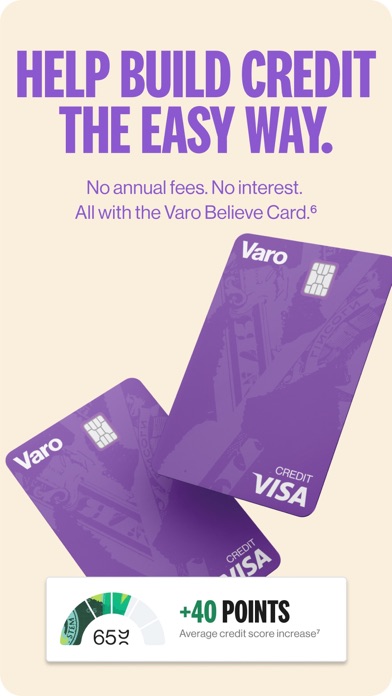

How can I build my credit score with Varo's secured credit card?

Apply for the secured card in the 'Credit' section, use it responsibly, set up automatic payments in Settings > Payments, and track your progress.

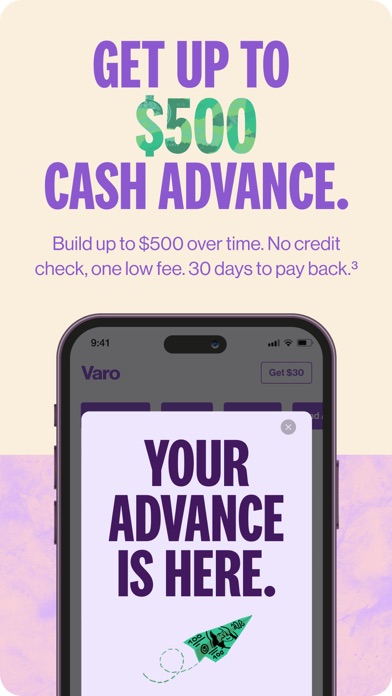

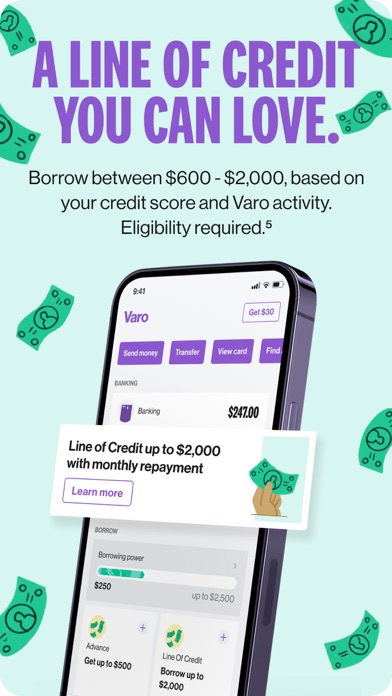

Does Varo offer personal loans or cash advances?

Yes, request cash advances in the 'Cash' tab from $20–$250 (up to $500 for qualified users) or apply for a line of credit in Settings > Personal Loans for amounts up to $2,000.

How do I send money to friends via Varo?

Use the 'Send Money' feature, enter the recipient's phone number or email, enter the amount, then confirm transaction—found in the Transfer menu.

What should I do if I experience transaction issues or app errors?

Try restarting the app or updating it. If issues persist, contact Varo's customer support via Settings > Help & Support within the app.

Are there any charges for using out-of-network ATMs?

Withdrawals at in-network ATMs are free, but out-of-network ATM usage may incur fees. Find fee-free ATMs using the app's ATM locator feature.