- Category Finance

- Version10.78.2

- Downloads 0.05B

- Content Rating Everyone

Introducing Venmo: Your Friendly Digital Wallet for Simple and Secure Payments

Venmo is a widely-used mobile payment app designed to make splitting bills, paying friends, and managing small transactions effortless and social. Developed by PayPal, it combines user-friendly features with robust security measures, making everyday digital payments seamless. Whether you're settling dinner tabs, sharing rent, or sending birthday gifts, Venmo aims to be your go-to pocket partner for quick and social financial exchanges. Its core appeal lies in the blend of convenience, social interaction, and security, targeting individuals who value both ease of use and a trusted platform for personal transactions.

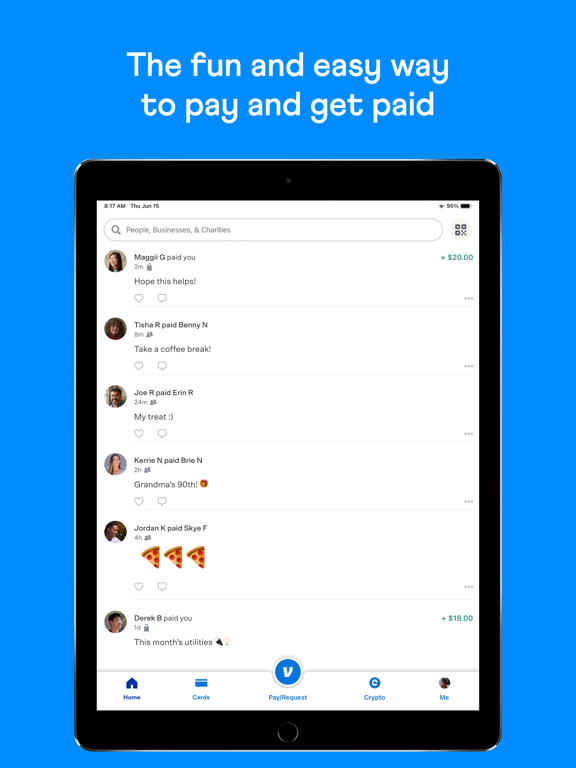

Vivid and Engaging Payment Sharing Experience

Imagine gathering with friends for a weekend trip, where splitting the costs feels as natural as sharing stories around a campfire. Venmo elevates this experience with a visually engaging interface that mirrors a social media feed. Transactions aren't just bland numbers; they're shared moments. The app's vibrant icons and transaction feed create an inviting ambiance, transforming what could be mundane into a social ritual. Sending money is as simple as a few taps, and the app often makes you smile with little animated icons and friendly prompts, making every financial interaction feel personable rather than transactional.

Streamlined User Interface and Flow

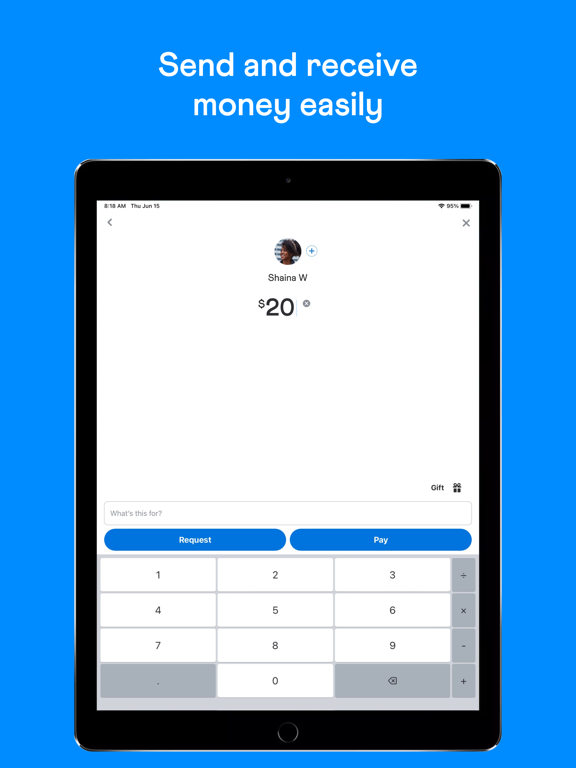

Venmo's interface feels like a well-organized social hub—clean, intuitive, and inviting. The home screen showcases recent transactions and friends, making it easy to pick up where you left off. The onboarding process is straightforward, with helpful hints guiding new users through setting up their payment methods and security features. Navigating between sending money, requesting payments, or viewing your transaction history feels seamless, thanks to the minimalistic design and logical layout. The app's responsiveness is commendable; transactions process swiftly, almost instantaneously in Wi-Fi environments, making the experience fluid and pleasant. For those new to digital payments, Venmo offers a gentle learning curve, supported by clear icons and step-by-step prompts.

Unique Security Features and Transaction Experience

What truly sets Venmo apart from similar financial apps is its robust approach to security intertwined with a user-centric transaction experience. Unlike some competitors that treat security as an afterthought, Venmo integrates multiple layers of protection—encrypted data transmission, fraud detection algorithms, and optional biometric authentication. These measures empower users to transact confidently, knowing their funds and personal info are guarded. Additionally, Venmo's transaction process feels like chatting with a trusted friend—simple, quick, and transparent. You can add notes or emojis to payments, making interactions more relatable and lively. Its social feed adds another layer of engagement, letting friends see and comment on transactions (if shared), fostering a community feeling unique among digital wallets.

Final Verdict and Usage Recommendations

Overall, Venmo shines as a top-tier social payment app that balances ease of use with security, making it highly suitable for casual users who want a friendly yet reliable platform. Its lively interface and focus on social payment sharing make routine transactions feel less like chores and more like part of daily conversations. For tech-savvy users who value quick, secure, and visually engaging payment experiences, Venmo is a strong recommendation. However, for those prioritizing high-level institutional security or complete anonymity, exploring additional security measures or other apps might be advisable.

In essence, Venmo is best suited for everyday social transactions—be it splitting dinner, chipping in for shared gifts, or reimbursing friends. Its unique feature of blending social interaction with financial exchange is a standout benefit, making payments feel more fun and less formal. For friends, groups, or even small businesses seeking a reliable, user-friendly payment solution, Venmo offers a compelling choice that makes money exchange feel just like sharing stories over coffee.

Similar to This App

Pros

User-friendly interface

Venmo offers an intuitive and easy-to-navigate layout, making transactions simple even for first-time users.

Instant transfers to bank accounts

Users can quickly transfer funds to their linked bank accounts, often within minutes.

Social payment streamlining

The social feed feature allows users to share and see payment activities, adding a social dimension to transactions.

No fees for standard transactions

Sending money to friends or family within Venmo usually incurs no fees, making it cost-effective.

Integration with multiple merchants

Venmo seamlessly integrates with various online and in-store merchants for easy payments.

Cons

Limited international accessibility (impact: high)

Venmo is primarily available in the US, which limits its usability for international transactions.

Security concerns over social feeds (impact: medium)

Sharing transaction activities might expose user financial behavior; users should adjust privacy settings accordingly.

Inconsistent customer support response times (impact: medium)

Some users report delays when seeking help; Venmo is working to improve support channels.

Potential for accidental payments (impact: low)

Small user errors can lead to unintended transactions; verifying recipient details can mitigate this.

Limited dispute resolution options (impact: low)

Dispute processes can be lengthy; Venmo recommends contacting support early for issues.

Frequently Asked Questions

How do I set up a Venmo account for the first time?

Download the app, open it, tap Sign Up, link your bank or card, and verify your identity following on-screen instructions.

Can I use Venmo to send money to someone without adding their bank info?

Yes, you can send money using their phone number, email, or Venmo username without needing their bank details.

How do I split a bill with friends on Venmo?

Tap 'Pay or Request,' select friends, enter amounts, and add a note before confirming the split payment.

What is the process to add a note to a transaction?

When sending or requesting money, type your note in the 'What's it for?' field before completing the transaction.

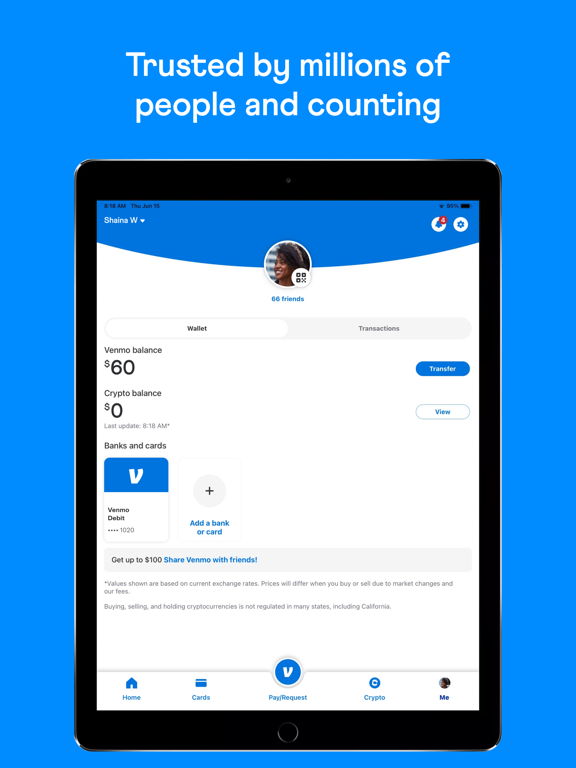

How can I earn rewards with the Venmo Credit Card?

Use your Venmo Credit Card for purchases; go to Settings > Venmo Credit Card > Rewards to see your cashback options.

How do I buy cryptocurrencies within Venmo?

Open the app, go to the 'Crypto' tab, choose a cryptocurrency, specify the amount (minimum $1), and follow prompts to buy.

How do I link my Venmo account to my bank for direct deposit?

Navigate to Settings > Direct Deposit, then follow prompts to provide your bank info and receive early paycheck deposits.

Can I use Venmo to pay for online or in-app purchases?

Yes, select Venmo as a payment option at supported online or app checkout pages, like Uber Eats or Grubhub.

How do I order and activate the Venmo Debit Card?

Go to Wallet > Venmo Debit Card, request one, and follow the instructions to activate and start using it.

What should I do if my Venmo transactions are delayed or not going through?

Check your internet connection, confirm your linked bank accounts, and ensure your app is updated to latest version.