- Category Finance

- Version1.57.0

- Downloads 5.00M

- Content Rating Everyone

Walmart MoneyCard: A Handy Financial Companion for Everyday Spending

The Walmart MoneyCard is a pre-paid debit card app designed to simplify your finances, offering a seamless way to manage your money, shop, and save with Walmart's trusted brand.

Developed by Walmart Inc., a retail giant with a knack for consumer-centric financial tools

The app is created by Walmart Inc., leveraging its extensive retail experience and customer-first approach to deliver a straightforward, secure, and user-friendly financial management solution.

Key Features That Make It Stand Out

- Secure Account and Fund Management: Keeps your money safe with robust security features and easy control over your funds.

- Cash Back Rewards & Discounts: Offers instant savings, discounts, and cashback on Walmart purchases, integrating shopping and financial management seamlessly.

- Real-time Transaction Tracking & Alerts: Instant notifications and clear transaction histories help you stay on top of your spending.

- Accessible Banking Services: Enables direct deposit, bill payments, and ATM withdrawals, bringing banking services right into your pocket.

An Insightful Dive into Walmart MoneyCard

If you've ever experienced that moment of rummaging through your wallet, trying to recall whether your funds are enough for that spontaneous purchase—well, Walmart MoneyCard aims to put an end to that uncertainty. Think of it as your trusty financial sidekick, blending the convenience of a prepaid card with the intelligence of modern banking apps. Let's explore what makes this app a noteworthy addition to your financial toolkit.

User Experience: Intuitive, Secure, and Familiar

When you first launch Walmart MoneyCard, you're greeted with a clean, brightly colored interface that echoes Walmart's familiar branding—approachable and easy to navigate, like a friendly store assistant. The home screen presents your current balance, recent transactions, and quick access to main features, making financial oversight feel less like a chore and more like a chat with a friend. Swiping and tapping are buttery smooth, with minimal loading times—an essential trait for those who crave instant gratification in their financial apps. Even if you're new to digital banking, the learning curve is gentle; helpful tips and guided tutorials ensure you're not left in the dark.

Core Functionalities: Managing Money Made Simple

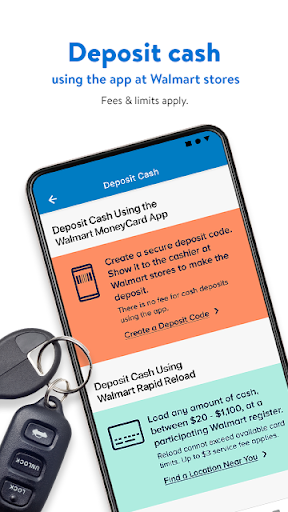

One of the standout features is the robust account security combined with effortless fund management. Users can load money via direct deposit, cash reload at participating stores, or bank transfers, much like filling a piggy bank—just smarter. The app's real-time transaction alerts serve as your personal financial watchdog, notifying you immediately of any activity, so you're never caught off-guard. This is particularly valuable during times when quick decisions, like stopping fraudulent activity, are crucial. The cashback and discounts feature shines for shopping enthusiasts—simply link your Walmart account, and enjoy exclusive savings, turning everyday shopping into a rewarding experience. It's akin to having a discount buddy riding along with you, making every dollar count.

Security and Unique Selling Points: Why Choose Walmart MoneyCard?

While many financial apps may boast features, Walmart MoneyCard distinguishes itself with its focus on transaction experience and security. Its multi-layered security protocols incorporate encryption, fraud monitoring, and the ability to lock your card instantly via the app if you suspect any suspicious activity—offering peace of mind akin to having a vigilant bodyguard. Unlike some apps that store sensitive data locally or rely heavily on cloud services, Walmart MoneyCard's banking backbone ensures your funds are protected, creating a trust bridge with its users.

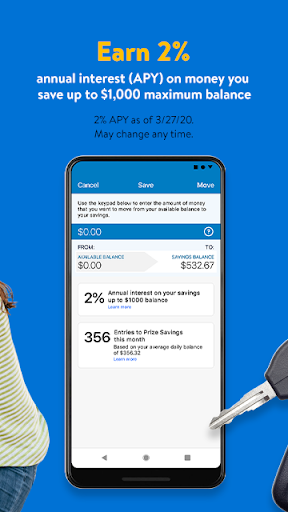

Another unique advantage lies in its integrated shopping ecosystem. Rewards and cashback are seamlessly tied to your Walmart shopping activities, creating an ecosystem where saving and spending go hand-in-hand. This integration transforms what could be a mere financial tool into a smart shopping and saving assistant, catering well to Walmart loyalists and bargain hunters alike.

Final Words: Should You Give It a Try?

Overall, Walmart MoneyCard offers a reliable, user-friendly, and secure platform tailored for everyday financial needs, especially if you're a Walmart shopper or someone looking for a straightforward prepaid solution. It's not aimed at heavy investors or complex financial planning, but as a practical, everyday app, it excels. Its focus on security, real-time control, and shopping rewards makes it a compelling choice for those seeking simplicity without sacrificing safety or convenience.

For casual spenders, families managing daily expenses, or anyone who values seamless shopping and financial oversight—this app comes highly recommended. Think of it as adding a reliable financial assistant to your pocket, guiding you smoothly through the daily grind without hassle. Give it a spin, and see how it might just become your new favorite financial companion.

Similar to This App

Pros

User-friendly mobile interface

Walmart MoneyCard offers an intuitive app design that makes managing finances straightforward for users.

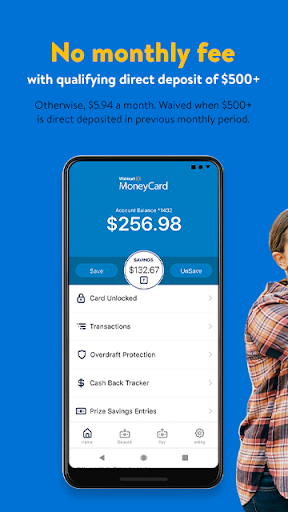

No monthly maintenance fee for basic accounts

Many users can enjoy fee-free accounts if they meet certain conditions, reducing ongoing costs.

Free direct deposit feature

Supports quick and convenient paycheck deposits directly into the card.

Cashback rewards on Walmart purchases

Provides savings and cashback incentives for regular Walmart shoppers.

FDIC insured funds

Ensures that user funds are protected up to regulated limits, enhancing trust.

Cons

Limited international usability (impact: medium)

The app and card are primarily designed for U.S. residents, which can restrict overseas use.

High overdraft fees (impact: medium)

Overdraft options are limited and can incur significant charges if not carefully managed.

Customer service wait times vary (impact: medium)

Some users report longer wait times when contacting support, which may hinder urgent assistance.

Inconsistent app updates (impact: low)

Occasional app bugs or delays in updates can affect user experience, but official improvements are planned.

Limited in-app features compared to traditional banks (impact: low)

Certain banking functions like wire transfers are not supported directly within the app, requiring external solutions.

Frequently Asked Questions

How do I sign up for the Walmart MoneyCard app?

Download the app from Google Play or Apple App Store, then follow the on-screen instructions to register with your personal details and link your bank accounts.

Can I load funds onto my Walmart MoneyCard without visiting a Walmart store?

Yes, you can load funds through direct deposit, bank transfers, or mobile check deposit via the app. Simply go to 'Load Funds' and select your preferred method.

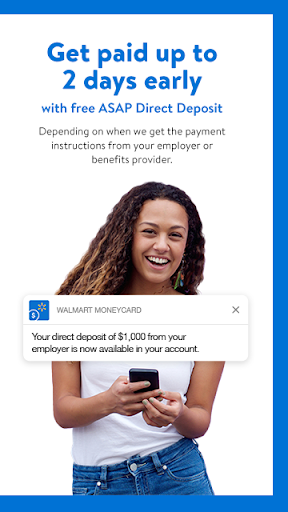

How can I access my pay early with the Walmart MoneyCard?

Set up direct deposit in the app under 'Settings > Direct Deposit' to receive your paycheck up to 2 days early when available.

How do I earn cash back on my purchases?

Use your Walmart MoneyCard for eligible Walmart.com, Walmart stores, or fuel purchases. The cash back is automatically credited to your account.

Where can I see my transaction history and manage alerts?

Open the app, go to 'Transaction History' to view details, and set up real-time alerts in 'Settings > Notifications' to stay updated on your account activity.

How do I lock or unlock my Walmart MoneyCard if it's lost?

In the app, tap 'Card Lock' under security features to temporarily lock or unlock your card instantly for added security.

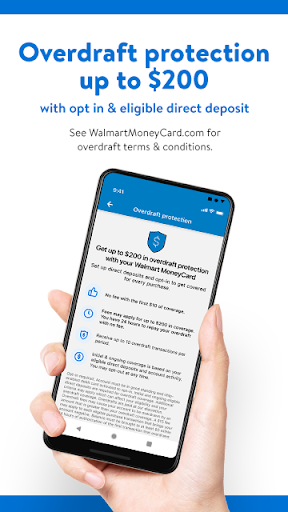

What is overdraft protection and how do I enable it?

Opt-in via 'Settings > Overdraft Protection' in the app, and meet eligibility requirements to have up to $200 overdraft coverage.

Does the app require a minimum balance or credit check to start?

No, the Walmart MoneyCard has no minimum balance or credit check; you can get started immediately after registration.

Are there any fees associated with using the Walmart MoneyCard app?

Fees may apply for certain transactions like cash loads or ATM withdrawals; refer to the 'Fee Schedule' in the app for details.

How do I contact customer support if I encounter issues?

Access support via 'Help' or 'Contact Us' in the app menu for assistance with account questions or technical problems.