- Category Finance

- Version9.3.2

- Downloads 0.01B

- Content Rating Everyone

Introducing Zelle®: Your Fast and Reliable Digital Payment Companion

Zelle® is a seamless peer-to-peer payment app designed to make money transfers quick, secure, and effortless. Developed by Early Warning Services, LLC, a joint venture between major banks like Bank of America, Wells Fargo, and JPMorgan Chase, it aims to bridge the gap between traditional banking and digital transactions. With its focus on speed, security, and user-friendliness, Zelle® is primed to serve those who prefer simple yet trusted financial exchanges. Whether you're splitting dinner bills with friends or paying for household services, Zelle® offers a streamlined approach tailored to modern needs.

Core Features That Make Zelle® Stand Out

Real-Time Transfers with No Fees

Zelle® excels at providing near-instantaneous transfer services directly between bank accounts. Unlike some apps that hold your money in a third-party wallet, Zelle® integrates directly with your bank account, enabling transfers often completed within minutes—and at no extra cost. This real-time feature is particularly appealing for urgent payments or spontaneous split bills.

Bank-Grade Security & Account Authentication

Security is a top priority with Zelle®. It leverages bank-level encryption and multi-factor authentication to ensure your money and personal data are protected. The app's integration within trusted banking environments offers users peace of mind, distinguishing it from less regulated P2P payment platforms. Additionally, Zelle® takes proactive steps to verify user identities and monitor suspicious activity, positioning it as a safe choice for everyday transactions.

User-Friendly Interface & Seamless Experience

The design of Zelle® is clean, intuitive, and minimalistic—much like guiding a friend through a well-marked trail. Navigating functions such as sending money, requesting payments, or checking transaction history is straightforward, with minimal learning curve. The app's smooth operation ensures quick, frustration-free interactions, making it suitable even for individuals new to digital banking.

Deep Dive into Zelle®'s Functional Strengths

Effortless Money Transfers and Transaction Experience

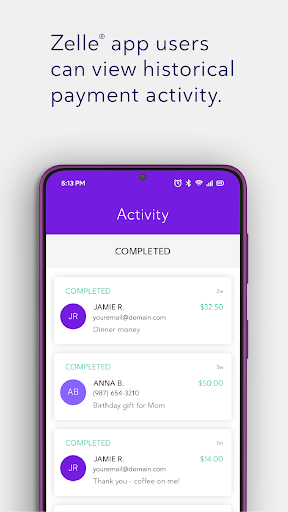

Picture yourself coordinating a group dinner—everyone chips in, and you want the money to land in their accounts swiftly without fuss. Zelle® makes this happen with remarkable speed. The transfer process involves selecting the recipient from your contacts or entering their email or mobile number, confirming the payment, and voilà—funds are transferred almost instantaneously if the recipient is also enrolled. This immediacy is what sets Zelle® apart from traditional bank transfers or other P2P apps, which can take hours or even days.

Account and Fund Security

Unlike some digital wallets that store money away from your actual bank account, Zelle® functionally connects directly to your existing bank account, offering a layer of familiarity and security. This direct link reduces the risk of fund loss due to wallet breaches. Its deployment of bank-level security measures, including encryption and authentication protocols, helps maintain the integrity of your financial information. Plus, because transactions occur through trusted banking networks, there's added confidence compared to third-party payment mediums.

Smart User Experience & Ease of Use

Using Zelle® feels akin to having a confident, helpful assistant at your side—always ready to carry out your financial errands with minimal fuss. The app's interface is designed with clarity, featuring large buttons and straightforward pathways that minimize confusion. For users, especially those who aren't particularly tech-savvy, the learning curve is gentle. The process of linking accounts, sending, and requesting money becomes second nature after a few uses, fostering a confidence that encourages regular transactions.

Final Thoughts: Is Zelle® Worth Your Trust?

Given its emphasis on security, speed, and simplicity, Zelle® emerges as a solid choice for everyday digital payments. Its biggest selling point—the real-time transfer combined with direct bank integration—acts like a financial express lane, letting users move money swiftly without extra costs or convoluted procedures. Compared to competitors that rely on third-party wallets or layered transaction steps, Zelle®'s direct approach offers clarity and peace of mind.

For those seeking a dependable, bank-backed solution for personal transfers—whether splitting bills, paying rent, or gifting—Zelle® comes highly recommended. Its intuitive design and emphasis on security make it suitable for users across all age groups and technological comfort levels. Just keep in mind that you'll need to verify your bank account, and transfers are typically limited by your bank's policies. Overall, if speed and security are your priorities, Zelle® deserves a spot on your digital wallet shortlist.

Similar to This App

Pros

Ease of Use

Zelle offers a simple and intuitive interface, making it easy for users to send and receive money quickly.

Fast Transactions

Funds are typically transferred within minutes, providing immediate payment confirmation.

No Additional Fees

Zelle does not charge transaction fees, saving users money on regular transfers.

Wide Bank Integration

Most major US banks support Zelle directly within their existing banking apps.

Secure Platform

Transactions are protected with bank-level security measures, ensuring user data safety.

Cons

Limited International Support (impact: high)

Zelle only works within the United States and doesn't support international transfers, which can be inconvenient for users with global contacts.

Recipient Must Have Zelle Account (impact: medium)

The recipient needs to have a Zelle account linked to their bank; otherwise, the transfer cannot be completed.

Lack of Payment Dispute Features (impact: medium)

Zelle does not offer strong options for disputing or reversing transactions, which could be problematic in case of errors or fraud.

Limited Transaction Tracking (impact: low)

Some users find it harder to track and manage multiple transactions compared to dedicated payment apps.

Potential for Fraud (impact: medium)

As transactions are quick and irreversible, users should be cautious with unfamiliar contacts; official guidance suggests verifying recipients beforehand.

Frequently Asked Questions

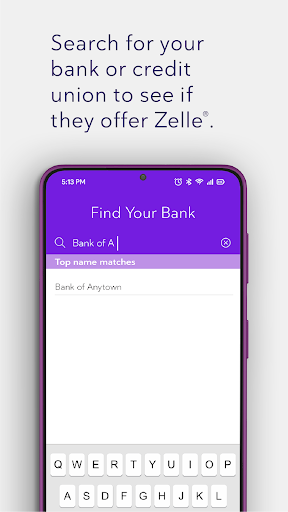

How do I set up Zelle® with my bank account?

Open your banking app or website, locate Zelle®, and follow the enrollment prompts to link your bank account or debit card, then start sending money easily.

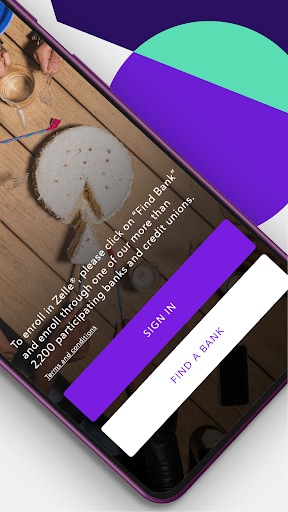

Can I use Zelle® if my bank doesn't support it?

Yes, download the standalone Zelle® app, sign up with your debit card, and link your bank account to send and receive money.

How do I send money using Zelle®?

Open your bank's app or Zelle® app, select a contact, enter the amount, and confirm the transaction; funds transfer instantly once sent.

Are there any fees to use Zelle®?

No, Zelle® is typically free when used through your bank or the standalone app for sending and receiving money.

What information is needed to receive money via Zelle®?

Share your registered email address or phone number associated with Zelle® so others can send you funds directly.

How fast does Zelle® transfer money?

Most transfers are completed within minutes, making Zelle® a fast solution for urgent payments or splitting bills.

How do I cancel a Zelle® payment if I made a mistake?

Once sent, Zelle® transactions are instant and cannot be canceled. Double-check recipient details before confirming.

Can I send money to someone who is not in my bank's Zelle® network?

Yes, as long as the recipient has a Zelle® account linked to their email or phone number, regardless of their bank.

Are there any subscription fees or costs for using Zelle®?

Zelle® itself is free to use; check with your bank for any potential fees, but the service generally incurs no additional costs.

What should I do if I encounter technical issues with Zelle®?

Try restarting your device, update your app, or contact your bank's support. Ensure your internet connection is stable.