- Category Educational

- Version2.0.31

- Downloads 0.10M

- Content Rating Everyone

Introducing cashflow: A Fresh Perspective on Financial Literacy

Cashflow positions itself as an innovative app aimed at demystifying personal finance and investment concepts through engaging gameplay and interactive learning modules. Developed by a dedicated team passionate about financial education, the app seeks to make complex money management topics accessible and even enjoyable for users of various experience levels. Its key highlights include a gamified approach to financial learning, real-time scenario simulations, and personalized progress tracking. Designed primarily for students, young professionals, and entry-level investors, Cashflow aspires to turn financial literacy from a daunting task into an enjoyable journey.

Engaging and Enriching User Experience

Stepping into Cashflow's virtual world feels akin to entering a vibrant marketplace where learning is a lively trade. The app's intuitive interface greets users with colorful icons and friendly animations that immediately suggest, “Here's a place to learn without boredom.” The smooth navigation flow ensures that both beginners and seasoned learners can access key features effortlessly, with minimal learning curve—think of it as a well-organized game level that gently guides you forward. As users progress through modules, the interface adapts to showcase personalized challenges and insights, creating an immersive experience that keeps engagement high without sacrificing clarity.

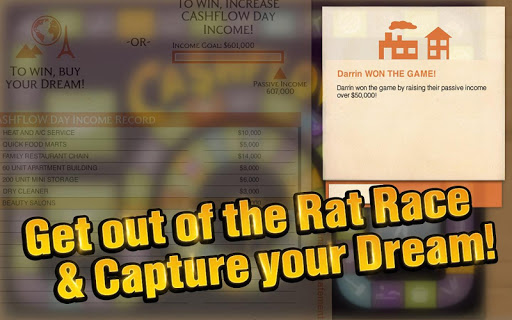

Core Functionality I: Gamified Financial Simulations

One of Cashflow's most remarkable features is its gamified simulation platform that mirrors real-life financial decisions. Users are presented with scenarios—investing in stocks, managing budgets, or negotiating loans—and faced with choices that influence their virtual financial health. This interactive setup transforms theoretical knowledge into tangible experience. Unlike traditional educational apps, where users passively read or watch videos, Cashflow's simulation rewards strategic thinking and decision-making skills, making learning both meaningful and enjoyable—like playing a strategic game where every move teaches you something new.

Core Functionality II: Personalized Learning and Progress Tracking

Another highlight is the app's ability to tailor content based on the user's expertise and learning pace. Through initial assessments and ongoing interactions, Cashflow adjusts difficulty levels and recommends targeted modules—much like a personal trainer for your financial skills. The detailed dashboards allow users to monitor their progress, revisit challenging concepts, and celebrate milestones. By measuring engagement through metrics such as completed scenarios, quiz scores, and retention rates, the app ensures that users are not just passive recipients but active participants in their learning journey. This emphasis on measurable progress sets Cashflow apart from many peers in the educational app space.

Comparing Cashflow with Other Finance Education Apps

While many financial literacy apps offer static lessons or simple quizzes, Cashflow's unique combination of gamification and real-time scenario analysis provides a dynamic learning environment. Its core strength lies in balancing educational objectives—such as understanding investment principles—with user engagement, achieved through immersive gameplay. Additionally, the app's ability to track and measure individual knowledge retention offers learners concrete feedback, helping them recognize their growth over time. This data-driven approach ensures that users not only learn but retain and apply their knowledge effectively, which is a significant leap forward compared to conventional apps that often lack ongoing assessment tools.

Recommendation and Usage Tips

Based on its innovative features and user-centric design, I consider Cashflow a highly recommended tool for beginners eager to grasp financial fundamentals in an engaging setting. For those already familiar with basic concepts, the app offers enough depth to reinforce knowledge and refine strategic decision-making skills. To get the most out of it, I suggest dedicating regular sessions—treat it like a game night with yourself or friends—and fully explore each scenario to internalize lessons. Keep an eye on your progress dashboard, and revisit challenging modules periodically. Ultimately, Cashflow is best employed as a supplementary learning resource—not the sole source—but its interactive, measurement-driven approach makes it a valuable addition to anyone's financial literacy toolkit.

Similar to This App

Pros

User-Friendly Interface

The app has an intuitive design that makes it easy for users to navigate and input financial data.

Comprehensive Cash Flow Analysis

Provides detailed insights into income, expenses, and cash flow trends to help users manage finances effectively.

Customizable Categories

Allows users to create personalized expense and income categories for more accurate tracking.

Real-Time Notifications

Offers alerts for unusual transactions or low cash balance to prevent surprises.

Secure Data Storage

Employs encryption and security protocols to protect sensitive financial information.

Cons

Limited Export Options (impact: low)

Currently, the app supports only basic formats like CSV; adding PDF or Excel exports could enhance usability.

Inconsistent Syncing with Bank Accounts (impact: medium)

Users have reported occasional delays or failures in syncing bank data, but temporary manual updates are possible.

Basic Reporting Features (impact: low)

Advanced reporting tools like custom graphs or advanced filters are limited, but future updates are planned.

Lack of Budget Planning Tools (impact: medium)

While cash flow tracking is robust, budget planning features are minimal, which may inconvenience some users.

Occasional App Crashes on Older Devices (impact: low)

Some users experience crashes on older smartphones; restarting the app or updating the OS can help mitigate this issue, with official fixes expected in upcoming versions.

Frequently Asked Questions

How do I start using СASHFLOW for the first time?

Simply download the app, create your profile, select your language, and start playing without any complex tutorials. The interface is user-friendly and designed to engage immediately.

What languages does СASHFLOW support?

The app supports multiple languages including English, Spanish, French, Portuguese (Europe), Turkish, and Hindi, which can be selected during the setup process in Settings > Language.

How do I understand the game's financial concepts better?

During gameplay, helpful tips and explanations appear when making decisions. You can also access tutorials in the learning section through Settings > Help for detailed guidance.

Can I connect with friends and compare strategies?

Yes, the app has a social feature. You can connect with friends via the Social tab to share strategies, challenge them, and learn from each other's gameplay.

How does СASHFLOW enhance my financial literacy?

The app combines realistic scenarios, educational tips, and gameplay to teach investment, budgeting, and money management in an engaging way, improving your financial knowledge.

Are there in-app purchases or subscriptions required to unlock features?

Basic gameplay is free, but you can subscribe for premium features or additional content through Settings > Subscriptions to enhance your learning experience.

What are the benefits of subscribing to premium?

Premium subscriptions unlock extra scenarios, personalized advice, and advanced tutorials, helping you deepen your financial knowledge and improve your strategies.

How can I manage or cancel my subscription?

Go to Settings > Account > Subscriptions in the app or your device's app store, then follow the prompts to view, modify, or cancel your subscription.

What should I do if the app crashes or doesn't work properly?

Try restarting the app, checking your device's internet connection, or reinstalling. For persistent issues, contact support via Settings > Help for assistance.